Navigation: »No topics above this level«

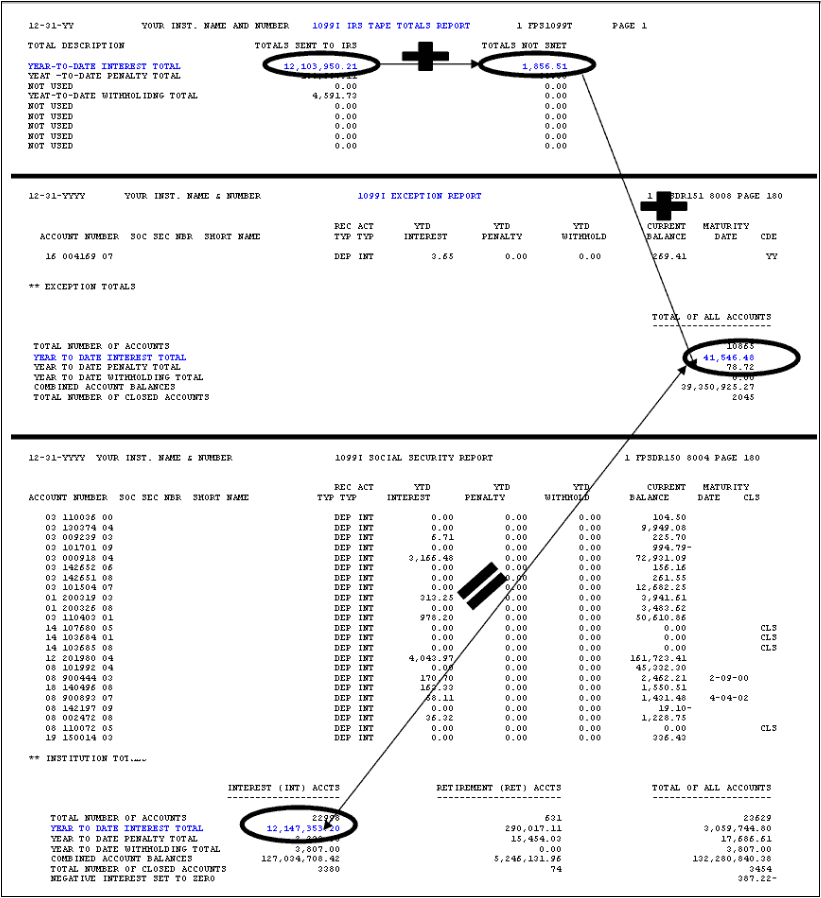

Three separate reports are needed for balancing the year-end 1099 information generated by FPS GOLD:

•One of either the 1099INT Customer Information, Numeric, Alpha, or Social Security reports

•The 1099INT IRS Tape Totals Report

The following table shows the totals that should balance on these reports.

The information in the cell below this one . . . |

Should match the information in the cell below this one |

The institution totals for interest, penalty, and withholding under the column INTEREST (INT) ACCTS on the 1099INT Customer Information, Numeric, Alpha, or Social Security reports |

The combined year-to-date interest of the TOTALS SENT TO IRS and the TOTALS NOT SENT column of the 1099INT IRS Tape Totals Report plus the institution totals in the TOTAL OF ALL ACCOUNTS column of the 1099INT Exception Report |

The following example illustrates interest balancing:

1099INT IRS Tape Totals Report |

|

|

|

Year-to-Date Interest Totals Sent to IRS |

$12,103,950.21 |

|

+Year-to-Date Interest Totals Not Sent |

$1,856.51 |

1099INT Exception Report |

|

|

|

+Year-to-Date Interest Totals of All Accounts |

$41,546.48 |

|

|

_____________ |

|

|

$12,147,353.20 |

1099INT Social Security Report |

|

|

|

=Year-to-Date Interest (INT) Accts |

$12,147,353,20 |

NOTE

You should be able to balance the total to the YTD total interest posted from the Deposit system. To do this, you can run a GOLDWriter to pull in the total YTD interest using the field DMYITL (Prior YTD Interest). Run this on the live (online) set, not the monthend set. |

The following shows the example above on the IRS Tape Totals Report.

lllustration of Year-End Balancing