Transaction

Tran

Code

Description

Payment

Method

This transaction performs a loan charge off for the full amount of the principal balance. It does not close the loan (also see the Charge-off transaction 2022-01).

The Automatic Charge-Off transaction box displays the following fields:

Account Number

As of Date

F/M New Data (This is the general category code you want the loan to be changed to.)

This transaction performs the following file maintenance:

- Places a general category (80, 82, 83, 84, 86-89) that you selected in the General Category field (LNGENL).

- Adds a hold code 2 (charge-off) in one of the Hold Code fields (LNHLD1/LNHLD2).

- Adds an action code 153 (charge-off date) (LNACDT-LNA10D).

- Places the current or "as-of" date in the charge-off date.

- Places the current principal balance in the Partial Charge-Offs field (LNCOBL).

This transaction does not close the loan. The principal balance does not change. However, the General Ledger is adjusted as explained below.

This transaction also performs account reclassification of the loan amounts in the General Ledger. Posting field number L-104 (principal charge-off/recovery), L-204 (principal charge-off contra), L-105 (interest recoveries), and L-205 (interest charge-off contra) allow you to further refine the posting to the General Ledger.

The journal transaction will send the reference number to the G/L. If the Journal Reference Number field is left blank, the program will automatically input the loan number.

This transaction appears on the Charged Off Loans Posting Journal and the Charged Off Loans Trial Balance Reports (FPSRP220).

Precomputed loans must be converted to a daily simple interest (payment method 6) prior to processing this transaction. This is done on the Convert Precomputed Loans screen, using teller number 8960.

The non-accrual book balance is written to history instead of the principal balance if the loan is in non-accrual status.

The Automatic Charge-Off transaction can be initiated automatically by the system if institution option CODY is set up. In addition, afterhours update function 24 must be turned on. This sets the frequency when the system will check the delinquency levels of loans in order for the Automatic Charge-Off transaction to process. To have institution option CODY or update function 24 activated, please submit a work order.

This transaction reverses the charge off by removing the information in the fields mentioned above (Automatic Charge-Off transaction) and replacing the general category with one that you select that is not an 80, 82, 83, 84, 86, 87, 88, or 89 (also see Charge-Off Reversal transaction 2022-02).

This transaction also performs account reclassification of the loan amounts in the General Ledger. Posting field number L-104 (principal charge-off/recovery), L-204 (principal charge-off contra), L-105 (interest recoveries), and L-205 (interest charge-off contra) allow you to further refine the posting to the General Ledger.

This tran code functions identically to tran code 2203.

This tran code functions identically to tran code 2204.

This is a journal transaction that decreases the Dealer Prepaid Interest/Premium. This transaction also does the offset to the General Ledger account via the Autopost.

The Dealer Interest Decrease transaction box displays the following fields:

Account Number

Transaction Amount

Journal In

Journal Reference #

As of Date

This is a journal transaction that increases the Dealer Prepaid Interest/Premium. This transaction also does the offset to the General Ledger account via the Autopost.

The Dealer Interest Increase transaction box displays the following fields:

Account Number

Transaction Amount

Journal In

Journal Reference #

As of Date

The 461 transaction is issued during the Cancel VSI Insurance transaction (tran code 2890). This transaction determines the amount of commissions earned based on the cancellation code and the effective date of tran code 2890.

On a flat cancel, the entire amortized amount is reversed from the General Ledger. This leaves the remaining amount the same as the original unearned. A 100 transaction is then issued to clear the remaining unearned commissions.

On an insured request, the 461 transaction will amortize the commissions from the Policy Effective Date to the Effective Date on the 2890 transaction. The difference between this unearned amount and the unearned amount on the policy is then adjusted in the General Ledger. A 100 transaction is then issued to clear the remaining unearned commissions.

This transaction works in conjunction with the Additional Advance CIM GOLD loan screen. Before using this transaction, the loan must be set up to allow advances. This is done on the Additional Advance CIM GOLD screen. Refer to the documentation for the Additional Advance screen for more details.

The Additional Advance transaction (tran code 500) is used to disburse funds to the borrower that the institution had committed to at origination time but were holding back until a future date. Generally, a portion of the loan commitment was disbursed at origination time. This transaction is used to disburse some, or all, of the remaining commitment.

This transaction processes a field debit (tran code 500) to the principal balance (a principal increase). The funds can then be given to the borrower by cash, check (mod 77), or using a journal transaction (mod 78).

The Additional Advance transaction box includes the following fields:

Account Number

Transaction Amount

New Description

Correction

As of Date

Cash Out

Inventory item #

Check Out

Check Out Number

Sub-limit Code

Bank Account Number

Detail Code

When processed, the transaction will increase the loan principal balance. It will also update the Disbursed Amount and the Number of Advances on the Additional Advance screen.

Before the transaction is completed, the program checks the Commitment Amount and the Disbursed Amount fields to ensure that the transaction amount does not exceed the commitment amount. It also checks the Advance Expiration date. If it is in the past, the transaction will fail.

The LOC Advance transaction for check/cash (500-50) advances the customer money against their loan. It debits the applicable General Ledger account for that amount for disbursement directly to the customer via cash or check withdrawal.

This transaction requires an SOV.

The LOC Advance transaction for journal (500-52) advances the customer money against their loan. It allows the advance to be run as a journal directly out of the LOC.

This transaction requires an SOV.

When a loan is written off, you are actually closing the loan by using the Pay-off transaction (tran code 580). You should use the Pay-off transaction code 580 by Journal In. This should be followed by a manual teller G/L debit transaction (tran code 1800) to reduce the Charge-off Recoveries G/L by Journal Out. These transactions close the loan account and remove all monetary balances from the G/L.

Be sure the general category is correct as it will be reported to the credit repositories.

For line-of-credit payment method 5, 9, 10, or 11 loans only, to pay a loan to zero but leave it with an "open" status, process this transaction for the amount and date selected from teller inquiry 197. When the transaction is processed, it will display history showing the portions to interest, principal, and late charges. Note: Reserves and miscellaneous fees must be cleared prior to the processing of this transaction.

For commercial lines of credit (payment method 9, 10 or 11), this transaction will create a billing record that appears on the Billing Summary screen. If this transaction is corrected, the billing record will be deleted.

If a loan is locked in for a payoff, the message "NO TRAN - LOAN LOCKED IN" will be displayed, and the transaction will not be processed.

Note on 2830 Pay-To-Zero with Capitalized Interest: The Teller Tran 1160/10 calls the loan 2830 Tran, which in turn calls the 830 tran and credits the capitalized interest amount to the YTD interest.

Pay to Zero 2830-00:

Debit to YTD interest 500-59 (PM 11 only)

Credit to YTD interest 510-59 (PM 11 only)

Pay to Zero – 2830-01:

Journal to YTD Interest 510-59 (PM 11 only)

This transaction performs a loan charge off for the full amount of the principal balance. It does not close the loan. This transaction is similar to the Automatic Charge-off transaction (tran code 022-01) except this transaction also reclassifies all miscellaneous fees. The Autopost determines how the fees are reclassified (also see the 022-01 transaction).

A maximum of 10 different fee codes can be reclassified. If more than 10 different fee codes are on the account, the message "ERROR - MORE THAN TEN MISC. FEES" will appear.

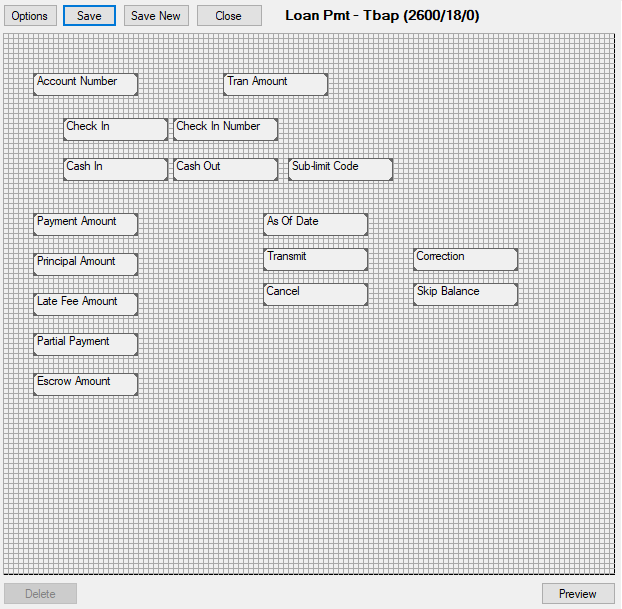

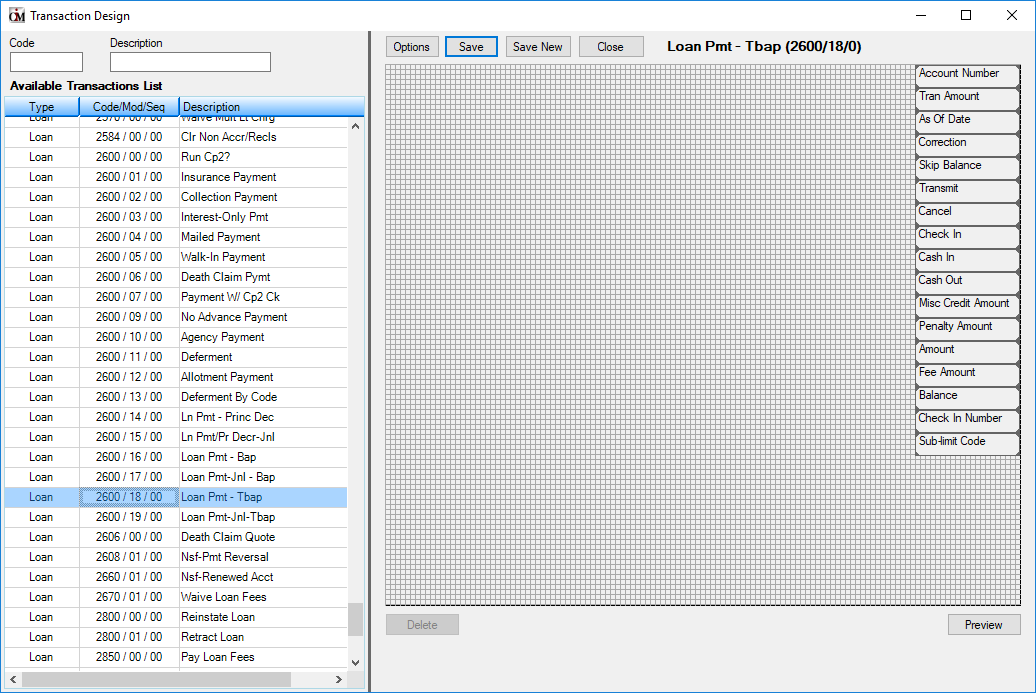

The Charge-Off transaction box displays the following fields:

Account Number

As of Date

New General Category (This is the general category code you want the loan to be changed to.)

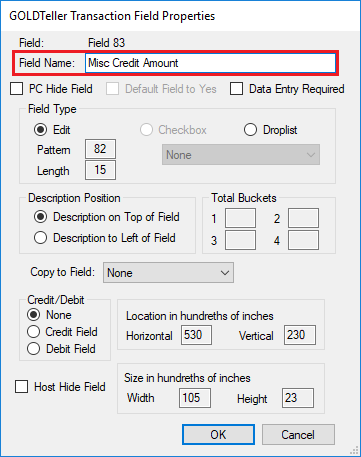

Y/N Field 1 (This checkbox field allows you to determine if the statement code (LNSTMT) should be changed to "1," which means no statement (on Consumer Finance statements only).) You can use the Transaction Design screen in CIM GOLDTeller to change the name of this field to something more meaningful to your institution’s operators.)

If using CIM GOLD, you need to first convert the precomputed loan to an interest-bearing loan using the Convert Precomputed to Interest Bearing function, then open GOLDTeller and fill in the charge-off information for the Charge-Off transaction.

This transaction performs the following file maintenance:

- Places a general category (80, 82, 83, 84, 86-89) that you selected in the General Category field (LNGENL).

- Adds a hold code 2 (charge-off) in one of the Hold Code fields (LNHLD1/LNHLD2).

- Adds an action code 153 (charge-off date) (LNACDT-LNA10D).

- Places the current or "as-of" date in the Charge Off Date.

- Places the current principal balance in the Partial Charge-Offs field (LNCOBL).

- Changes the statement advertising code (LNSADV) to zero. This means no advertising.

- Finalizes all insurance commissions.

Transaction code 136 (Charge-Off Summary transaction) launches once a Charge-Off transaction has been run. The 136 transaction provides a summary of the charge off. The following fields are displayed as part of the Charge-Off Summary: charge-off balance, total of income fees, total of non-income fees, and total of insurance refunds.

An institution option, COOP, is available that will allow this transaction to work differently depending on the number placed in the option. If this option is left blank, the Charge-Off transaction will continue to work as it has been. If the COOP option is set to "1," then the following will occur when the Charge-Off transaction is run:

- The following will be completely amortized at monthend (after the charge-off):

- remaining Deferred Fees, Costs, Discount/Gain, Premium/Loss, MSR’s

- remaining Finance Charge Amount for Force Place Insurance

- remaining amortizing fees (G/L section only)

- remaining Dealer Prepaid Interest.

- The statement cycle (LNSCYC) will be changed to "1."

- All late charges will be removed from the account.

If the COOP option is set to "2," the Charge-Off transaction will do everything option 1 does, in addition to the following:

- Refund all insurances. This is done prior to charging off the balance. If institution option IOPS IVSI (Add Interest to P/I on the Force Place VSI Insurance transaction) is set to "Y," or if there is a remaining unearned finance charge, then the finance charge will be rebated as of the charge-off date.

- Change the Cancellation Code to "4 - Insured request" on all open policies.

- Populate a requested event letter. It will use Event # 24, Letter Number 249, and the transaction date for the event Letter Date. If a hold code 4 or 5 (Bankruptcy) exists on the loan, the fields will be blank and no event letter will be sent.

- On interest-bearing loans, change the interest rate to "0.00." You will need to run the Reverse Charge-Off transaction (tran code 2022-02) to reinstate the previous interest rate.

- Zero out the Accrued Interest field and the Interest Rate field. You will need to run the Reverse Charge-Off transaction (tran code 2022-02) to reinstate the previous interest rate and accrued interest amount.

- Change the statement cycle (LNSCYC) to "1."

This transaction does not close the loan. The principal balance does not change. However, the General Ledger is adjusted as explained below.

This transaction performs account reclassification of the loan amounts in the General Ledger. Posting field numbers L-104 (principal charge-off/recovery), L-204 (principal charge-off contra), L-105 (interest recoveries), and L-205 (interest charge-off contra) allow you to further refine the posting to the General Ledger. In addition, posting field L-27 (miscellaneous fees code) within L-23 (miscellaneous loan fees) is also used to reclassify the miscellaneous loan fees to the charge-off G/L.

This transaction appears on the Charged Off Loans Posting Journal and the Charged Off Loans Trial Balance Reports (FPSRP220).

Precomputed loans must be converted to a daily simple interest (payment method 6) prior to processing this transaction. This is done on the Convert Precomputed Loans screen using teller number 8960.

Insurance commissions will be finalized with this transaction.

This transaction reverses the charge off by removing the information in the fields mentioned above (tran code 2022-01) and replacing the general category with one that you select that is not an 80, 82, 83, 84, 86, 87, 88, or 89.

This transaction also reverses all history and reclassifies fees to the general category entered.

This transaction also performs account reclassification of the loan amounts in the General Ledger. Posting field numbers L-104 (principal charge-off/recovery), L-204 (principal charge-off contra), L-105 (interest recoveries), and L-205 (interest charge-off contra) allow you to further refine the posting to the General Ledger.

Transaction code 136 (Charge-Off Summary transaction) launches once a Charge-Off transaction has been run. The 136 transaction provides a summary of the charge off. The following fields are displayed as part of the Charge-Off Summary: charge-off balance, total of income fees, total of non-income fees, and total of insurance refunds.

This transaction will not, however, reverse the loan back to a precomputed loan once its been converted to an interest-bearing loan, as described in the Charge-Off description above.

Note: In order to run the Reverse Charge-Off transaction, the Charge-Off Summary history must be the last history on the account. If any file maintenance or monetary transactions have been processed on the account after the Charge-Off transaction, the charge-off reversal must be processed manually.

Insurance commissions will be finalized with this transaction.

This transaction opens an inquiry screen, where you can enter the account number and effective date (the date to which you want interest calculated). Once you enter the account number and effective date, a new display screen appears showing:

Borrower’s Short Name

Loan Due Date

Investor/Dealer Master #

Principal Balance

Total Late Charges

Total Loan Fees

30-Day Interest Amount

Total Interest

Interest to XX-XX-XX (The effective date entered on the first transaction screen.)

Total Amount Due

This transaction also initiates the Interest-Only Payment transaction (tran code 2600-03) to appear.

This inquiry displays the amount of interest due.

The inquiry transaction box displays:

Account Number

Effective Date (Interest is calculated to this date. Generally, enter a date in the future.)

Once you press <Enter>, it displays the following:

Short Name

Account Balance

Interest Rate

Accrued Interest (includes the Accrued Interest field plus accrued interest to today)

Effective Date (This is the date you entered in the inquiry box of the transaction.)

Interest Amount (interest to or from the effective date)

- If the effective date is in the future, this is the interest from today to the effective date.

- If the effective date is in the past, this is the amount of interest from today back to the effective date. (You would subtract this amount from the interest accrued to today.)

This inquiry initiates the Waive Interest transaction (tran code 2510-01).

6

Correction: No (inquiry only)

This transaction identifies that property securing the loan has been repossessed.

The Repossess transaction box displays the following fields:

Account Number

As of Date

F/M New Data (general category)

Y/N Field 1 (This checkbox field allows you to determine if the statement code (LNSTMT) should be changed to "1," which means no statement (on Consumer Finance statements only).) You can use the Transaction Design screen in CIM GOLDTeller to change the name of this field to something more meaningful for your institution.)

This transaction performs the following file maintenance:

- Changes the general category code to 81 (repossessed non-real estate) or 85 (repossessed assets).

- Puts a hold code 93 (repossession by grantor) on the loan.

- Puts action code 93 (repossession) and a date on the loan.

- Removes the prepayment penalty code.

- Changes the statement advertising code (LNSADV) to zero, for no advertising.

- Puts a charge-off date on the loan. If no date is entered in the As of Date field on the transaction, the transaction date is used.

The Repossession field is updated on the Credit Life & Disability screen with the principal balance.

This transaction also performs account reclassification of the loan amounts in the General Ledger.

The general category and charge-off date on the loan will not be changed with the Repossess transaction if the loan is charged off (the loan has a general category of 80, 82, 83, 84, 86, or 87).

This transaction reverses the Repossess transaction by removing the information in the fields mentioned above (Repossess transaction). It requires that you enter a general category.

The general category and charge-off date will not be changed with the Reverse Repossess transaction if the loan is charged off (general category 80, 82, 83, 84, 86, or 87).

This transaction also performs account reclassification of the loan amounts in the General Ledger.

This inquiry displays the deferment amount due on a loan. It displays the payment method, due date, effective date, principal balance, total loan fees, total late charges, and interest due for a deferment payment.

The Deferment Inquiry transaction box displays:

Account Number

Effective Date

On a simple interest loan (payment method 6), the interest is calculated from the date last accrued to the effective date. This can be in the future or the past. If the date is too far in the future or if the date is before the date of the last transaction, an error will appear.

On a precomputed loan (payment method 3), the effective date is ignored and the "interest" is calculated as 1 percent of the principal balance.

The Deferment Inquiry transaction also includes all outstanding late fees and miscellaneous fees.

If the loan has a VSI policy (insurance type 90), then one month’s premium is included in the deferment amount due. The premium amount is calculated by subtracting the original P/I from the current P/I. This equals one month’s premium.

All items are displayed separately with the total deferment amount at the end.

The Deferment Payment transaction (tran code 2600-11) is then automatically initiated with the account number, deferment amount, and effective date already filled in.

The Deferment transaction (tran code 2600-13) will automatically be displayed after the Deferment Inquiry transaction if the deferment Code found on the Consumer Fields screen is anything but 0 (California). The Deferment Notice transaction (tran code 2270-02) is automatically run after the Deferment transaction. Please see tran codes 2270-02 and 2600-13 below for more information concerning these transactions.

Note: If the loan is two or more months delinquent, the Deferment Inquiry is displayed and the delinquency is noted at the bottom of the inquiry. When this occurs, the Deferment Payment transaction (2600-11) is not automatically initiated.

Also see Deferment Payment transaction (tran code 2600-11) below.

*This transaction is run from the Nonaccrual & Charge-offs & Recoveries screen.

This places the loan into a nonaccrual status.

Runs transaction 583 - Set Nonaccrual (program FPS21190)

- Loan frequency cannot be zero (LNFREQ)

- Loan cannot be unopen or closed (LNUNOP, LNCLSD)

- If IOPTS APCO is Y (Accept Payments on Charge-offs?) then allow hold code 2 (Charge-off)

- No hold code with HNOT (Hold cannot be overridden)

- Update nonaccrual book balance (LNNABB) with principal balance (LNPBAL)

- Set nonaccrual status to 1 (LNACST)

- Set nonaccrual start date to today (L2NASD)

- Clear nonaccrual end date (L2NAED)

- Update nonaccrual original amount (L2NAOA) with principal balance minus LIP undisbursed (LNPBAL – LNLBAL)

All

Correction: Yes — 2300-02

*This transaction is run from the Nonaccrual & Charge-offs & Recoveries screen.

This clears the Nonaccrual Book Balance field and creates a 22 File Maintenance Tran Log to reclassify the balance into the general ledger between the principal balance and the nonaccrual book balance.

- Transaction input fields: Journal reference number

- Loan must be open, not unopen, closed, or released (LNUNOP, LNCLSD, LNRLSD)

- Loan must be in Nonaccrual (LNACST=1)

- Save principal balance minus nonaccrual book balance (LNPBAL – LNNABB)

Runs transaction 584 - Clear Nonaccrual (program FPS21190)

- If loan is not partial charge-off (LNPCHG), then charge-off balance must be zero (LNCOBL)

- Loan frequency cannot be zero (LNFREQ)

- If IOPTS APCO is Y (Accept Payments on Charge-offs?) then allow hold code 2 (Charge-off)

- No hold code with HNOT (Hold cannot be overridden)

- Clear nonaccrual book balance (LNNABB)

- Clear nonaccrual status to 0 (LNACST)

- Set nonaccrual end date to today (L2NAED)

- Add Journal reference number to history if one entered

If the saved principal balance minus nonaccrual book balance not zero, write reclass tranlog 22.

*This transaction is run from the Nonaccrual & Charge-offs & Recoveries screen.

This processes and posts a partial charge off by adding it to the loan record and the general ledger.

For a correction, it will remove a previously posted partial charge-off. The transaction removes the charge-off from both the loan record and the general ledger and restores the loan’s balance and accounting entries to their state prior to the partial charge-off.

- Transaction input fields: Amount, Set

- Nonaccrual (Y/N), Journal reference number, As of date

- Loan must be open, not unopen, closed, or released (LNUNOP, LNCLSD, LNRLSD)

- Loan frequency cannot be zero (LNFREQ)

- If IOPTS APCO is Y (Accept Payments on Charge-offs?) then allow hold code 2 (Charge-off)

- No hold code with HNOT (Hold cannot be overridden)

- Loan cannot be modified (LWHAMP)

- Transaction amount plus charge-off balance (LNCOBL) cannot be GT principal balance (LNPBAL)

- Transaction amount plus charge-off balance (LNCOBL) cannot EQ principal balance (LNPBAL) (must run full charge-off)

If set nonaccrual requested, run transaction 583 - Set Nonaccrual (program FPS21190)

- Loan frequency cannot be zero (LNFREQ)

- Loan cannot be unopen or closed (LNUNOP, LNCLSD)

- No hold code with HNOT (Hold cannot be overridden)

- Update nonaccrual book balance (LNNABB) with principal balance (LNPBAL)

- Set nonaccrual status to 1 (LNACST)

- Set nonaccrual start date to today (L2NASD)

- Clear nonaccrual end date (L2NAED)

- Update nonaccrual original amount (L2NAOA) with principal balance minus LIP undisbursed (LNPBAL – LNLBAL)

Run transaction 860 – Partial charge-off (program FPS21180)

- Cannot have full charge-off status (LNFCHG)

- Add Journal reference number to history if one entered

- Add transaction amount to charge-off balance (LNCOBL)

- Set partial charge-off status (LNPCHG)

Run transaction 311(1811) – Offset Debit

- Runs for negative transaction amount

Partial Charge-off Correction 2300-03

- Transaction input fields: Amount, Clear

- Nonaccrual (Y/N), Journal reference number, As of date

- Loan must be open, not unopen, closed, or released (LNUNOP, LNCLSD, LNRLSD)

- Loan frequency cannot be zero (LNFREQ)

- If IOPTS APCO is Y (Accept Payments on Charge-offs?) then allow hold code 2 (Charge-off)

- No hold code with HNOT (Hold cannot be overridden)

- Loan cannot be modified (LWHAMP)

Run transaction 868 – Partial charge-off correction (program FPS21180)

- Cannot have full charge-off status (LNFCHG)

- Charge-off balance (LNCOBL) minus transaction amount cannot be negative

- Add Journal reference number to history if one entered

- Subtract transaction amount from charge-off balance (LNCOBL)

- If charge-off balance is zero, clear partial charge-off status (LNPCHG)

Run transaction 312(1812) – Offset Credit

- Runs for negative transaction amount

- If clear nonaccrual requested

- Save principal balance minus nonaccrual book balance (LNPBAL – LNNABB)

Run transaction 584 - Clear Nonaccrual (program FPS21190)

- If loan is not partial charge-off (LNPCHG), then charge-off balance must be zero (LNCOBL)

- Loan frequency cannot be zero (LNFREQ)

- If IOPTS APCO is Y (Accept Payments on Charge-offs?) then allow hold code 2 (Charge-off)

- No hold code with HNOT (Hold cannot be overridden)

- Clear nonaccrual book balance (LNNABB)

- Clear nonaccrual status to 0 (LNACST)

- Set nonaccrual end date to today (L2NAED)

- Add Journal reference number to history if one entered

If the saved principal balance minus nonaccrual book balance not zero, write reclass tranlog.

*This transaction is run from the Nonaccrual & Charge-offs & Recoveries screen.

This processes and posts a full charge off. The loan must be in a nonaccrual status before this transaction will run.

For a correction, it will remove the previously posted full charge off, remove the charge off from both the loan record and the general ledger and restore the loan’s balance and accounting entries to their state prior to the charge-off.

- Transaction input fields: General Category, Remove bill code (Y/N), Add hold code 2 (Y/N), JNL ref number, As of date

- Loan must be open, not unopen, closed, or released (LNUNOP, LNCLSD, LNRLSD)

- Principal balance (LNPBAL) cannot be zero Loan frequency cannot be zero (LNFREQ)

- If IOPTS BKPM is Y (allow payments on bk hold codes 4 and 5?), then hold codes 4 and 5 are okay

- Cannot have legal hold codes 4, 5, 6, 7, 9, 27, 86

- Loan cannot be sold (LNISLD = 0)

- Construction balance must be zero (LNLBAL)

- If rule of 78s (LNPMTH = 3) then remaining unearned must be zero (LN78CG)

- If IOPTS APCO is Y (Accept Payments on Charge-offs?) then allow hold code 2 (Charge-off)

- No hold code with HNOT (Hold cannot be overridden)

- Loan cannot be modified (LWHAMP)

- Must have an empty action code field available

- New general category must be 80–89

- Current general category (LNGENL) cannot be 80–89

- If adding hold code 2, a hold code field must be zero (LNHLD1, LNHLD2)

- Transaction amount plus charge-off balance (LNCOBL) cannot be GT principal balance (LNPBAL)

- Income fees remaining cannot exceed 9,999,999.99 (fee codes (FOFECD) 9, 16, 33, 39, 40, 47, 51, 52, 64, 65, 66, 67, 68)

- Non income fees remaining cannot exceed 9,999,999.99 (all other fee codes that are not income codes)

If loan is not nonaccrual status, run transaction 583 - Set Nonaccrual (program FPS21190)

- Loan frequency cannot be zero (LNFREQ)

- Loan cannot be unopen or closed (LNUNOP, LNCLSD)

- No hold code with HNOT (Hold cannot be overridden)

- Update nonaccrual book balance (LNNABB) with principal balance (LNPBAL)

- Set nonaccrual status to 1 (LNACST)

- Set nonaccrual start date to today (L2NASD)

- Clear nonaccrual end date (L2NAED)

- Update nonaccrual original amount (L2NAOA) with principal balance minus LIP undisbursed (LNPBAL – LNLBAL)

Run transaction 22-14 (program FPS22010)

- Update history description to ‘FULL CHARGE-OFF’

- Add charge-off descriptor 221 to history

- Update the general category (LNGENL)

- Add hold code 2 if requested

- Add action code 153 (Charge-off date) with today’s date or as of date

- Set full charge-off status (LNFCHG)

- Clear partial charge-off status (LNPCHG)

- Update charge-off date (LNCODT) with today’s date or as of date

- Update charge-off balance (LNCOBL) with principal balance (LNPBAL)

- If loan is in nonaccrual status (which should always be)

- Update charge-off balance (LNCOBL) with nonaccrual book balance (LNNABB)

- Add Journal reference number to history if one entered

- If requested, clear bill code (LNBILL)

- Clear advertising code (LNSADV)

- Write income fees remaining to history if not zero

- Write non income fees remaining to history if not zero

Full Charge-off Correction 2300-04

- Transaction input fields: General Category, Clear nonaccrual (Y/N), As of date

- Loan must be open, not unopen, closed, or released (LNUNOP, LNCLSD, LNRLSD)

- Principal balance (LNPBAL) cannot be zero

- Loan frequency cannot be zero (LNFREQ)

- If IOPTS BKPM is Y (allow payments on bk hold codes 4 and 5?), then hold codes 4 and 5 are okay

- Cannot have legal hold codes 4, 5, 6, 7, 9, 27, 86

- Loan cannot be sold (LNISLD = 0)

- Construction balance must be zero (LNLBAL)

- If rule of 78s (LNPMTH = 3) then remaining unearned must be zero (LN78CG)

- Loan cannot be modified (LWHAMP)

- New general category cannot be 80–89

- Current general category (LNGENL) must be 80–89

- Principal balance (LNPBAL) and charge-off balance (LNCOBL) must be equal

- Read history backwards looking for full charge-off transaction (transaction code 22 with description ‘FULL CHARGE-OFF’)

- If history transaction code 22 with description ‘FULL CHARGE-OFF CORR’ found, then error, already corrected

- If history transaction code 22 with description ‘FULL CHARGE-OFF’ not found, then error

- Save current bill code (LNBILL) to use if not found in history

- Save current advertising code (LNSADV) to use if not in history

- Loop through the full charge-off history F/M fields

- Save the bill code to put back if found in history

- Save the advertising code to put back if found in history

- Save the journal reference number to use if found in history

Run transaction 22-14 correction (program FPS22010)

- Update history description to ‘FULL CHARGE-OFF CORR’

- Add charge-off correction descriptor 222 to history

- Update the general category (LNGENL)

- Remove hold code 2

- Remove action code 153 and date (Charge-off date)

- Clear full charge off status (LNFCHG)

- Clear charge-off date (LNCODT)

- Clear charge-off balance (LNCOBL)

- Add journal reference number to history if found

- Put back the bill code (LNBILL) ) if found in history

- Put back the advertising message (LNSADV) ) if found in history

This transaction runs a General Ledger Miscellaneous Credit (310). It uses the Prepayment Penalty or Minimum Interest field on the GOLD Services > Autopost Setup > Loans > G/L Account Identifiers By Loan Type screen for the G/L account number. This transaction updates a loan's year-to-date interest (LNYTDI). This displays in loan history as a 310 transaction with the description "Pre-Payment Penalty Int." If this transaction is reversed, it runs a 318 transaction.

The Loan Account Number will always be displayed in the Journal Reference Number field on reports when a 2310 transaction is run. Because of this, the Journal Reference Number field has been marked as a Host Hidden Field in GOLDTeller > Administrator Options > Transaction Design > Transaction Field Properties because it cannot be overwritten.

This transaction reduces the principal balance by the amount of the transaction. It is used when you are charging off only a portion of the actual principal balance rather than the full principal balance. It would be used, for example, if you needed to reduce the principal balance so it would be below the state limit for filing small claims. For example, if the state limit for filing a small claim is $3,000, and your loan balance was $3,200, you would run the transaction for $200; leaving a principal balance of $3,000.

This transaction automatically debits the General Ledger account by the amount of the transaction, and credits that amount to the principal balance. The General Ledger number is pulled from the G/L Account Identifiers by Loan Type screen (in Loans > System Setup or in GOLD Services).

Institution option OP04 ANAC allows a partial charge-off if a loan is not in a non-accrual status.

The history description for this transaction is "Prtl W/Off Cr."

This transaction updates the Partial Write-Off field. It also feeds to the Daily Statistics Report (FPSRP210 and FPSRP211).

If you need to do a full charge off, refer to the Charge-Off Transaction (tran code 022-01).

This amount is not used in any regulatory reporting. If you report to the FDIC, use the Partial Charge Off fields (tran code 860).

All

Correction: Yes

The Waive Interest Transaction box displays:

Account Number

Tran Amount

Effective Rate

Waive Future Int?

With this transaction you can waive past interest or future interest.

If you are waiving future interest, you must reduce the interest rate to equal what future interest you are waiving (enter it in the Effective Rate field on the transaction inquiry screen).

If you are waiving past interest, the Waive Interest Inquiry (tran code 2180), explained above, shows the amount owing from the effective date to today. In the Tran Amount field, type the amount of interest that you are waiving.

Processing this transaction will automatically change the Date Last Accrued to the date this transaction was run, and the Date Interest Paid To field will reflect the date the interest has been paid to using this transaction.

The amount in the Accrued Interest field on the transaction shows the amount of past interest that can be waived.

The history description for this transaction is "Waive Interest."

This transaction updates the Interest Waive Date and Interest Waive Amount fields.

6

Correction: Yes

This transaction is run once the institution has been awarded a judgment. It changes the principal balance of the loan to the amount of the judgment.

The following fields are displayed; however, you do not need to enter data in all the fields.

Account Number

Judgment Amount

Judgment Date

Attorney Fees

Court Costs

Back Interest

Effective Rate

P/I Payment

Maturity Date

Late Charge

Prevailing Party Fee

NSF Fee

Y/N Field 1 (This checkbox field allows you to determine if the statement code (LNSTMT) should be changed to 1. This means no statement (on Consumer Finance Statements only).) You can use the Transaction Design screen to change the name of this field to something more meaningful to your institution’s tellers or employees.)

Using this transaction increases or decreases the principal balance by the difference between the current principal balance and the judgment amount. This is done as a journal transaction.

This transaction automatically debits or credits the General Ledger account number pulled from the G/L Account Identifiers by Loan Type screen (in Loans > System Setup or in GOLD Services) for the amount you write off. A different General Ledger number can be used for accounts that are charged off versus those that are not.

The transaction also performs the following functions:

- Adds a Hold Code 90 (judgment).

- Adds an Action Code 99 (judgment awarded) and Date.

- Adds a Partial Write-Off amount (if applicable).

- Clears any amount in the Partial Payments/Applied to Payment field.

- The Date Last Accrued and Interest Paid to Date fields are changed to the judgment date of this transaction.

- Waives the amount in Late Charges Due.

- Does not update/decrease the Times Late.

- Does decrease the Times Waived by 1.

- Changes the Late Charge Code to 0.

- Waives any interest owing by running a 120 transaction.

- Clears the interim paid amount.

- Changes the Prepayment Penalty Code to 0.

- Changes the Lifetime Late Charges Collected field to 0.

- Clears the Interim Late Charges field (if institution option OP04 UDQG is set to "Y").

- Waives any existing miscellaneous fees.

- Assesses attorney fees as miscellaneous fee code 31, court costs as miscellaneous fee code 32, back interest as miscellaneous fee code 33, late charges as miscellaneous fee code 39, prevailing party fees as miscellaneous fee code 40, and NSF fees as miscellaneous fee code 9.

In addition, this transaction can change the future interest rate. This may be because the judge has included the ability to accrue future interest on the judgment amount at a different rate.

You can also change the rate to zero if interest cannot be accrued beyond the judgment date.

Precomputed loans (payment method 3) must be converted to a daily simple-interest loan (payment method 6) before running this transaction.

Institution option OP14 PJPL prohibits the Judgment transaction on precomputed loans. It also forces the judgment amount to be the same as the principal balance.

6

Correction: Yes

This transaction performs a credit to the principal balance for the amount of the transaction.

The Sale of Security transaction box displays:

Account Number

Tran Amount

Check In/Check out Number

Journal In

Jrnl Reference Nbr.

G/L Account Number

Cash In

The history description for this transaction is "Sale of Security."

This transaction does not check for CP2 eligibility.

When this transaction is processed, the system will automatically update the Sale of Security date (L2RRSD) and amount (L2NASA) fields on the Valuation & Credit Risk tab of the CIM GOLD Loan Account Detail screen. The amount field is updated with the outstanding principal balance minus the LIP undisbursed balance at the time the transaction is processed—this is not the amount the principal balance was reduced by.

If institution option OP03 CISS is set, the transaction will collect interest and pay late charges, fees, and principal following the order set up in the Payment Application group box on the Payment Detail tab on the Account Detail screen. It will also update the Date Last Accrued and Date Interest Paid To fields on the Balance & Dates tab on the Account Detail screen to the date of the transaction.

If institution option OP02 APCO is set, this transaction can be run on charged-off accounts.

3, 5, 6

Correction: Yes

This transaction will debit partial payments (tran code 500) and automatically credit the principal balance (tran code 510) as a curtailment at the same time. The same edits (SOV, TOV, etc.) are used as with all other field credit (510) and field debit (500) transactions.

This transaction processes each transaction separately, and they will appear in history as two separate transactions.

This transaction can only be run on payment method 6 loans (daily simple interest). If you need to run this transaction on any other payment method, the loan must be converted to payment method 6 prior to running the transaction.

This transaction will do the following:

- Accrue interest to today and waive all interest owing.

- Waive all late charges owing.

- Waive all miscellaneous loan fees owing.

- Credit the principal balance to zero and close the loan.

If institution option OP10-CIFW is set to "Y," all open insurance policies will be refunded and cancelled.

In order to correct the Full Write-off transaction, the Full Write-off Summary history must be the last history on the account. If any other transactions or file maintenance have been processed after running the Full Write-off transaction, the transaction must be corrected manually.

This transaction can be used on the Daily Statistics Report (FPSRP211) to show charged-off accounts moving from active charge-off status to non-active status (dead file).

Insurance commissions will be finalized with this transaction.

This transaction performs a credit to the principal balance for the amount of the transaction.

The Sale of Security transaction box displays:

Account Number

Tran Amount

Check In/Check Out Number

Journal In

Jrnl Reference Nbr.

G/L Account Number

Cash In

Cash Out

Sales Tax (Amount)

The history description for this transaction is "Sale of Security."

This transaction does not check for CP2 eligibility.

When this transaction is processed, the system will automatically update the Sale of Security date (L2RRSD) and amount (L2NASA) fields on the Valuation & Credit Risk tab of the CIM GOLD Loan Account Detail screen. The amount field is updated with the outstanding principal balance minus the LIP undisbursed balance at the time the transaction is processed—this is not the amount the principal balance was reduced by.

Note: The General Ledger number the Sales Tax will be credited to should be set up in GOLD Services, Autopost Setup Menu, G/L Account Identifiers by Loan Type.

If institution option OP03 CISS is set, the transaction will collect interest and pay late charges, fees, and principal following the order set up in the Payment Application group box on the Payment Detail tab on the Account Detail screen. It will also update the Date Last Accrued and Date Interest Paid To fields on the Balance & Dates tab on the Account Detail screen to the date of the transaction.

If institution option OP02 APCO is set, this transaction can be run on charged-off accounts.

3, 5, 6

Correction: Yes

This transaction applies a field credit to the principal balance.

Transaction origination codes (TORCs) identify which G/L (income or expense) the amortization should be posted to.

TORC 40 When a loan is sold on a percentage basis

TORC 56 Regular amortization

TORC 80 When a loan is sold 100%

Overview

This is only applicable to accounts using amortization method 3 (Interest FASB 91).

This feature affects individual principal decreases posted in conjunction with a field credit to principal (tran code 2510-47 or 2510-48) or principal decreases posted in conjunction with a loan payment (tran code 2600-16 or 2600-17).

The teller transaction (tran code 2510-47 (chk) and tran code 2510-48 (jnl)) must be used if you want to calculate the income on the principal decrease when it is posted as an individual principal decrease.

When a principal decrease is posted (tran code 2510 (field credit to principal)) during the transaction, the following actions will occur:

1. The amount of the principal decrease will be divided by the current principal balance prior to the principal decrease to determine the percentage of the principal decrease.

2. The remaining fee is multiplied by the percentage and that amount will immediately be amortized.

Example: Current principal balance is $100,000, and a principal decrease of $20,000 would equal a 20% reduction. If the remaining fees are $1,500.00, then 20% x $1,500.00 would be $300.00. The $300.00 would be posted to income or expense. This amount will appear in loan history as a separate item and will be posted to the G/L during the afterhours.

3. The date of last amortization will not be updated. This will allow the regular amortization to process at monthend.

When the amortization of the principal decrease is processed, it will appear on the appropriate Deferred Fees and Costs daily reports: Deferred Costs/Premiums Amortization Report (FPSRP035), Deferred Fees/Discounts Amortization Report (FPSRP077), and Deferred MSRs Amortization Report (FPSRP156).

The Bulk Activity Loan Payment transaction (tran code 2600-16 (chk)) must be used if you want to calculate the income on the principal decrease when it is posted as part of the payment.

For more information on interest rate changes and principal decreases, see the Deferred Fees in CIM GOLD with Interest Rate Changes and Principal Decreases section in section 2.4, Deferred Fees and Income.

See Field Credit to Principal (tran code 2510-47 (chk)) for details.

This transaction provides the ability to waive late charges either by a monetary amount or by the number of late charges.

Example: Two late charges were assessed for $15.00 each, resulting in the amount of $30.00 in late charges due. You could enter "1" in the Waive No. of Lt Chrg box, and $15.00 would be waived.

This transaction updates the Times Late, Times Waived, and Times Past Due fields.

This will only waive late charges from live history. Once the late charges have been moved to dead history, they cannot be waived (dead history is history that is usually over a year old).

The Enhanced Payoff Transaction (2580) should be used to process loan payoffs. If there are deferred amounts on a loan, this transaction will run a Modification Reapply first and then proceed with the loan payoff. The 2580 transaction performs both the reapply and the payoff in one.

Reclassify

This transaction will delete the checkmark in the Non-Accrual? field, clear the amount in the Non-Accrual Book Balance field, update the Non-Accrual End date field on the Valuation & Credit Risk tab of the CIM GOLD Loan Account Detail screen, and, in General Ledger, it will reclassify the balance between the principal balance and the non-accrual book balance. The transaction will send the loan number to the G/L if the Jnl Reference Nbr box on the transaction is left blank.

Institution option STRN (Allow Special Transactions with Supervisor Override) is needed for this transaction.

Note: This transaction replaces the 584 transaction (Remove Non-Accrual Status on a Loan).

This is not a monetary transaction, although it can be processed in connection with a loan payment. This transaction can be run with or without the institution using the CP2 Transaction Processing Rules screen in GOLD Services.

The CP2 Transaction box displays:

Account Number

Apply CP2 Tran (Y/N)

Term (Note: You should hide the term on the transaction. Currently, this field does not do anything.)

The CP2 Transaction advances the Due Date (LNDUDT) to a current status.

Definition of Current: Once the due date is advanced to the month the transaction is processed, it then compares the due date to the CP2 Transaction date. If the new due date is within 10 days of the CP2 Transaction date, the due date is advanced by one frequency (if the loan has a frequency of "1," it would advance to the next month). The result is that the loan due date will always be advanced to at least 10 days greater than the date the CP2 was processed.

Example: The due date is 02/08/05. On 04/05/05 the CP2 Transaction is processed. The due date would be advanced to the next month (05/08/05). Note: If the CP2 is processed in connection with a loan payment, remember that the loan payment will advance the due date one frequency, plus the CP2 transaction will advance the due date as mentioned in the above paragraph.

The CP2 Transaction advances the loan Due Date (LNDUDT).

Institution option OPO3 CP2R will advance the loan term and maturity date by the same number of frequencies by which the loan due date is advanced.

This transaction also clears the amount in the Applied to Payment field.

This transaction updates the CP2 Transaction Dates field. (There are four date fields. It updates the first empty field. Once all fields are full, it writes over the oldest date.)

The history description for this transaction is "CP2."

When any transaction that tests for CP2 eligibility is run (such as Insurance Payment), if the account is eligible, then the CP2 Transaction will automatically appear in GOLDTeller.

If this transaction is run in conjunction with a payment, and the payment must be reversed, the CP2 Transaction must be reversed before reversing the payment.

If the amount of credit insurance refunds and/or pre-computed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 Transaction (tran code 2600-00)

Insurance Payment (tran code 2600-01)

Collection Payment (tran code 2600-02)

Interest-Only Payment (tran code 2600-03)

Mail-In Payment (tran code 2600-04)

Walk-In Payment (tran code 2600-05)

Regular Payment with CP2 Eligibility Test (tran code 2600-07)

No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example

The loan balance is $100.00, and the principal and interest is $75.00. The refunds equal $40.00.

As you attempt to post the loan payment, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF."

You would then process a Payoff transaction, which reduces the principal balance by $40.00, and then use a portion of the $75.00 to apply toward the remaining payoff amount. You would then refund the difference to the customer.

3, 6

Correction: Yes

This transaction is processed if the monthly loan payment is received from an insurance company (e.g., Accident & Health, Involuntary Unemployment). It is the same as posting a regular payment (tran code 600).

The Insurance Payment transaction box displays the following fields:

Account Number

Transaction Amount

Loan Descriptor (Insurance Type drop-list)

As of Date

Check In

Check In Number

Waived Fee Amount (These are late charge fees.)

Cash In

This transaction includes an Insurance Type drop-list field and a Waived Fee Amount field. By indicating the Insurance Type, the information will be stored in history identifying where the payment was received from. If an amount is entered in the Waived Fee Amount field, the transaction will reduce the amount in the Late Charges Due field. Note: You may want to change the Waived Fee Amount description to "waived late charges" in the GOLDTeller setup to make it more clear.

When making an insurance payment, an open policy must be in effect for the insurance type for which you are making the payment, or the transaction will not run.

If you don’t enter a late charge amount:

- It automatically waives the last unpaid late charge.

- It does not decrease the number of times assessed.

- It does increase the number of times waived.

Note: Some states don’t allow late charges to be collected after injuries or layoffs. You will need to determine what late charges were assessed before and after the injury, and waive the applicable charges.

The history description for this transaction is the type of insurance you entered in the Insurance Type field on this transaction (for example, "A&H Ins Payment").

The Insurance Claim Amount and Insurance Claim Date fields are updated with the transaction amount and the transaction date. If the Claim Amount field already has an amount in it, the new transaction amount will be added to the amount in the field. The Insurance Claim Date will be changed to the new date from the transaction. The Insurance Claims Paid Report (FPSRP216) shows these transactions.

This transaction will test for CP2 eligibility if the CP2 rules have been set up on the CP2 Transaction Processing Rules screen in GOLD Services. (Refer to the CP2 Transaction (2600-00) above.)

If, after taking the payment into consideration, the amount of credit insurance refunds and/or precomputed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 Transaction (tran code 2600-00)

Insurance Payment (tran code 2600-01)

Collection Payment (tran code 2600-02)

Interest-Only Payment (tran code 2600-03)

Mail-In Payment (tran code 2600-04)

Walk-In Payment (tran code 2600-05)

Regular Payment with CP2 Eligibility Test (tran code 2600-07)

No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example

The loan balance is $100.00, and the principal and interest payment is $75.00. The refunds from insurance amortization and precomputed interest equal $40.00.

As you attempt to post the loan payment from the insurance company, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF."

You would then process a Payoff transaction (on the Payoff screen), which reduces the principal balance by $40.00, and then use a portion of the $75.00 insurance payment to apply toward the remaining payoff amount. You would then refund the difference of $15 to the customer.

This transaction is processed when the loan payment is received by a third party (such as an attorney or collection agency). The attorney deducts his or her collection fee and forwards a new check to you, which is the payment amount minus his fee. Using this transaction increases the principal balance by the amount of the fee, and combines the principal increase amount with the check received and posts the full loan payment. (It does both a journal and a check transaction).

The Collection Payment transaction box displays the following fields:

Account Number

Tran Amount

Collection Fee Amt

Check In

Check In Number

Cash In

As of Date

Jnl Reference Nbr

Note: This transaction is different from the Agency Payment transaction (tran code 2600-10) because this transaction increases the principal balance by the fee amount.

Example: The actual loan payment amount is $160.00. The attorney received the borrower’s check for $160.00 but held back the attorney fee of $20.00. The attorney forwarded a check to you for $140.00.

You would process the check as follows: In the Tran Amount field, enter "160.00." In the Collection Fee Amt, enter "20.00." In the Check In field, enter "140.00."

The transaction will increase the principal balance by $20.00 (tran code 500 journal). It will then process a loan payment for $20.00 (tran code 600 journal), and another loan payment for $140.00 (tran code 600 check).

The history description for this transaction consists of three descriptions: "Collection Fee, Collection Pmt, Collection Pmt."

If the amount of credit insurance refunds and/or pre-computed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 Transaction (tran code 2600-00)

Insurance Payment (tran code 2600-01)

Collection Payment (tran code 2600-02)

Interest-Only Payment (tran code 2600-03)

Mail-In Payment (tran code 2600-04)

Walk-In Payment (tran code 2600-05)

Regular Payment with CP2 Eligibility Test (tran code 2600-07)

No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example

The loan balance is $100.00, and the principal and interest is $75.00. The refunds equal $40.00.

As you attempt to post the loan payment, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF."

You would then process a payoff transaction, which reduces the principal balance by $40.00, and then use a portion of the $75.00 to apply toward the remaining payoff amount. You would then refund the difference to the customer.

3, 6

Correction: No

The amount of this transaction must be for at least 30 days of interest (even if 30 days of interest isn’t due), plus fees and late charges. The 30-Day Interest Inquiry identifies the interest amount (see 30-Day Interest Inquiry (transaction code 2170-00)).

Option OP04 IPCL, if set to "N" (no), will stop the transaction if the loan is a contract (when the Originated or Purchased? Field is set to "Purchased").

Note: If institution option IORC (Interest-Only Requirement Code) is set to "1," then the following requirements must be fulfilled before an interest-only payment will be allowed:

- The principal balance must be below $10,000.00.

- The original maturity (MLOMAT) must be in the future. If MLOMAT is blank, then the loan maturity date (LNMATD) will be used instead.

- The loan opened date (LNOPND) must be three or more months ago.

- Three full payments must have been made on the loan. A payment is considered a full payment if the history’s partial amount plus amount to fees plus amount to principal plus amount to interest plus amount to late charges is less than the principal/interest payment as of the history date.

- The last payment can’t be an interest-only payment.

- Allow the payment if this is the second interest-only payment in the calendar year. You can also allow a third interest-only payment made in a calendar year, if the third payment is being made in December.

The Interest-only Payment transaction box displays the following fields:

Account Number

Transaction Amount

Check In

Check In Number

Cash In

Cash Out

As of Date

This transaction rolls the loan due date at least one payment frequency when the 30-day interest amount is paid. The transaction disregards the payment application (LNAPPL) and applies the money to fees, late charges, interest, and principal (in that order). Once the fees and late charges are paid, it then posts to all interest that is accrued, and if any amount is left over, it then applies that amount to principal. (If the amount of interest accrued is not at least as much as 30-days interest, you still must collect the 30-day interest amount and the difference is credited to the principal balance.) The Applied to Payment field is always cleared to zero.

When you process this transaction:

- The due date is advanced by at least one frequency (see next bullet).

- This transaction adds the amount posted to principal, plus the amount in Applied to Payment, and divides that by the P/I payment. It the rolls the due date by the number of P/I payments that are satisfied, and any remaining amount will stay in Applied to Payment. (The net result is that it is rolling the due date by more than one frequency depending on the amount in the Partial Payments field.)

- The Maturity Date always advances by one frequency.

- The Date Last Accrued field will be updated to the date the transaction was processed.

- The Date Interest Paid To field will be updated.

This transaction does not affect variance fields.

The history description for this transaction is "Int Only Payment."

This transaction will test for CP2 eligibility if the CP2 rules have been set up on the CP2 Transaction Processing Rules screen in GOLD Services. (Refer to CP2 transaction (tran code 2600-00) above.)

If the amount of credit insurance refunds and/or pre-computed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 transaction (tran code 2600-00)

Insurance Payment (tran code 2600-01)

Collection Payment (tran code 2600-02)

Interest-Only Payment (tran code 2600-03)

Mail-in Payment (tran code 2600-04)

Walk-in Payment (tran code 2600-05)

Regular Payment with CP2 Eligibility Test (tran code 2600-07)

No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example

The loan balance is $100.00, and the principal and interest is $75.00. The refund equals $40.00.

As you attempt to post the loan payment, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF."

You would then process a payoff transaction, which reduces the principal balance by $40.00, and then use a portion of the $75.00 to apply toward the remaining payoff amount. You would then refund the difference to the customer.

6

Correction: Yes

This transaction works like a regular payment (tran code 600) and follows the same rules.

The Mail-in Payment transaction box displays the following fields:

Account Number

Transaction Amount

Check In

Check In Number

Cash In

As of Date

Y/N Field 1 (You should change this field description to "Assess NSF Fee.")

The history description for this transaction is "Mail_In Payment."

This transaction can be used with the CP2 Transaction Processing Rules screen in GOLD Services. Also see the CP2 Transaction (2600-00) description above.

If the amount of credit insurance refunds and/or pre-computed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 Transaction (tran code 2600-00)

Insurance Payment (tran code 2600-01)

Collection Payment (tran code 2600-02)

Interest-Only Payment (tran code 2600-03)

Mail-In Payment (tran code 2600-04)

Walk-In Payment (tran code 2600-05)

Regular Payment with CP2 Eligibility Test (tran code 2600-07)

No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example

The loan balance is $100.00, and the principal and interest is $75.00. The refunds equal $40.00.

As you attempt to post the loan payment, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF."

You would then process a payoff transaction, which reduces the principal balance by $40.00, and then use a portion of the $75.00 to apply toward the remaining payoff amount. You would then refund the difference to the customer.

3, 6

Correction: Yes

This transaction works like a regular payment (tran code 600) and follows the same rules.

The Walk-in Payment transaction box displays the following fields:

Account Number

Transaction Amount

Check In

Check In Number

As of Date

Cash In

Y/N Field 1 (You should change this field description to "Assess NSF Fee.")

The history description for this transaction is "Walk_in Payment."

This transaction can be used with the CP2 Transaction Processing Rules screen in GOLD Services. Also see the CP2 transaction (2600-00) description.

If the amount of credit insurance refunds and/or pre-computed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 Transaction (tran code 2600-00)

Insurance Payment (tran code 2600-01)

Collection Payment (tran code 2600-02)

Interest-Only Payment (tran code 2600-03)

Mail-In Payment (tran code 2600-04)

Walk-In Payment (tran code 2600-05)

Regular Payment with CP2 Eligibility Test (tran code 2600-07)

No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example

The loan balance is $100.00, and the principal and interest is $75.00. The refund equals $40.00.

As you attempt to post the loan payment, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF."

You would then process a payoff transaction, which reduces the principal balance by $40.00, and then use a portion of the $75.00 to apply toward the remaining payoff amount. You would then refund the difference to the customer.

3, 6

Correction: Yes

This transaction is processed when you receive a check from the insurance company upon death of one of the borrowers. The check may or may not be enough to pay off the loan.

The Death Claim transaction box includes the following fields:

Account Number

Transaction Amount

Cash In

Check In

Check In Number

Interest Days

Effective Date (the date of death)

When processed, this transaction will accrue and pay interest on the current principal balance up to the date of the death, plus the number of days that were entered in the Interest Days field. If option 1 (see below) is used and nothing is entered in the Interest Days field, the program defaults to "30."

Institution option DCOP has the following three options that will affect this transaction:

Setting DCOP option 1 will do the following:

In addition to doing everything the transaction does currently, this option also collects any outstanding miscellaneous loan fees, collects all outstanding late charges up to the date of death, and waives any late charges assessed after the date of death. This option will cancel all insurance policies regardless if the Death Claim Payment closes the account or not. This option will only rebate interest and amortize fees if the Death Claim Payment closes the account.

Setting DCOP option 2 will do the following:

This option does everything the transaction does currently, but it also waives all miscellaneous fees with a fee code of 9 (non-sufficient funds) or 16 (charge back). This option also collects all outstanding late charges up to the date of death, and waives any late charges assessed after the date of death. This option will cancel all insurance policies regardless if the Death Claim Payment closes the account or not. This option will only rebate interest and amortize fees if the Death Claim Payment closes the account.

Setting DCOP option 3 will do the following:

This option does everything the transaction does currently, but it also waives all miscellaneous fees with a fee code of 9 (non-sufficient funds) or 16 (charge back) if the account is paid off during the transaction; it leaves all fees on the account if the account is not paid off. This option also collects all outstanding late charges up to the date of death, and waives any late charges assessed after the date of death. This option will cancel all insurance policies if the Death Claim Payment closes the loan. If the Death Claim Payment does not close the loan, only the life insurance will be cancelled with the payment. This option will only rebate interest and amortize fees if the Death Claim Payment closes the account.

Also, the principal balance is decreased effective the same date for which the interest was accrued (based on what was entered in the Interest Days field). The system then calculates interest up to today on the reduced principal balance.

Note: Some state laws only allow you to collect interest up to 30 days after the date of death. Other states allow you to collect interest up to the date the claim check was received, or 30 days of interest, whichever is less.

Note: This transaction will not run if the loan does not have a life insurance policy (INTYPC = 50-59).

The history description for this transaction is "Death Claim."

On the Credit Life & Disability screen for all policies, except the life insurance policy, the date of death is automatically entered in the Date Cancelled field, and a Cancellation Code of "4 - Insured Request" is entered.

These policy amounts are also refunded (credited to the principal balance) with this transaction.

For payment method 6 loans that refund interest back to the borrower, the interest will be credited to the principal balance.

For the life insurance policy, a Cancellation Code of "8 - Death Claim" is added and the cancellation date is entered in the Date Cancelled field. This will cause the unearned premium for the life insurance to be fully earned at monthend. If you are using the Assurant Insurance Company transmission, the cancellation information for all policies will be sent with the next monthly transmission.

If the claim check is for enough money to pay the loan off (including the rebates) this transaction will also close the loan.

This transaction does not process fees or late charges. You must post or waive them prior to processing this transaction.

If a pay-off record exists, you must drop it prior to processing this transaction.

If the G/L account numbers for rebates are not set up in GOLD Services, the transaction will not process.

WARNING: If the death claim check was not enough to pay off the loan and the DCOP institution option is not "3," these insurance policies are still cancelled. If you don’t want them cancelled, you should not use this transaction as the transaction refunds the unearned premiums and places the cancelled date on the policies on the Credit Life & Disability screen.

If the Death Claim Payment is not enough to pay off the loan, interest and amortizing fees will not be refunded.

The Insurance Pmt Amt Received and Insurance Pmt Received Date fields are updated with the transaction amount and the transaction date. If the "claim amount" field already has an amount in it, the new transaction amount will be added to the amount in the box.

The insurance claim date will be changed to the new date. The Insurance Claims Paid Report (FPSRP216) shows these transactions.

Insurance commissions will be finalized with this transaction.

0, 3, or 6

Correction: Yes

This transaction works exactly like a regular payment (tran code 600). It follows all the same rules as a regular payment, except it tests the account to see if it is eligible for a CP2 (exception payment) transaction (tran code 2600-00).

If the account is eligible, the message "ELIGIBLE FOR CP2" and the CP2 transaction window will both automatically appear on the screen.

If the account is not eligible, the message "INELIGIBLE FOR CP2" will appear.

The Regular Payment with CP2 Eligibility Test transaction box displays the following fields:

Account Number

Transaction Amount

Check In

Check In Number

As of Date

Cash In

The history description for this transaction is "Regular Payment."

Refer to the CP2 transaction (tran code 2600-00) for more details on how the loan due date advances.

If the amount of credit insurance refunds and/or pre-computed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 Transaction (tran code 2600-00)

Insurance Payment (tran code 2600-01)

Collection Payment (tran code 2600-02)

Interest-Only Payment (tran code 2600-03)

Mail-In Payment (tran code 2600-04)

Walk-In Payment (tran code 2600-05)

Regular Payment with CP2 Eligibility Test (tran code 2600-07)

No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example

The loan balance is $100.00, and the principal and interest is $75.00. The refunds equal $40.00.

As you attempt to post the loan payment, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF."

You would then process a payoff transaction, which reduces the principal balance by $40.00, and then use a portion of the $75.00 to apply toward the remaining payoff amount. You would then refund the difference to the customer.

The following items provide general information on partial payments. (See also transaction 2510-04—Curtailment from partial payment.)

Update Function 84

Afterhours update function (84) will automatically debit the loan Partial Payment field and post a loan payment. It can be run daily, weekly, or monthly.

When payments are automatically posted from partial payments, the debits from partial payments accompany each transaction instead of being accumulated and debited as a lump sum at the end. (There will be a separate debit from partial payment for each loan payment, late charge, and fee payments.)

When using this update function, the loan must meet the following conditions:

- The loan must be a payment method 0, 4, or 7.

- The loan cannot have any holds that cannot be overridden. (For instance, the loan cannot have a hold code 7—legal hold/foreclosure.)

- The loan cannot be "locked in" for a payoff or payment reversal.

- There must be enough in partial payments to post at least a full payment.

- The due date can be in the past, in the current month, or one month in the future. (Refer to option OPPP PPPA below.)

This process functions as follows:

With update function 84 set, but none of the institution options set, during the afterhours process, the system will compare the loan payment (P/I plus reserve 1 and/or 2) with the amount in partial payments. If there is enough money in partial payments to post a full payment, it will post a loan payment (tran code 600) and then debit partial payments.

Three institution options pertaining to paying late charges and miscellaneous fees, allowing the loan to be paid "in the future," and processing excess funds as a curtailment are also available. They are as follows:

OPPP PPLF—Partial Payments–Pay Late Charge/Fees?

After the loan is brought current by posting payments, any excess funds will post next to late charges and last to fees.

OPPP PPPA—Partial Payments–Pay Ahead?

This will post full payments due two months in the future as funds are available.

Examples:

A. In July, if a loan has a due date in July or August, the payment would be posted.

B. In July, if a loan has a due date of September or later, the payment would not be posted unless this option to pay in advance is used.

OPPP PPPC—Partial Payments–Pay Curtailment?

After paying all full payments (and fees and late charges if the appropriate options are set), any excess funds will be posted as a principal decrease (only on loans not sold to an investor (Percent Sold equal to zero)). After bringing the loan current, paying the late charges and fees (according to the option), and paying the loan ahead (according to the option), any remaining funds will be posted.

Note: None of the options will function without at least a full loan payment being posted at the same time.

Any or all of the options can be set.

Another institution option, UBAP, will cause update function 84 to use a 2510 transaction instead of a 510 for principal decreases.

All transactions are posted with a supervisor override (SOV) and as a TORC 61. They are identified in loan history as a payment from partial payments except the loan fees.

All transactions will appear on the Transaction Journal by Tran Origination Code Report (FPSRP041). Any transactions that fail will appear on the Afterhours Processing Exceptions Listing (FPSRP013). A failure of one these transactions may require a manual debit to partial payments.

WARNING: Prior to using this transaction, please contact the FPS GOLD financial team as your Autopost may need to be adjusted for using TORC 61.

Note: When a loan has a repayment plan and a partial payment is made, it must be run through the BAP or TBAP for the repayment plan to be updated. If the transaction has TORC 61 (which is only created when the afterhours has a payment from partial being applied to the loan), the repayment plan will be skipped.

This transaction works similarly to a regular payment transaction (tran code 600), but does not roll the due date or increment the installment number. (Funds are posted to the loan based on the payment application code (i.e., interest, principal, late charges, fees, etc.))

The No Advance Payment Transaction box displays the following fields:

Account Number

Transaction Amount

Check In

Check In Number

Cash In

Cash Out

As of Date

Y/N Field 1 (You should change this field description to "Assess NSF Fee.")

The history description for this transaction is "No Advance Payment."

If the amount of credit insurance refunds and/or pre-computed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 Transaction (tran code 2600-00)

Insurance Payment (tran code 2600-01)

Collection Payment (tran code 2600-02)

Interest-Only Payment (tran code 2600-03)

Mail-In Payment (tran code 2600-04)