Navigation: Deposit Year-End Run Options Screen >

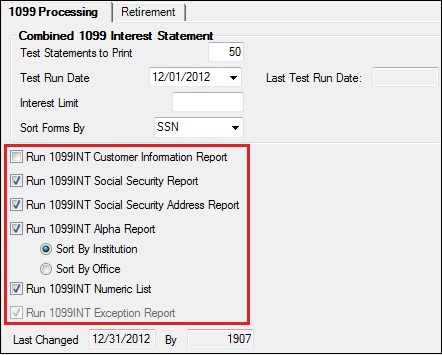

The 1099 Processing tab on the Deposit Year-End Run Options screen allows you to select the number of 1099-INT statements you want to audit in the test run, the test run date of those statements, the type of 1099-INT reports you want run, and other options affecting your year-end processing.

The Combined 1099 Interest Statement field group contains information specific to 1099-INT statements (forms).

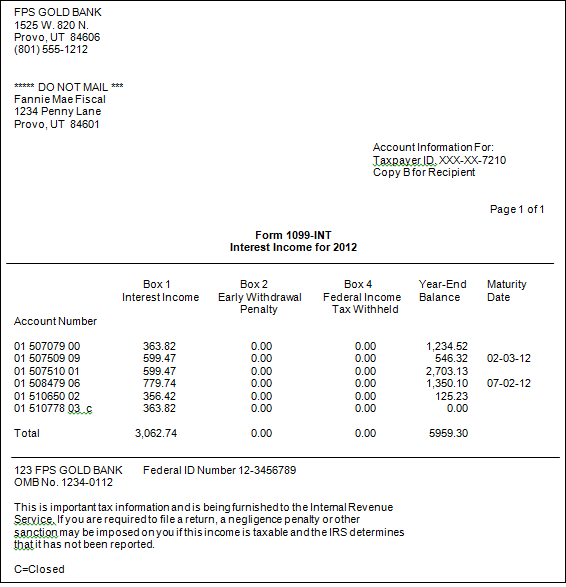

Your bank's return address and contact phone number must be set up on the rendered form. If it is incorrect, send a work order to get it fixed before the year-end final run. It is an image on the rendered statement.

Account owners with more than one account at your institution that earned interest will be combined by Social Security number and then sorted according to how the Sort Forms By field is selected (which is either by Social Security number, alphabetically by name, or by ZIP code). Names with CID numbers will print on separate forms.

Combined 1099s can also include interest earned on contract collection accounts and interest earned on loan reserves. There are institution options available to turn these off. Consult your loan year-end specialist if you want loan interest included on 1099-INT statements. These options are set up using the Loans > System Setup > Year-End screen.

The 2nd TIN Not. field will be indicated on the 1099-INT statement if you have sent out two B notices within three years of each other and they have not been resolved. See the IRS B Notices field group on the CIS > Entity Maintenance - Person, Trust, or Organization screens for more information.

For both the test and final year-end runs, FPS GOLD stores all reports and forms in GOLDView. Your institution-defined number of days to keep those reports and forms may be different from FPS GOLD's default settings. Test-run forms will be stored for 90 days. Final year-end forms will be stored for 180 days.

See the following definitions for more information on each of the 1099-INT options:

Field |

Description |

|

|---|---|---|

Test Statements to Print (DYFNBR) |

Enter the number of statements (forms) you want processed during the test run of the year-end processing. In November (according to the Action Dates), FPS GOLD will process this amount of test statements and put them in your warehouse for audit. The system uses the Sort Forms By field to determine the order of the statements. For example, if the Sort Forms By field is set to SSN, and this field was set to 50, then the first 50 Social Security numbers of account owners would be processed in numerical order for the test run.

|

|

Test Run Date (DYTSTD) |

Enter the date you want FPS GOLD to process a test run of your 1099-INT statements. The statements created from this test will be put into your warehouse for audit. Only the number of statements indicated in the Test Statements to Print field (see above) will be processed during the test run. If any part of the test statements appear to be incorrect, or you have selected the wrong setup options, contact your FPS GOLD Deposit Banking Consultant. Failure to contact FPS GOLD will result in your final run at year-end being incorrect, and you will be charged for any reruns.

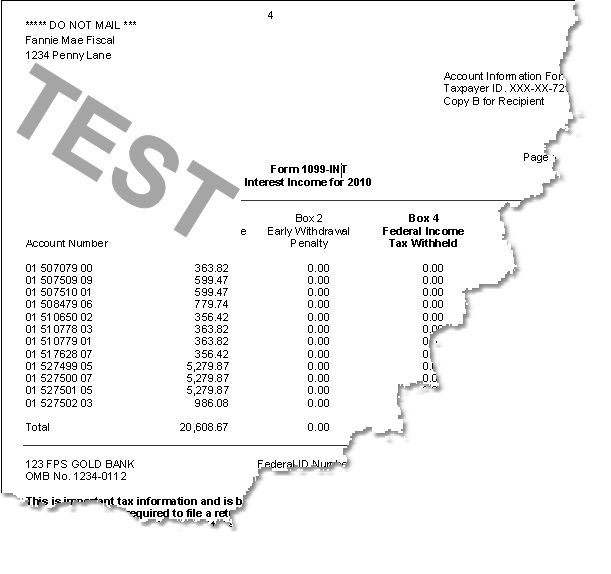

Test statements will have the word "TEST" across the front of each statement, as shown below: |

Field |

Description |

|---|---|

Last Test Run Date |

This field displays the last test run date of 1099-INT processing for your institution. |

Interest Limit (DYTNIL) |

Enter the minimum amount of interest earned by accounts for which you want to print a 1099-INT statement for. IRS regulations require that all deposit accounts earning $10.00 of interest or more must have a 1099-INT statement sent to the account owner at year-end processing. However, your institution may choose to send 1099-INT statements for all deposit accounts earning any amount of interest. In this case, you would enter "0" in this field or leave it blank. |

Sort Forms By (DYSBO1) |

Use the drop-down list to select the method you want to use to sort statements. You can sort statements by Social Security number, alphabetically by the last name of the IRS owner, or by ZIP code of the address of the IRS owner. |

Create New Form If Address Changed |

Check this box to print separate 1099-INT statements if IRS owners' addresses are not exactly the same. If this box is checked, all accounts with the same Social Security number are combined and for every different address, a separate 1099 is created for those owners. |

Print 'C' by Closed Accounts |

Check this box if you want a "C" to print to the right of the account number on the 1099-INT statement. The "C" indicates that the account is closed. |

Print IRS Owner's Name Only |

Check this box if you only want the name of the IRS owner to print on the 1099-INT statement. When combining by Social Security number, we may include husbands, wives, and children's accounts, where different co-owners are listed. If this box is checked, only the IRS owner's name and Social Security number will be shown. If this box is not checked, then the lowest account number in the accounts combined will print both owner and co-owner names. |

Field |

Description |

|---|---|

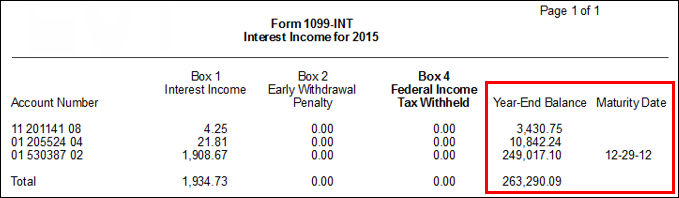

Print CD Balance and Maturity |

Select this option if you want to include the Year-End Balance and Maturity Date fields on 1099-INT statements. The Year-End Balance field displays the balance of the account at year-end. The Maturity Date is the date of maturity for any CDs, if applicable. Year-End balance and maturity date are not furnished to the IRS. You can’t select both Print CD Balance and Maturity and Print State Withholding on Form because there is not enough room on the form to print both. Select None if you don't want either of these options.

The following example shows these fields on the 1099-INT statement:

|

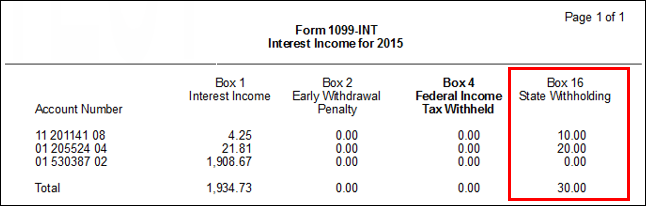

Print State Withholding on Form |

Select this option if your institution does state withholding on any interest posted to any accounts. You can’t select both Print CD Balance and Maturity and Print State Withholding on Form because there is not enough room on the form for both. Select None if you don't want either of these options.

The following example shows this field on the 1099-INT statement:

|

The following is an example of a final 1099-INT statement:

1099-INT (Front of Statement)

1099-INT (Back of Statement)

Below the Combined 1099 Interest Statement field group on the 1099 Processing tab of the Year-End Run Options screen is a list of reports. You can check the box in front of each of them to indicate you want to run that report at year-end, as shown below:

Deposits > Miscellaneous > Year-End Run Options Screen, 1099 Processing Tab

The reports are available for you to view, print, and save from GOLDView in CIM GOLD once you indicate you want the report.

Each report is documented fully in the Deposit Reports manual on DocsOnWeb.

See the following links for more information concerning each of these reports:

•1099INT Customer Information Report

•1099INT Social Security Report

•1099INT Social Security Address Report

•1099INT Alpha Report By Office or Institution

•1099INT Numeric List (Account Number Order)

For a quick definition of all the reports available from the Year-End Run Options screen, see Reports.