Navigation: Deposit Year-End Run Options Screen >

The Retirement tab on the Deposit Year-End Run Options screen allows you to select whether you want FPS GOLD to print and send you all year-end retirement forms or whether your institution uses a third-party source to handle retirement account year-end forms.

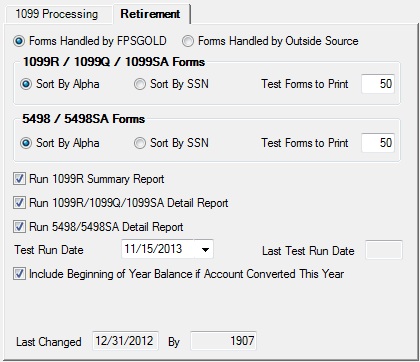

The following is an example of the Retirement tab:

Deposits > Miscellaneous > Year-end Run Options Screen > Retirement Tab

At the top of this tab are two radio buttons called Forms Handled by FPS GOLD and Forms Handled by Outside Sources. Select one of these buttons to indicate how your institution handles year-end retirement forms (1099R, 1099Q, 1099SA, 5498, and 5498SA). You have three options for handling them:

1.Have FPS GOLD process the year-end forms, send the information to the IRS, send the forms to you during year-end processing.

2.You print them from GOLDView and send them to your account owners.

3.Use an outside source to compile the year-end retirement data and generate the forms.

Your bank return address comes from Institution Options, Name, ADDR, and state. The phone number comes from Institution Number in CIS.

If you select Forms Handled by FPS GOLD, then you must also enter information about how you want the forms sorted and how many test forms you want printed for each type of retirement account. See the following definitions for more information.

Field |

Description |

|

|---|---|---|

1099R/1099Q/1099SA Forms (FPDYFNBR) |

Enter the number of statements (forms) you want processed and put into your warehouse for audit during the test run of the year-end processing for these retirement forms in the Test Forms to Print field. In November (according to the Action Dates), you will audit the forms in GOLDView. The system uses the Sort By Alpha and Sort By SSN fields to determine the order of reports for both the test and final runs. Forms are sorted by SSN. In the Test Forms to Print field, enter the number of test forms you want to review.

For more information and an example concerning the specific type of form, see Forms. |

|

5498/5498SA Forms (FPDYFNBR) |

Enter the number of statements (forms) you want processed and put into your warehouse for audit during the test run of the year-end processing for the 5498 and 5498SA forms in the Test Forms to Print field. In November (according to the Action Dates), you will audit the forms in GOLDView. The system uses the Sort By Alpha and Sort By SSN fields to determine the order of reports for both the test and final runs. Forms are sorted by SSN. In the Test Forms to Print field, enter the number of test forms you want to review.

For more information and an example concerning the specific type of form, see Forms. |

|

Run 1099R Summary Report |

Check this box if you want to generate a 1099R Summary Report (FPSDR152-2) in GOLDView in CIM GOLD. The 1099R Summary Report shows how the information on retirement accounts, their owners, and distributions made from those retirement accounts was sent to the IRS. This report can be sorted by short name or by Social Security Number (SSN). It lists one account per distribution code in summary form, printing the IRS owner's short name and Social Security Number. This report matches the 1099R forms..

For detailed information concerning this report, see FPSDR152-2 in the Deposit Reports manual in DocsOnWeb. Also see the Reports section of this help for summary information concerning this report. |

|

Run 1099R/1099Q/1099SA Detail Report |

Check this box if you want to generate a 1099R, 1099Q, or 1099-SA Detail Report (FPSDR152-1, FPSDR154, and FPSDR103) in GOLDView in CIM GOLD. These reports are run in November every year as a test. On December 31st of every year these reports are run. These reports show the relationship between retirement accounts, their owners, and distributions made from those retirement accounts. These reports can be sorted by short name or by Tax Identification number (TIN). They will list every account by social security number and each distribution code.

For detailed information concerning these reports, see FPSDR152-1, FPSDR154, and FPSDR103 in the Deposit Reports manual in DocsOnWeb. Also see the Reports section of this help for summary information concerning this report. |

|

Run 5498/5498SA Detail Report |

Check this box if you want to generate the 5498 or 5498-SA report (FPSDR174 and FPSDR104) in GOLDView. The Retirement 5498 and 5498-SA Reports shows all retirement accounts that require 5498 or 5498-SA forms. Every account holder that has a balance or contribution for the year must receive a 5498 or 5498-SA form by January 31. If the account holder has more than one account, only one account number will be printed. This account number must be used for any corrections after year-end.

For detailed information concerning these reports, see FPSDR174 and FPSDR104 in the Deposit Reports manual in DocsOnWeb. Also see the Reports section of this help for summary information concerning these reports. |

|

Test Run Date

|

Enter the date you want FPS GOLD to process a test run of your retirement forms. The forms created from this test will be sent to you for verification of their accuracy. Only the number of forms indicated in the Test Forms to Print field (see above) will be processed during the test run. If any part of the test forms appear to be incorrect, or you have selected the wrong setup options, contact your FPS GOLD deposit banking consultant and tell him or her about the errors. Failure to contact FPS GOLD will result in your final run at year-end being incorrect, and you will be charged for any necessary reruns.

Test forms will have the word "TEST" across the front of each form. |

|

Include Beginning of Year Balance if Account Converted This Year |

Check the checkbox for this field if you want to include the beginning of year balance on the combined retirement statement for accounts that converted this year.

|

|

Last Changed ... By |

These fields display the date and employee number of the person who last made changes to this screen. |