Navigation: »No topics above this level«

FPS GOLD credit reporting works as follows:

1.During the afterhours process at monthend, FPS GOLD updates the Loans > Account Information > Credit Reporting screen for all loans. The updating includes determining the credit bureau (CB) Account Type (BUACCO), CB Account Status (BUCBRS), and date of first delinquency.

2.Your institution can then view or file maintain the information on the Credit Reporting screen.

3.After the third business day of the following month, a test report based on the information on the Credit Reporting screen is generated in the afterhours process.

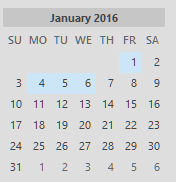

Note: The test report of the Credit Bureau Report and Transmission (FPSRP293) will have a "when to run" of MS + 3 on the report setup, which is "month start" plus three business days. Month start for the test report is always the 1st plus 3 days—in the above example, it is January 6th. Business days do not include Saturday, Sunday, or holidays. The Credit Bureau Warning Report (FPSRP184) will have a "when to run" of DAILY, but will only generate daily for the first eight business days of the month.

4.Your institution can continue to make changes to the Credit Reporting screen or to CIS information, as needed, through the eighth business day.

5.After the eighth business day of the month, the final reports are generated, and the transmissions will be sent to the credit repositories. The reports are available for printing by your institution from GOLDView. This will be the last time the Credit Reporting screen will be of use during that month for anything other than inquiry.

|

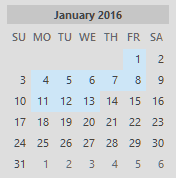

| Note: The final report of the Credit Bureau Report and Transmission (FPSRP293) will have a "when to run" of MS + 8 on the report setup, which is month start plus eight business days. Month start for the final report is always the 1st plus 8 days—in the above example, it would run on January 13th. |

| WARNING: Any updating of the Credit Reporting screen after the transmissions are sent will not change the information sent to the credit repositories that month. |

6.Changes that need to be made to a loan file after the credit transmission has been sent to the repositories must be made on the regular loan screens (not the Credit Reporting screen) by the next monthend or by making the correction directly with the credit repositories.