Navigation: »No topics above this level«

Using the Year-End Run Options screen, you can signify which year-end reports you want run for your institution. These reports are available to view, print, and save in GOLDView in CIM GOLD. Each of these reports must be checkmarked on the Year-End Run Options screen. Detailed information for each report is found in the Deposit Reports manual in CIM GOLD.

The reports are divided by section:

Check the boxes in front of each report on the Year-End Run Options screen, 1099 Processing tab for the report you want to run in GOLDView. The following paragraphs briefly describe each of the 1099INT reports.

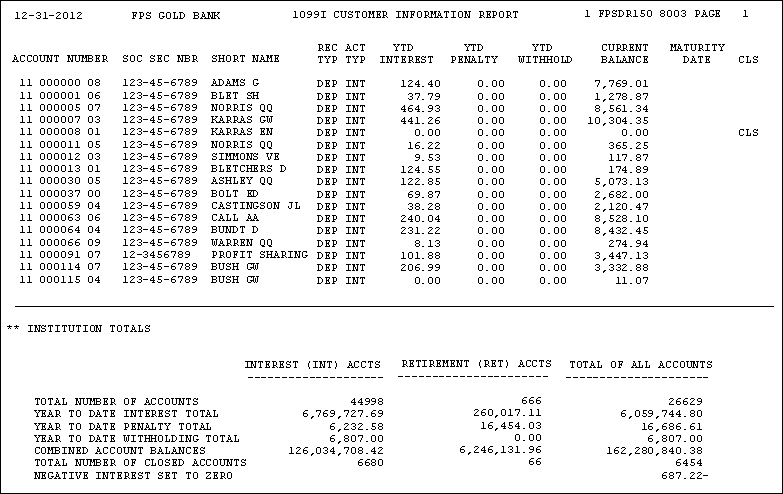

•1099INT Customer Information Report

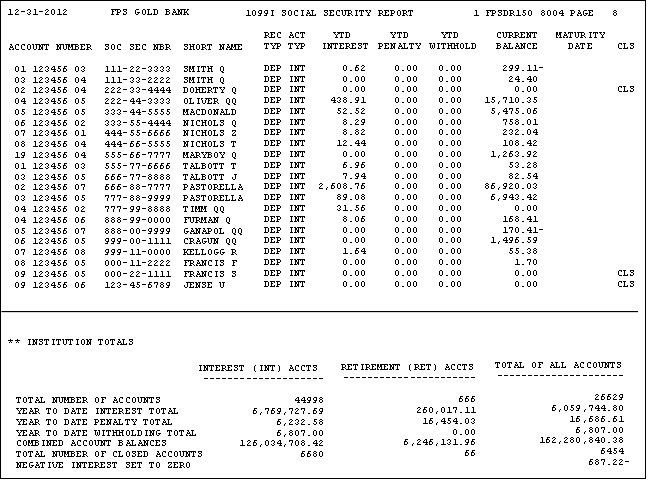

•1099INT Social Security Report

•1099INT Social Security Address Report

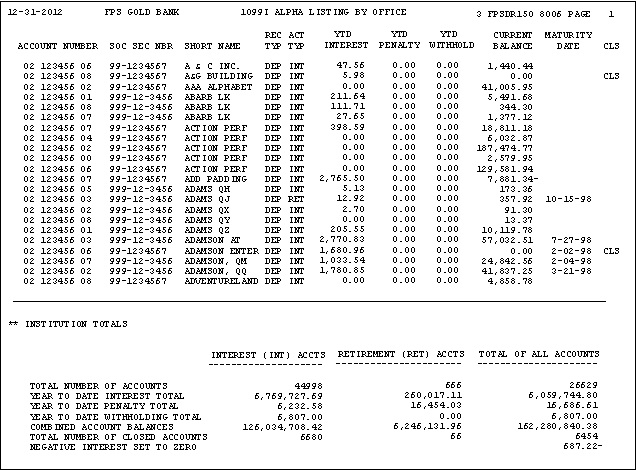

•1099INT Alpha Report By Office or Institution

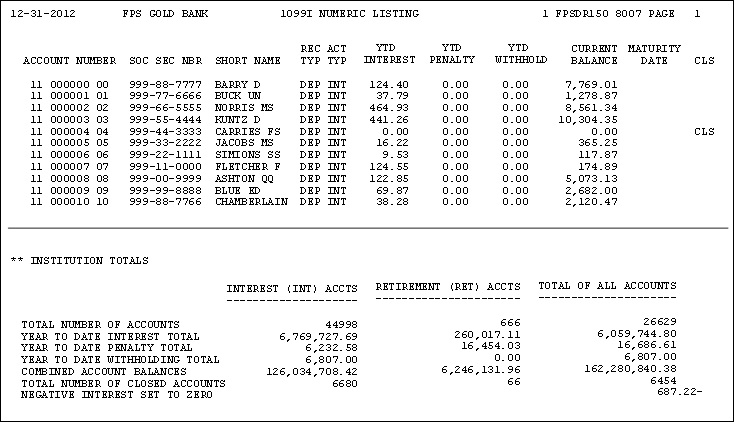

•1099INT Numeric List (Account Number Order)

FPS GOLD does not print a paper copy. All reports requested will be placed in GOLDView.

See the following example of the 1099INT Customer Information Report.

For more information concerning this report, see 1099INT Customer Information Report in DocsOnWeb.

The Numeric Listing is printed in account number order and contains the same information as the Alpha Listing.

FPS GOLD does not print a paper copy. All reports requested will be placed in CIM GOLDView.

See the following example of a 1099 Numeric Listing Report (account number order).

For more information concerning this report, see 1099INT Numeric List (Account Number Order) in DocsOnWeb.

The 1099INT Alpha Listing report may be sorted either by short name within office or by short name within institution. Please indicate your preference on the Year-End Run Options screen.

FPS GOLD does not print a paper copy. All reports requested will be placed in CIM GOLDView.

See the following example of a 1099 Alpha Listing Report by office.

For more information concerning this report, see 1099INT Alpha Report By Office or Institution in DocsOnWeb.

The 1099INT Social Security report is printed in Social Security number order. There are two different types for the Social Security List. One report will display the account dollar figures, and the second report displays the address information.

FPS GOLD does not print a paper copy. All reports requested will be placed in CIM GOLDView.

See the following example of a Social Security Report showing the dollar amounts. (See also 1099INT Social Security Address Report below.)

For more information concerning this report, see 1099INT Social Security Report in DocsOnWeb.

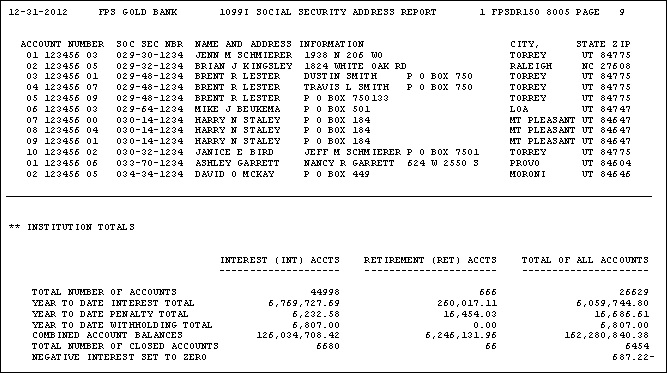

The 1099INT Social Security Address Report shows tax identification numbers (TINs) and the associated account(s) and name and address information. Invalid customer numbers (CIDs) will be sent to the IRS with blank TINs. The report is sorted by tax identification number, then by account number within each tax identification number.

Detailed information on interest, withholding, and penalty amounts for retirement accounts will print on this report. However, retirement accounts will not print a 1099INT form or go to the IRS for reporting.

FPS GOLD does not print a paper copy. All reports requested will be placed in CIM GOLDView.

See the following example of a Social Security Address Report. (See also 1099INT Social Security Report above.)

For more information concerning this report, see 1099INT Social Security Address Report in DocsOnWeb.

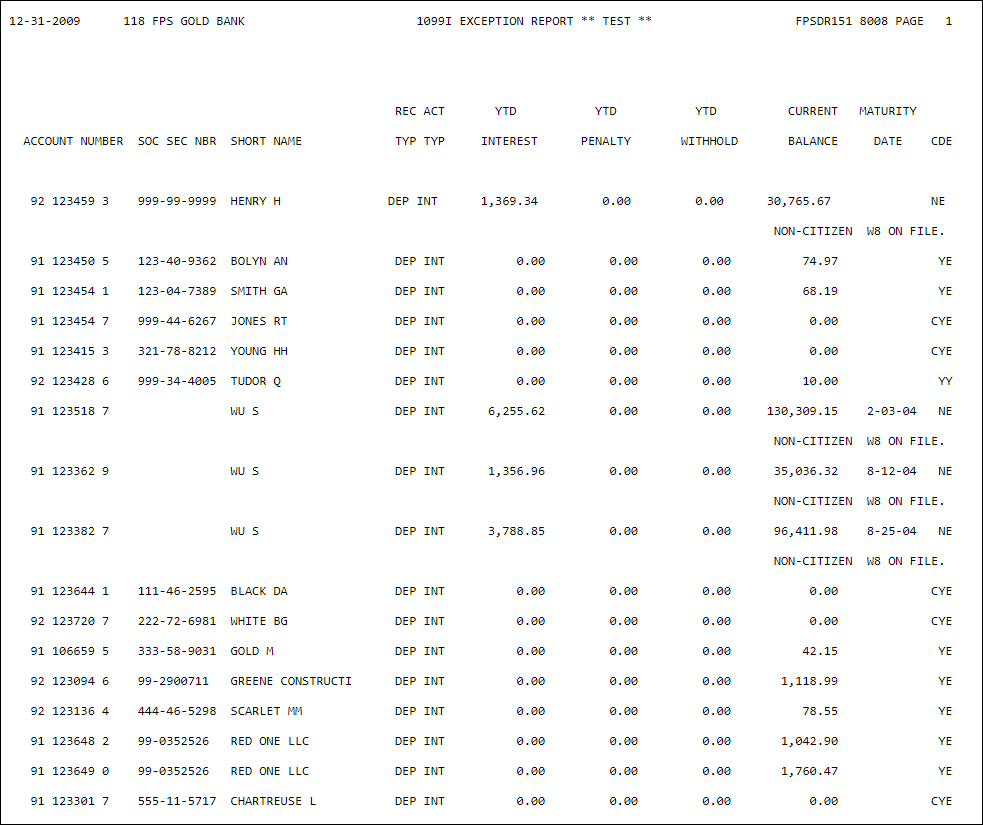

The 1099INT Exception Report lists accounts not reported on a 1099 form. Accounts are exceptions for the following reasons:

•Missing or invalid Social Security number (reported with a blank TIN to the IRS).

•Interest is below the minimum specified on the Year-End Run Options screen.

•A hold code 017 or W8 indicator = Y.

•1042-S required.

•W-8 on file.

See the following example of a 1099INT Exception Report. The table above the report example explains the codes in the far right column of the table.

1099 Exception Report

For more information concerning this report, see 1099INT Exception Report in DocsOnWeb.

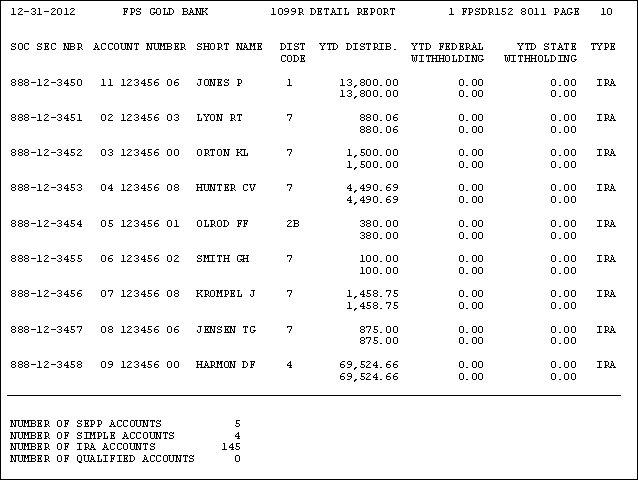

The 1099-R/1099-Q/1099-SA Detail Report lists by Social Security number the detail of the information reported on each 1099-R/1099-Q/1099-SA form. These reports sort in the same order as the 1099-R/1099-Q/1099-SA forms.

FPS GOLD does not print a paper copy of this report. All reports requested will be placed in GOLDView in CIM GOLD.

For detailed information concerning these reports, see FPSDR152-1, FPSDR154, and FPSDR103 in the Deposit Reports manual in DocsOnWeb.

See the following example of a 1099-R Detail Report follows.

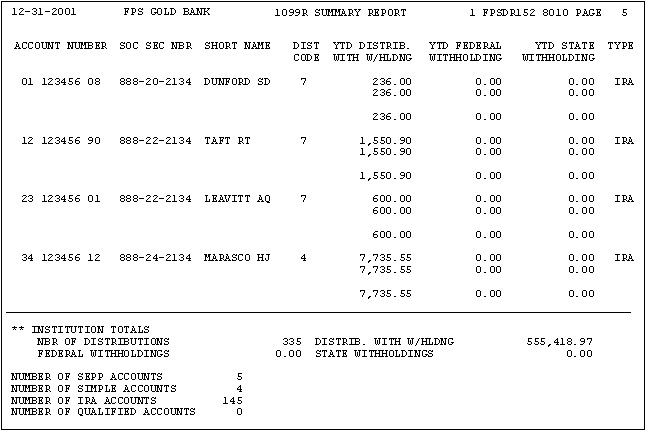

The 1099-R/1099-Q/1099-SA report accompanies the 1099-R/1099-Q/1099-SA forms. This report lists all of the accounts that received a 1099-R/1099-Q/1099-SA and the amounts reported to the IRS. This report will sort in the same order as your 1099-R/1099-Q.1099-SA forms.

FPS GOLD does not print a paper copy. All reports requested will be placed in CIM GOLDView.

For detailed information concerning these reports, see FPSDR152-1, FPSDR154, and FPSDR103 in the Deposit Reports manual in DocsOnWeb.

See the following example of a 1099-R Summary Report.

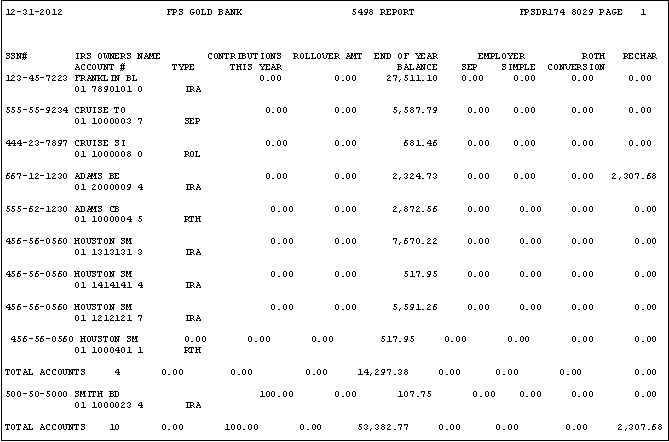

The Retirement 5498 and 5498-SA Reports shows all retirement accounts that require 5498 or 5498-SA forms. Every account holder that has a balance or contribution for the year must receive a 5498 or 5498-SA form by January 31. If the account holder has more than one account, only one account number will be printed. This account number must be used for any corrections after year-end.

For detailed information concerning these reports, see FPSDR174 and FPSDR104 in the Deposit Reports manual in DocsOnWeb.

The 1099I IRS Tape Totals Report is created with 1099 forms on 1-part paper. Balance this report with your transmittal to the IRS. This is not an optional report.

The following is an example of the 1099I IRS Tape Totals Report:

Tape Totals