Navigation: »No topics above this level«

Retirement forms can be processed by FPS GOLD or an outside source of your choosing. You must select how you want Year-End Retirement Forms generated using the Year-End Run Options screen, Retirement tab.

The following paragraphs describe each of the Retirement Forms available.

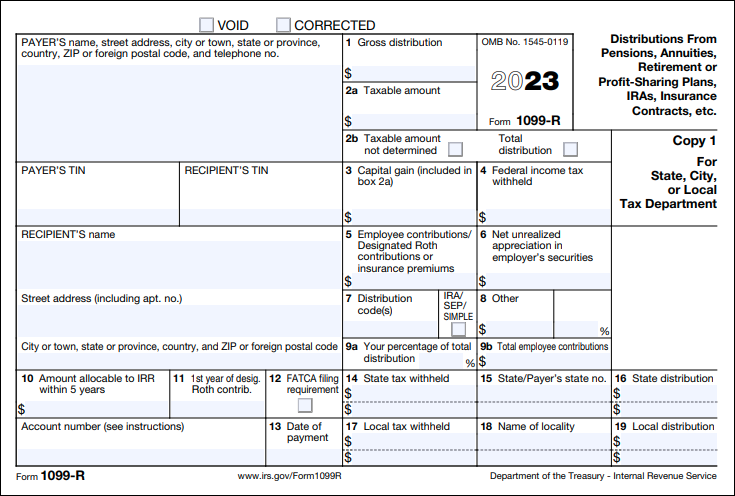

1099-R forms are created for retirement accounts with distributions in the current year. A separate 1099-R is created for each Distribution Type. FPS GOLD will print the 1099-R forms using a laser printer. FPS GOLD will create two forms for customers with withholding and make one additional copy for the bank. Your bank's phone number will also be added to this form. Qualified plans will be on a separate form. The only sorts available are by Social Security Number or Alphabetically.

See the following example of a 1099-R form:

1099-R Form

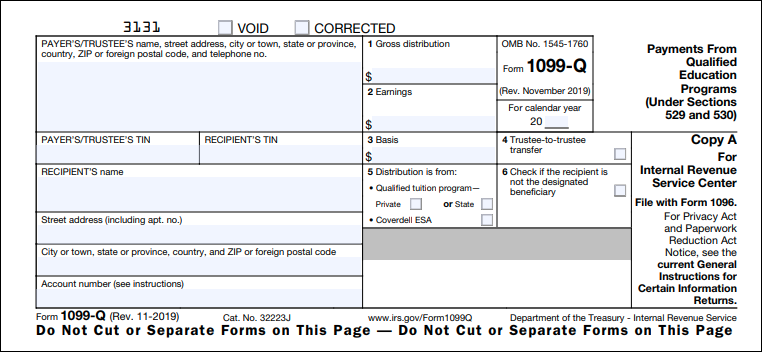

1099-Q forms list the gross distribution (including in-kind distributions) paid this year from a Qualified Tuition program or a Coverdell ESA.

The following is an example of a 1099-Q form.

1099Q Form

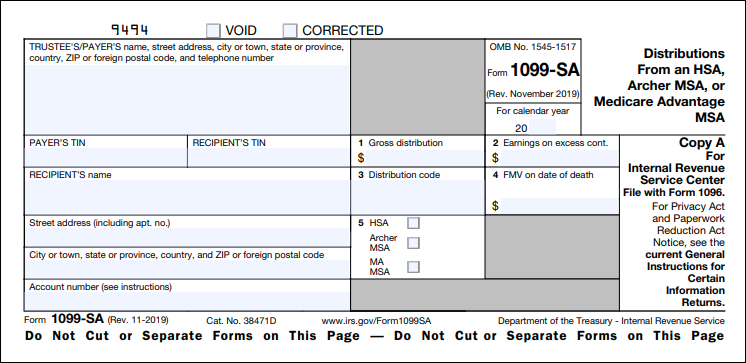

1099-SA forms lists distributions from Health Savings Accounts plans.

The following is an example of a 1099-SA form.

1099-SA Form

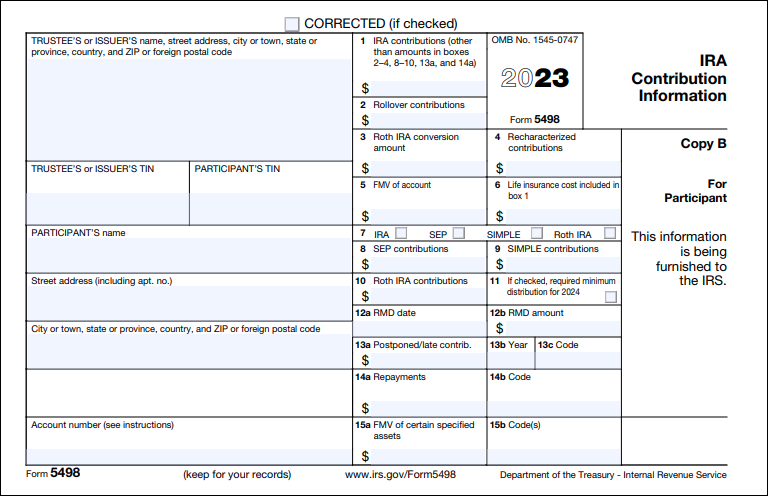

5498 forms are created for all retirement plans to disclose the fair market value and the owners in distribution. The only sorts available are by Social Security Number or Alphabetically. If you do not select a sort, the default is Social Security number.

The following is an example of a 5498 form.

5498 Form

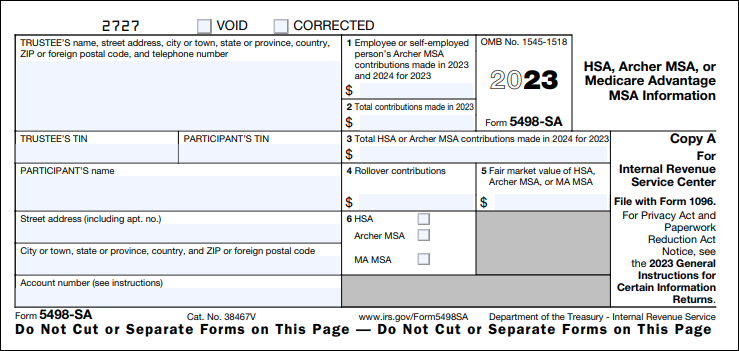

Every account holder that has a balance or contribution to a Health Savings Account (HSA) for the year must receive a 5498-SA form by January 31st.

The following is an example of a 5498-SA form.