Navigation: »No topics above this level«

The Loans > Account Information > Credit Reporting screen is the primary source of information reported to the credit repository. During the month as payments are posted, reversed, etc., the account adjusts. At monthend, the Credit Reporting screen is updated and reflects the actual condition of the loan at that time. This is the information that will be reported. File maintenance can be done to this screen prior to the transmission being sent.

However, once transmissions have been sent, any changes made to the screen will have no effect for that month.

A credit bureau record (Credit Reporting screen) is established for every loan, regardless of the reporting option. Note that you may need to manually update some of the fields on this screen when additional information is required. The Payment Rating, Compliance Code, Specialized Payment Indicator, Special Comments, and/or Consumer Information Indicator are all manually entered and are used to provide additional information to the credit repositories. Consult the Consumer Data Industry Association manual for additional clarification on the use of these fields for credit reporting.

NOTE

In instances where more detail is required or additional handling by the credit repositories is needed, you may need to manually update the following fields: Payment Rating, Compliance Code, Specialized Payment Indicator, Special Comments, and/or Consumer Information. All fields that are file maintained by your institution on this screen are written to Loan History. Be aware that file maintenance to these fields does not change the actual fields on other loan screens. |

Also see the General Reporting Information section for additional information regarding credit reporting.

To save changes you make to fields on this screen, click the <Save Changes> button in the lower right-hand side of the screen.

See the following example of this screen, followed by descriptions of the fields.

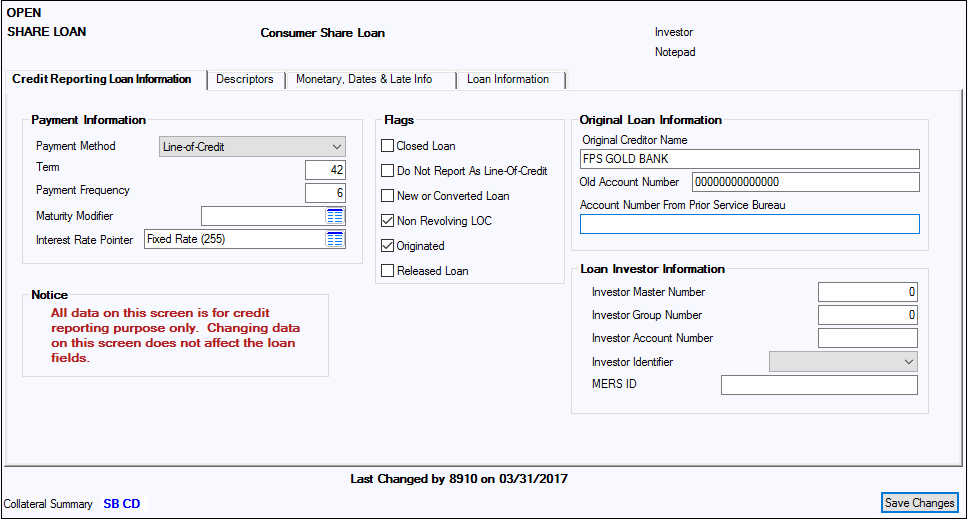

Loans > Account Information > Credit Reporting Screen, Credit Reporting Loan Information Tab

The Credit Bureau screen contains a “snap shot” of various information on the loan at monthend. Some of these fields are directly reported to the Credit Bureau (for example, Date Opened), while others are used indirectly to aid in reporting other fields. For instance, Payment Method is used to help determine the CDIA Portfolio Type and CDIA Credit Limit when applicable, and so on.

Field |

Description |

||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Account Status

(ASBASTATUS) |

This field displays one of the following account statuses:

This field may also be blank. |

||||||||||||||||||||||

Account Description |

This is the product description, loan pattern description, or customized description your account holder has given the account. Examples include "Loan," "Commercial," or "Business ARM." It is pulled from the Account Description field on the Entity Maintenance Account screen in CIS. If that field is blank, this field will display data from the Account Type field on that screen. |

||||||||||||||||||||||

Information Message |

Messages are displayed in this field that are specific to the screen you are on. For example, it may alert you that the payment method of the current account is not accessible on that screen, or that a date on the screen is invalid. |

||||||||||||||||||||||

Alert Status |

This field indicates various “alert” statuses of a loan. The alert identifies that the loan is non-performing, non-accrual, charged-off, repossessed, bankruptcy, judgment, written off, or in foreclosure.

Alerts will be displayed under the following conditions:

For a non-performing and/or non-accrual loan, if either of those fields is checked, that field will appear in the alert status area. If an account has a general category and is a non-performing and/or non-accrual loan, both descriptions will appear with slashes (“/”) before and after. |

||||||||||||||||||||||

Loan Type Description |

This field displays the loan type description defined by your institution. It is pulled from the Loan Type field on the Classification tab of the Account Detail screen. The codes and descriptions are set up in System Setup on the Loan Type & Class Descriptions screen.

The Loan System does not use the loan type for any reason; however, it may be displayed on reports for loan servicing convenience. Also, some reports can be sorted by the loan type code. |

||||||||||||||||||||||

Investor |

This field enables you to determine if the loan is sold and to whom. If the loan is sold, this field will show the investor master and group number assigned to this loan. The information is pulled from the Investor system. |

||||||||||||||||||||||

Notepad |

This is the date of the last loan Notepad comment. |

||||||||||||||||||||||

Last Changed By/On

(BUEMPN and BUBUPD) |

This field shows the employee number of the last employee who updated the Credit Reporting screen and the date the information was updated. Teller number 8910 is the FPS GOLD afterhours number. |

||||||||||||||||||||||

Collateral Summary

(LNCLDS) |

This is a brief description of the collateral used to secure the loan. If there is no collateral description, this field will be blank.

The Collateral Summary field is file maintained through the Account Detail screen. |

This tab is used to enter and view loan information related to credit reporting for the account.

There is a Notice on this tab indicating that all data on this screen is used just for credit reporting purposes. If you change data on this screen, those changes will not affect the loan fields.

Field |

Description |

||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Payment Information field group |

|||||||||||||||||||||||||

Payment Method

(BUPMTH) |

This is the payment method (LNPMTH) as of monthend. It determines how to calculate interest and what rules to follow in processing the loan account. Once the payment method has been set up on a loan, it should not be changed.

The following payment methods are available:

The payment method is used in various ways for credit reporting purposes but is not reported directly. Example: Depending on what the Payment Method is, the CDIA Scheduled Monthly Payment Amount will be calculated or pulled from a different field. It is also used in and not limited to determining CDIA Portfolio Type and CDIA Credit Limit. |

||||||||||||||||||||||||

Term

(BUTERM) |

This is the loan term in months (LNTERM) at monthend, pulled from the Account Detail screen, Origination tab. If the term is blank, 360 is used.

It is used in calculating rebates on loans with precomputed interest (payment method 3) and in determining the remaining term of ARM (payment method 7) loans.

WARNING: This field is used to calculate payments and should reflect the number of calendar months over which the loan is being amortized. This is not always the same number as the maturity date of a loan.

The term is used to report the CDIA Terms Duration, but is not reported directly itself. However, if the loan is in bankruptcy (hold code 4 or 5), this field will be pulled from the Repayment Plan, if present, along with the CDIA Terms Frequency and CDIA Scheduled Monthly Payment Amount. |

||||||||||||||||||||||||

Payment Frequency

(BUFREQ) |

This is the payment frequency pulled from the Payment Frequency field (LNFREQ) or the Maturity Modifier field (LNMATM) at monthend.

The frequency field is used to report the CDIA Terms Frequency and CDIA Scheduled Monthly Payment amount, but is not directly reported itself.

However, if the loan is in bankruptcy (hold code 4 or 5), this field will be pulled from the Repayment Plan, if present, along with the CDIA Terms Frequency and CDIA Scheduled Monthly Payment Amount. Appropriate payment frequency codes include the following:

|

||||||||||||||||||||||||

Maturity Modifier

(BUMATM) |

This field displays the maturity modifier (LNMATM) for this loan, pulled from the loan Account Detail screen. The maturity modifier is used in determining the CDIA Specialized Payment Indicator as well as the Scheduled Monthly Payment Amount (BUSCPM) when applicable, but is not directly reported itself.

If the maturity modifier is 1 (balloon payment) or 2 (single payment), then the CDIA Specialized Payment Indicator will be 01 (balloon payment).

It is also a factor in determining the CDIA Terms Duration. If the maturity modifier is 2 (single payment), the CDIA Terms Duration will be 001.

The following options are available:

|

||||||||||||||||||||||||

Interest Rate Pointer

(BURPTR) |

This field displays the interest rate pointer (LNRPTR) on the loan. Interest rate pointers and descriptions are institution-defined and entered in System Setup > Interest Rate Table. The interest rate pointer is used to report the CDIA Interest Type Indicator, but is not directly reported itself. If the Interest Rate Pointer is Fixed Rate (255), then "F"- Fixed Rate will be reported. Any other value will be flagged as "V" – Variable/Adjustable. If there is no interest rate pointer, then we will blank fill. |

||||||||||||||||||||||||

Flags field group |

The Closed Loan, Do Not Report As Line-Of-Credit, New or Converted Loan, Originated, and Released Loan fields reflect a status of the loan as of monthend and impact various CDIA-required fields. |

||||||||||||||||||||||||

Closed Loan

(BUCLSD) |

This flag indicates that the loan was closed for the reporting cycle and the credit bureau information will not be updated in months to follow. Closed loans will report to the credit bureau no more than 3 months. |

||||||||||||||||||||||||

Do Not Report As Line-Of-Credit (BUDLOC) |

This flag indicates that the loan will not report as a line of credit. It will report as an installment loan and must have a term on the loan as well, and the credit limit will not be reported. If there is no term, it will show up on the Credit Reporting Warning Report (FPSRP184) with error code 5012, MISSING TERM: NOT REPORTING AS LINE OF CREDIT. |

||||||||||||||||||||||||

New or Converted Loan

(BUNCLN) |

This flag indicates that the loan is newly opened this reporting cycle or was converted and was not originated on the FPS GOLD system. A converted loan is determined by looking at the following fields on the Account Detail screen, Origination tab: Purchased date (LNPUDT), Transferred or Converted date (LNCVDT), and Old Loan Number (LNOLD#). If any of these are populated, this field will be set. |

||||||||||||||||||||||||

Non Revolving LOC

(BUNLOC) |

This flag indicates that the line-of-credit loan is a non-revolving line of credit. It is pulled from the Loan system field Non-Revolving (LNNLOC) at monthend. |

||||||||||||||||||||||||

Originated

(BUORGN) |

This flag indicates that the loan was originated. This is pulled from the Loan system field Originated (LNORGN) at monthend. |

||||||||||||||||||||||||

Released Loan

(BURLSD) |

This flag indicates that the loan was servicing released for the reporting cycle, and the credit bureau information will not be updated in months to follow. Released loans will report to the credit bureau no more than three months. |

||||||||||||||||||||||||

Original Loan Information field group |

The fields contained in this field group are reported, when applicable, to credit repositories. The Original Creditor Name and Old Account Number are populated on all loans. The Old Account Number is populated when originated with 00000000000000. Only acquired or converted loans will have something in the Account Number from Prior Service Bureau field.

The Account Number from Prior Service Bureau (BUCMSC/LNCMSC) should contain the account number that was reported to the credit repositories, in addition to the Old Account Number (LNOLD#/BUOACC) field. These fields are sent one time when the New or Converted Loan (BUNCLN) indicator is set, so the credit repositories can match up what was previously reported and not create duplicate tradelines. |

||||||||||||||||||||||||

Original Creditor Name

(BUOCNM) |

This field can be one of two things.

The first time the credit reporting record is created, if the Originated radio button (LNORGN) on the Account Detail screen, Origination tab, is selected, at monthend, your institution name is entered in this field.

If the Purchased radio button is selected, you can manually enter the original creditor’s name in this field. (This would be used if you acquired the loan from another institution.)

See also: General Reporting Information, Conversions and Acquisitions. |

||||||||||||||||||||||||

Old Account Number

(BUOACC) |

On the credit transmission, this is the Identification Number located in the Base Segment.

This field contains the old account number for converted or acquired loans. The first time the credit reporting record is created, the old account number is pulled from Loan system field LNOLD#.

See also: General Reporting Information, Conversions and Acquisitions. |

||||||||||||||||||||||||

Account Number from Prior Service Bureau

(BUCMSC) |

On the credit transmission, this is the Consumer Account Number located in the Base Segment.

This field contains the old identification number from the previous loan servicing data center as it was reported to the credit bureau. The first time the credit reporting record is created, the old account number from the prior service center is pulled from MLCMSC. (The old reporting identification number (MLCMSC) is a field that is used at conversion or acquisition time. It is not displayed on any screen, but once the new credit reporting record is created, it will be pulled into this field.)

Note: If you purchase a loan that was previously reported to a credit repository, you must enter the account number exactly as was used for reporting. The first time FPS GOLD sends a transmission, the loan is reported under the “old” loan number (using the L1 segment). The L1 segment notifies the credit repository that the loan will be reported under the “new” loan number in the future. The credit repository then updates its file so it won’t look like the borrower has two loans. Work closely with each credit repository to ensure that data is processed correctly.

WARNING: If the number is not entered correctly, the credit report could show two loans for the borrower.

If you purchase a loan that was not previously reported to a credit repository, you should leave this field blank.

FPS GOLD Only: Field MLCMSC must be populated before the first credit bureau update. BUCMSC pulls the account number from that field upon the initial credit bureau update for the institution. |

||||||||||||||||||||||||

Loan Investor Information field group |

The fields contained in this field group are reported, when applicable, to credit repositories, specifically for CDIA K3 Segment reporting. |

||||||||||||||||||||||||

Investor Master Number

(BUIMST) |

This is the investor master number pulled from the Loan system field Investor (LNIMST) at monthend. |

||||||||||||||||||||||||

Investor Group Number

(BUIGRP) |

This is the investor group number pulled from the Loan system field Group Number (LNIGRP) at monthend. |

||||||||||||||||||||||||

Investor Account Number

(BUIACT) |

This is the investor account number pulled from the Loan system field Investor Account Number (LNIACT) at monthend. |

||||||||||||||||||||||||

Investor Identifier

(BUIDE) |

This is the investor ID pulled from the Loan system field Investor Identifier (IMIDE) at monthend |

||||||||||||||||||||||||

MERS ID

(BUMERS) |

This is the MERS ID pulled from the field MLMERS at monthend. |

The following is an example of the Reporting Codes & Subscriber Numbers tab, followed by descriptions of the fields on this tab.

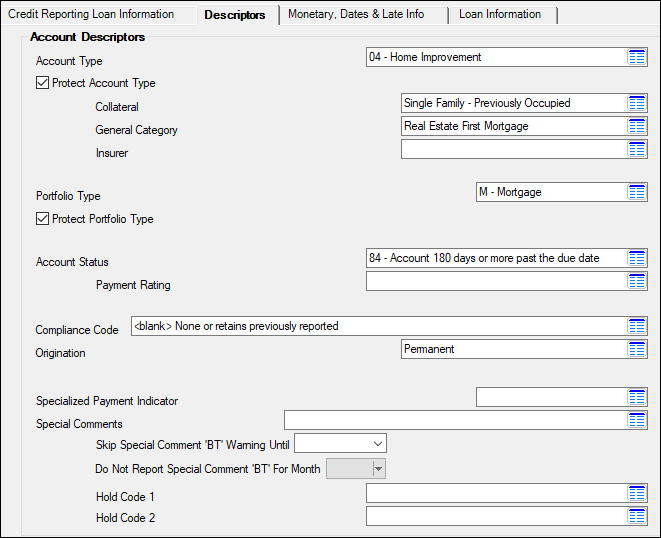

Loans > Account Information > Credit Reporting Screen, Descriptors Tab

Field |

Description |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Account Descriptors field group |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Account Type

(BUACCO) |

The CDIA Account Type is determined by FPS GOLD by looking at the Collateral Code (LNCOLL), General Category (LNGENL), and/or Insurer Code (LNINSU). The CDIA Portfolio Type impacts the CDIA Account Type. IMPORTANT: If you change one, you should evaluate the accuracy of the other.

For example:

If the account is determined to be a CDIA Portfolio Type M (Mortgage) and the FPS GOLD collateral code is 001 (Single Family New), the Account Type will be 26 (Conventional Mortgage).

If the Portfolio Type is I (Installment) and the FPS GOLD collateral code is 001 (Single Family New), the Account Type will be 02 (Secured). Refer to the CDIA documentation for valid Account Types within Portfolio Type.

WARNING: Please review both the test and the final Credit Bureau Report and Transmission (FPSRP293) for accounts with no Account Type listed. Notify your client service representative if there are any accounts on the report missing an Account Type.

Valid values are as follows:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Protect Account Type

(BUATLK) |

When this field is checked, it protects the account type from being file maintained and displays the teller number (BUATPB) and the date (BUATPO) it was protected. Protecting the account type means the account type will not update at monthend. This allows you to override the FPS GOLD system-calculated account type so when the credit reporting updates at monthend, this field will not change.

This field is necessary because we have found, in rare circumstances, that loans are set up in a matter that the system cannot correctly calculate the account type.

For example: An amortizing loan type usually used for mortgages is set up, but it is a basic installment loan. This will allow for institutions to override the mortgage type and report it as an installment.

If an account type has been protected, warning code 5023, Account Type Protected, will be displayed on the Credit Bureau Warning Report (FPSRP184). This is informational only and will show on the report for the first two months from the date on which it was protected. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Collateral Code

(BUCOLL) |

This is the collateral code (LNCOLL) as of monthend. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

General Category

(BUGENL) |

This is the general category (LNGENL) as of monthend. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Insurer Code

(BUINSU) |

This is the insurer code (LNINSU) as of monthend. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Portfolio Type

(BUPOTP) |

The CDIA Portfolio Type is determined by FPS GOLD by looking at various fields including, but not limited to, payment method. Below is the logic used to determine the portfolio type:

•If the payment method is 5, 9, or 10, the type will be C (Line of Credit). However, if the Do Not Report As Line-of-Credit field is set, then it will be I (Installment). •If the general category (LNGENL) is 1, 2, 10, or 11, then it will be M (Mortgage). •If the payment method is 3, it will be I (Installment). •If the payment method is 6 without LNRTSN, it will be I (Installment); if 6 with LNRTSN, then M (Mortgage). •If the payment method is 0 with a Collateral Code (LNCOLL) of 110 or 235, it will be I (Installment); else payment method 0 is M (Mortgage). •If the payment method is 4, it will be M (Mortgage). •If the payment method is 7, it will be M (Mortgage).

IMPORTANT: If you determine that the portfolio type FPS GOLD calculates is not acceptable, you can change it and protect it from being updated on the screen.

The CDIA Portfolio Type impacts the CDIA Account Type. IMPORTANT: If you change one, you should evaluate the accuracy of the other. File maintenance to this field writes to loan history.

Determining the Portfolio Type and Corresponding Account Type FPS GOLD first determines the Portfolio Type by looking at the Payment Method Code as follows:

*In order for payment method 5, 9, or 10 to be reported as a line of credit, the account option Do Not Report As Line-of-Credit on the Loans > Account Information > Line-of-Credit > Consumer Line-of-Credit screen, Options tab, must not be checked.

Once the CB Portfolio Type is determined, we look to the FPS GOLD Collateral Code, General Category, and/or Insurer codes to determine the CB Account Type. Note: These reporting field calculations are done generally and may not fit all products/loan types for your individual institution. Loans being reported to credit repositories should be verified for accuracy by your institution before reporting occurs.

Note: The Portfolio Type can also be blank.

Note: Changing the portfolio type on an account that has previously been reported can cause duplicate tradelines. Credit repositories should be notified before making changes.

If an information provider is visible with the message “May Cause Duplicate Tradeline,” this field's value has changed since the loan was last reported and you will need to research the loan to determine why the field has changed. If you choose to report the change, you may need to contact the credit repositories to be sure it will not create duplicate tradelines.

CDIA Portfolio Types

The following tables describe the portfolio types as listed in the CDIA (Consumer Data Industry Association) Manual for credit reporting.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Protect Portfolio Type

(BUPTLK) |

When this field is checked, it protects the portfolio type from being file maintained and displays the teller number (BUPTPB) and the date (BUPTPO) it was protected. Protecting the portfolio type means the portfolio type will not update at monthend. This allows you to override the FPS GOLD system-calculated portfolio type so when the credit reporting updates at monthend, this field will not change. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Account Status

(BUCBRS) |

The CDIA Account Status is determined by a number of factors. FPS GOLD determines if the account is delinquent and also looks for hold codes or if the loan is closed, released, or has a zero balance to determine the appropriate status.

Note: If the CDIA Account Status has been file maintained to DA (Delete Account) or DF (Delete Account Fraud), it will not be updated by the FPS GOLD. Once the account has been reported with either of these codes, the Report to Credit Bureau field will be turned off automatically so it will not be sent again. This happens on the night the data is sent to the credit bureau. File maintenance writes to loan history.

For valid account statuses, see the Credit Bureau Status (Account Status) section.

IMPORTANT: If the Account Status is 5, 13, 65, 88, 89, 94, or 95, then a Payment Rating and Special Comment may also need to be reported. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Payment Rating

(BUPTRT) |

The payment rating identifies whether the account is current or past due at monthend. It must be reported if the credit bureau Account Status is 5, 13, 65, 88, 89, 94, or 95.

The Payment Rating must be blank for all other Account Status codes. Note: If the loan is closed or released and has an Account Status of 5, 11, or 13, this field is not recalculated.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Compliance Code

(BUCMCD) |

The CDIA Compliance Code is typically user-entered. The compliance codes allow your institution a way of notifying credit repositories of problems on the account. It also allows a way of indicating if the institution required an account to be closed or if the borrower closed an account. The codes notify the credit repositories of disputes and other factors that better clarify the information being reported.

The only time FPS GOLD will update this field is when a Retraction or Reinstate transaction is run; then XA will be added. If a loan is open on the system and XA exists, the field will be cleared. (This could happen if a loan is manually reopened using an FPS GOLD file maintenance transaction.)

A Compliance Code identifies the condition that is required for legal compliance; e.g., according to the Fair Credit Reporting Act (FCRA) or Fair Credit Billing Act (FCBA). This condition may refer to accounts closed at consumer’s request, accounts in dispute under FCRA, or accounts in dispute under FCBA.

The code should be reported one time and will remain on file until another Compliance Code or the XR (Removal value) is reported. As an option, the code may be reported each month as long as the condition applies. Regardless of the method of reporting, the code will be deleted only when another Compliance Code or the XR (Removal value) is reported.

Note: When a dispute investigation is completed, it is important to update the credit bureau Compliance Code to show that the investigation has been completed or to delete the previously-reported Compliance Code.

File maintenance to this field writes to loan history.

Valid codes are as follows:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Origination Code

(BUORIG) |

This is the origination code of the loan (LNORIG) as of monthend. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Specialized Payment Indicator

(BUSPPI) |

The CDIA Specialized Payment Indicator identifies special payment terms on the account, such as a balloon payment (action code 1) or a HAMP-modified loan (LWHAMP = yes). This field impacts what is reported in the CDIA K4 segment. It also impacts the CDIA Terms Frequency, in particular when payments are deferred.

This indicator will automatically be set to 1 (Balloon) for HAMP-modified loans (LWHAMP = yes) with a Current Deferred Unpaid Principal Balance (LWDUPB), and also for loans with a Maturity Modifier (LNMATM) of 1 (Balloon) or 2 (Single Payment).

If the loan has deferred payments, this field should be manually set by the institution to 2 (Deferred) and the CDIA Deferred Payment Start Date should also be updated.

File maintenance to this field writes to loan history. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Special Comments

(BUSPCM) |

The CDIA Special Comments field is typically user-entered, but in some instances FPS GOLD will update this field. This field allows you to better clarify the CDIA Account Status that is being reported.

Special Comment codes will be either system-updated or user-entered depending on the situation. The system will update this field in the following situations:

•When foreclosure is started indicated by adding hold code 7 or 9 on the account. Special Comment BO (Foreclosure proceedings started) will be updated at monthend. •When Consumer Credit Counseling indicator is set on account (MLCCC is set on the Account Detail screen, Valuation and Credit Risk tab, Non-Accrual & Partial Charge Off field group). Special Comment Code B (Account payments managed by Credit Counseling Service) will be updated at monthend. •When Sailors and Solders indicator is set on account (MLSASA is set on the Account Detail screen, Classification tab). Special Comment Code AI (Recalled to active military duty) will be updated at monthend. •When a loan is assumed, a Special Comment Code H (Loan assumed by another party) will be sent to the credit repositories on the Credit Bureau Report and Transmission (FPSRP293) only. The Credit Bureau screen will not reflect this information. •When GOLDTrak PC closes a loan during a renewal/refinance field. Special Comment Code AS (Account closed due to refinance) will be updated at monthend.

Otherwise, this field should be updated manually when necessary to better reflect the status that has been reported for that month. Below are a couple of scenarios when this field should be updated manually:

•When reporting a short sale, Special Comment Code AU (Account paid in full for less than the full balance) should be sent to credit repositories. •When reporting an account in forbearance, Special Comment Code CP (Account in forbearance) should be sent to credit repositories. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Skip Special Comment "BT" Warning Until (Date Field)

(BUBTDT) |

This field will prevent warning message 5024: “SPECIAL COMMENT BT - PRIN DEFERRED/INT ONLY - CHECK CURRENT PAYMENT APPLICATION.” This warning will show up on the Credit Bureau Warning Report (FPSRP183) if the loan is using multiple payment applications, irregular payments, or payment schedules. By entering a date in this field, the warning will not print until the date entered. If code "BT" is no longer applicable on the loan, you will need to remove this date to stop the message from printing.

Enter the date using MMDDYYYY format, or use the drop-down calendar to select the date.

How to Report Interest Only Payments to the Credit Bureau The following information explains how to handle Interest Only payments when reporting to the credit bureau.

CDIA Rules The CDIA Manual (Section 6-50) specifies that consumer loans with multiple payment schedules (such as principal due annually and interest due monthly) should be reported as follows: •Report the most frequent payment schedule for Terms Frequency. For example, if principal is due annually and interest is due monthly, report Terms Frequency M (Monthly). •The Scheduled Monthly Payment Amount should reflect the minimum amount due each month and may change when the principal amount is also due. •In months when only the interest payment is due, report Special Comment Code "BT" (Principal deferred/interest payment only). In months when both principal and interest payments are due, the Special Comment Code BT should not be reported. (See Do Not Report Special Comment "BT" For Month below.)

How to Use the Skip Special Comment "BT" Warning Until Field As explained above, a Special Comment Code "BT" should be set for the months where Interest Only Payments are due and removed when principal and interest are due.

Below is an explanation of how to handle a loan with an Annual Interest Only payment in February.

When the loan is originated, the Credit Reporting screen would be set up with a Skip Special Comment "BT" Warning Until date of 02/01/2020 (the month of the Annual Interest Only Payment). Any February date will work. See the example below.

With this February date in place, beginning in March (reporting period for February), the Credit Bureau Warning Report will start displaying the message CHECK SPECIAL COMMENT BT – PRIN DEFERRED/INT ONLY, indicating that the Credit Bureau Special Comment Code should be reviewed. In this instance, Special Comment Code "BT" would be set, indicating an interest-only payment due for February. The Skip Special Comment "BT" Warning Until date would then be changed to 03/01/2020. See the example below.

Beginning in April (reporting for March), the Credit Bureau Warning Report will start displaying the message CHECK SPECIAL COMMENT BT – PRIN DEFERRED/INT ONLY, indicating that the Credit Bureau Special Comment Code should be reviewed. In this instance, the "BT"code would be removed from the Special Comments field, and the Skip Special Comment "BT" Warning Until date would then be changed to 02/01/2021 (the next Annual Interest Only Payment). See the example below.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Do Not Report Special Comment "BT" For Month

(BUSKBT) |

Click the arrow to open the drop-down list, then select the month you want the code "BT" to not report to the credit repositories. Special comment code "BT "is Principal Deferred/Interest Only Payment.

This field is used for loans that are interest only and using multiple payment applications, irregular payments, or payment schedules. If you have a loan that is interest only for the year but requires a P&I payment one month of the year, enter the month of the P&I payment in this field, and the "BT" code will not be reported to the credit repositories for that month. This way you do not need to remember to remove it for that month and place it back on the following month. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Hold Code 1 and Hold Code 2

(BUHLD1 and BUHLD2) |

These fields display any hold codes on the account as of monthend. Hold codes are used for reporting in many instances, such as bankruptcy, foreclosure, etc., but are not reported directly. See Hold Codes for more information. |

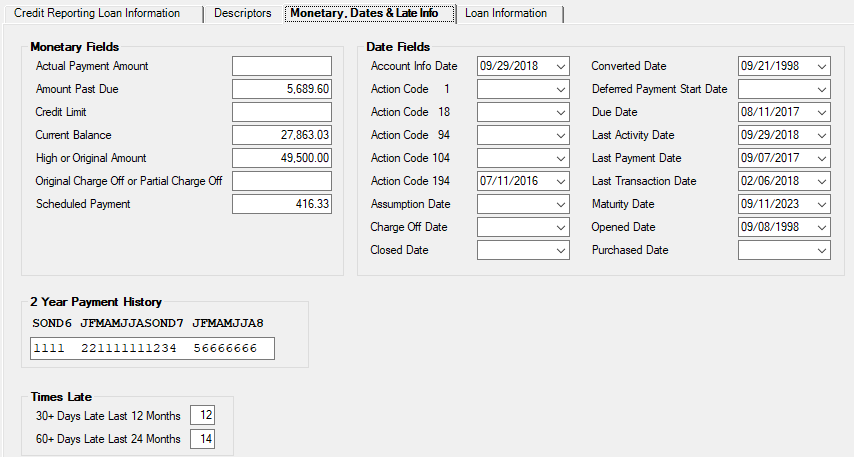

Monetary, Dates & Late Info tab

Loans > Account Information > Credit Reporting Screen, Monetary, Dates & Late Info Tab

Field |

Description |

||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Monetary Fields field group |

|||||||||||||||||||||||||||||||||||||||||||||

Actual Payment Amount

(BUAMPA) |

The CDIA Actual Payment Amount field displays the to-date amount the borrower paid during the reporting period. You cannot make changes to this field. It is updated at monthend when the Credit Bureau Update is run.

A field called Loan Amount Paid this Month (LNAPTM) is updated by the system each time specific teller transactions are run and account balances are either added to or subtracted from, based on those transactions. The list of transactions that affect this field are shown in the following table.

When the Credit Bureau Update runs at monthend, the system pulls the information in LNAPTM and places it in the Amt Paid this Month field (BUAPTM) on the Credit Reporting screen. The LNAPTM field is then cleared to 0.00 to start the next month’s payment tracking.

This amount is then reported to the credit repositories through the Credit Reporting Report and Transmission (FPSRP293). When the Credit Reporting Report and Transmission runs, the system takes the amount in BUAPTM, truncates it to whole dollars, and puts the whole dollar amount in the Actual Payment Amount field (Base Segment field 16).

Note: Reversals that happen for transactions from a previous month are not tracked. Only reversals for transactions that happen in the same month as when the Credit Bureau Update is run will be subtracted from LNAPTM. |

||||||||||||||||||||||||||||||||||||||||||||

Amount Past Due

(BUAMPD) |

The CDIA Amount Past Due is calculated by FPS GOLD. This calculation is made by determining the amount due to bring the loan current. Then late charges and fees are added to that amount and partial payments are subtracted. A past due payment is any payment that is at least one month past due.

If it is a payment method 5 with Credit Life Insurance (LNUINS set), then the premium amount will be added. |

||||||||||||||||||||||||||||||||||||||||||||

Credit Limit

(BUCRLM) |

This field is used for reporting the CDIA Credit Limit. The Line-of-Credit Limit field (LNRLCL) on the Information tab of the Loans > Account Information > Line-of-Credit > Consumer Line-of-Credit screen is pulled for payment methods 5, 9, and 10. File maintenance to this field writes to loan history. |

||||||||||||||||||||||||||||||||||||||||||||

Current Balance

(BUPBAL) |

This is the calculated payoff amount as of monthend (excluding prepayment penalties) and is used to report the CDIA Current Balance. The current balance should contain the principal balance including balloon payment amounts (when applicable), as well as interest currently due, and late charges and fees due this month, and for mortgage accounts, it should also include the escrow amount currently due. Note: Only whole dollars will be reported to the credit repositories. Negative or credit balances will be reported as zero. |

||||||||||||||||||||||||||||||||||||||||||||

High or Original Amount

(BUHOAM) |

This field is used to report the CDIA High or Original Amount field as follows: For payment methods 5 (line-of-credit loans), 9 (commercial LOC - daily), and 10 (commercial LOC - periodic), the original balance (LNOBAL) will be used. For payment methods 5, 9, and 10, the principal balance is compared to the previous High or Original Amount (BUHOAM), and the greater of the two is used. Then the Loan Regulatory Reporting Record (FPRG) is compared to the Daily Balances for the current month, and the higher is used. Note: Only whole dollars will be reported to the credit repositories. File maintenance to this field writes to loan history and is temporary for that month. Changing the main Loan system fields can make permanent changes. |

||||||||||||||||||||||||||||||||||||||||||||

Original Charge Off or Partial Charge Off

(BUOGCO) |

This is how we report the CDIA Original Charge-off Amount. If the CDIA Account Status (BUCBRS) is 97 (Unpaid balance reported as loss (charge-off)) and the Original Charge Off or Partial Charge Off (BUOGCO) is 0, then the calculated payoff amount (LNCLAT) will be used.

If there is a hold code 2 (charge-off) and a charged off date (LNCODT), the partial charge off (LNCOBL) will be used. |

||||||||||||||||||||||||||||||||||||||||||||

Scheduled Payment

(BUSCPM) |

This is the what is sent for the CDIA Monthly Scheduled Payment Amount. This field is calculated as of monthend as follows:

1.If the principal balance (LNPBAL) is 0, then the scheduled payment will remain 0. 2.If the maturity modifier (LNMATM) is 1 (Balloon Payment) and the loan is matured, then the scheduled payoff will be the calculated payoff amount as of monthend. 3.If the CDIA Special Payment Indicator is 2 (Deferred) with no CDIA Special Comments code, then the scheduled payment will remain 0. 4.For payment method 5 loans, the scheduled payment will be the last billed amount (LNLSTB). 5.For payment method 9 and 10 loans, the scheduled payment will be the amount due in the FPBR (Billing Statement Info) record for the current month. 6.For all other payment methods (0, 4, 6, and 7), the scheduled payment will be calculated; otherwise, the P/I payment (LNPICN) will be used.

However, if the loan is in bankruptcy (hold code 4 or 5), this field will be pulled from the Repayment Plan if present, along with the CDIA Terms Frequency and CDIA Terms Duration. |

||||||||||||||||||||||||||||||||||||||||||||

Balloon Amount

(BUAMPA) |

This field is for reporting the balloon amount that is disclosed at the origination of the loan (pulled from the Original Balloon Amount field on the Account Detail screen, Origination tab). Your institution will need to manually input this amount. If the amount is left blank or is zero, then the payoff amount will be submitted to the credit repositories. If the amount has any other number, then this amount is what will be reported.

The balloon amount is sent in the credit reporting K4 segment if the CDIA Special Payment Indicator is 1 (Balloon Payment). |

||||||||||||||||||||||||||||||||||||||||||||

Date Fields field group |

|||||||||||||||||||||||||||||||||||||||||||||

Account Info Date

(BUDUPD) |

This field is used for reporting the CDIA Date of Account Information. It will typically be the monthend date this record is created for. However, for closed or released loans, the system will report the paid off date (LNCLDT) or date released if the loan is released (LNRLSD = yes) and Action Code 104/Action Date are found. |

||||||||||||||||||||||||||||||||||||||||||||

Action Codes |

The action codes 1, 18, 94, 104, and 194 (described below) are used in various ways for reporting information to the credit repositories but are not reported directly. |

||||||||||||||||||||||||||||||||||||||||||||

Action Code 1

(BUBALD) |

This field contains the balloon payment due date. The system will pull the date associated with action code 1 (Balloon Payment Due) if different from the maturity date.

If action code 1 is found, the CDIA Special Payment Indicator will automatically be set to 1 (Balloon Payment) and the CDIA Balloon Payment Due Date found in the K4 segment will be impacted. |

||||||||||||||||||||||||||||||||||||||||||||

Action Code 18

(BUFPMD) |

This field contains the final payment due date. The system will pull the date associated with action code 18 (Final Payment Due) if different from the maturity date.

If action code 18 is found, the CDIA Special Payment Indicator will automatically be set to 1 (Balloon Payment) and the CDIA Balloon Payment Due Date found in the K4 segment will be impacted. |

||||||||||||||||||||||||||||||||||||||||||||

|

(BUDFDD) |

This is the date of occurrence and is one of two dates pulled for reporting the CDIA FCRA Compliance/Date of First Delinquency. One of the following conditions must occur:

1.If the action date connected to action code 194 (Date of First Delinquency) is in the past, this date will be used. or 2.If both action code 94 (Date of Occurrence) and 194 (Date of First Delinquency) are present on the loan, the date associated with action code 94 is used. The process the system goes through in establishing the action code 194 and date is discussed in Coding of Derogatory Credit Status. This date of occurrence is the earliest date the delinquency began, resulting in foreclosure or bankruptcy. This action code is automatically entered in conjunction with hold codes 1, 2, 4, 5, 6, 7, 9, 91, 92, 93, 94, 95, 96, 97, 98 and 99. File maintenance to this field writes to loan history. |

||||||||||||||||||||||||||||||||||||||||||||

Action Code 104

(BURLDT) |

When a loan is service released, an action code 104 (Loan Released) is automatically placed on the loan (Account Detail screen, Letters & Actions tab). This field contains the date associated with action code 104. The system looks for released loans (LNRLSD = "Y"), and if this action code 104 date is within the current month, at monthend, the CDIA Special Comments field is automatically updated with "O" (Account transferred to another company/servicer). This action code is also used for reporting the CDIA Date of Account Information for released loans. The loan will typically be reported for 90 days after being released. (This is controlled by a report option on Credit Bureau Report and Transmission (FPSRP293).) Example: If the loan was service released April 15, at monthend the screen will be updated to display "O" in the Special Comments field; the transmissions created through July 15 will report the loan as service released unless otherwise specified by FPSRP293. |

||||||||||||||||||||||||||||||||||||||||||||

|

(BUWDFDL) |

This is the date of first delinquency and is one of two dates pulled for reporting the FCRA Compliance/Date of First Delinquency.

1.If the action date connected to action code 194 (Date of First Delinquency) is in the past, this date will be used. or 2.If both action code 94 (Date of Occurrence) and 194 (Date of First Delinquency) are present on the loan, the date associated with action code 94 is used. The process the system goes through in establishing the action code 194 and date is discussed in Coding of Derogatory Credit Status. File maintenance to this field writes to loan history. Action code 194 is the earliest due date that a delinquency began. The date indicates the delinquent due date of the loan at monthend. This field is used in calculating the CDIA FCRA Compliance/Date of First Delinquency date. FPS GOLD will take this date, if available, and add 30 days to determine the Date of First Delinquency for the account, when applicable. This code is automatically updated by the system and entered during afterhours processing. Also see Action Code 94.

Action code 194 is also used to determine the date the loan was last current on the regulatory-required Delinquency Notice (FPSRP317). It is used in the history of payments section. The history section is payment activity for the previous six months or the period since the last time the account was current, whichever is shorter.

FPS GOLD Only: Afterhours Update Function 73 updates this field the night before the next due date if a payment is still owing. Example: If a loan is due on June 12, 2018, on July 11, 2018, this action code will be updated with the June 12, 2018 date. If the loan is brought current, this update function will also remove the action code. |

||||||||||||||||||||||||||||||||||||||||||||

Assumption Date

(BUASDT) |

This field stores the date this loan was assumed, if applicable. It is pulled from the Assumed On date (LNASDT) on the Account Detail screen, Origination tab, and is used to determine when to report new borrower information.

Assumptions are reported over a two-month period. The first month following the assumption, information for the Seller will be reported; the second month, information for the Buyer will be reported. Note: When an assumption is processed at monthend, seller information will be reported for two cycles.

This field is used in conjunction with reporting the correct borrower name information. Depending on when the loan was assumed, the borrower name information is either pulled from the assumption record or CIS. It impacts CDIA ECOA and other borrower name and address information. |

||||||||||||||||||||||||||||||||||||||||||||

Charge Off Date

(BUCODT) |

This field contains the date this loan was charged off (LNCODT). It impacts the CDIA Original Charge Off or Partial Charge Off field. When a loan is charged off, the general category should be changed. If you attempt to enter either a hold code 1, 2, 6, 92, or 93 or a general category of 80-89, the system will require that a charge-off date be entered before allowing file maintenance. Note: If you leave the loan open, we recommend that within a month or two of this date, you uncheck the Report to Credit Bureau field so the loan doesn’t continue to report. |

||||||||||||||||||||||||||||||||||||||||||||

Closed Date

(BUCLDT) |

This field is used to report the CDIA Date Closed. This is the date that the loan was physically closed on the system and is pulled from the action code fields when action code 37 (Payoff Transaction Date) is found on the loan. Action code 37 is automatically placed on the loan at the time the Payoff transaction (580) or Open/Close Loan File Maintenance transaction (022) is processed using GOLDTeller. If action code 37 is not found, the Paid Off Date (LNCLDT) will be used. This field also impacts the CDIA Date of Account Information field. This date must be in the past. When a loan closes, the account is reported as "paid in full" the following month. A CDIA Account Status of 13 (paid or closed account/zero balance) will be reported unless there is a hold code 1, 2, 6, 91, 92, 93, 94, 95, 96, 97, or 98. File maintenance to this field writes to loan history.

Note: The Closed Date (BUCLDT) may not be the same as the Paid Off Date (LNCLDT) in cases where the payoff is effective dated. The Paid Off Date (LNCLDT) is pulled from the Payoff Date (PODATE) found on the Loans > Account Information > Payoff screen and is the date the payoff was calculated to (using the Effective Payoff Date field on the Payoff screen).

Loans will be reported to credit repositories (when applicable) for 90 days after the Closed Date (BUCLDT). For example, if the loan has a Closed Date of April 15, it would be reported as “paid in full” on the transmissions created through July 15. It would not appear on any transmissions thereafter.

WARNING: If you use the payoff transaction to remove a loan that was repossessed, foreclosed, etc., and you do not use the correct hold codes and general category, you are not reflecting a derogatory status. |

||||||||||||||||||||||||||||||||||||||||||||

Converted Date

(BUCVDT) |

This field if populated indicates the loan was converted and will impact the CDIA Consumer Account Number that is reported. Converted loans will report the Account Number From Prior Service Bureau (BUCMSC) field so that duplicate entries are not created.

Reporting a loan that has been acquired or accounts that have been newly converted onto the FPS GOLD system is accomplished in two steps. Both steps require the use of the Transferred or Converted or Purchased date fields on the Account Detail screen, Origination tab.

The account number that was previously used in credit reporting should be in the Old Account Number field. The institution name or the name of the original credit grantor should be entered in the Original Creditor Name field. The first time the credit reporting record is created, the old account number will be pulled from LNOLD#.

•If the Originated radio button (LNORGN) on the Account Detail screen, Origination tab, is selected, at monthend, your institution name is entered in the Original Creditor Name field the first time the credit reporting record is created.

•If the Purchased radio button (LNORGN) on the Account Detail screen, Origination tab, is selected, you can enter the original creditor’s name in the Original Creditor Name field. (This would be used if you acquired the loan from another institution.)

In the Transferred or Converted field on the Account Detail screen, Origination tab, enter the date that the loan was set up on the FPS GOLD system. This date and the blank credit bureau status indicator (no credit reporting record has been created) will cause the system to report the old number as the account number and the FPS GOLD number as a number change.

For loans acquired and converted manually, you will enter the date converted. For loans converted by FPS GOLD, the system will enter the date. |

||||||||||||||||||||||||||||||||||||||||||||

Deferred Payment Start Date

(BUDPST) |

This field should be manually entered when applicable and will be reported as the CDIA Deferred Payment Start Date when the CDIA Specialized Payment Indicator is a 2 (Deferred). |

||||||||||||||||||||||||||||||||||||||||||||

Due Date

(BUDUDT) |

This is the loan due date (LNDUDT) as of monthend. This field is informational as of monthend and not reported directly at this time. |

||||||||||||||||||||||||||||||||||||||||||||

Last Activity Date

(BUACTV) |

This field contains the date of the last maintenance or transaction on this account. The system supplies this date when file maintenance or teller transactions are processed. This is pulled from the loan field LNACTV at monthend. This field is informational as of monthend and not reported directly at this time. |

||||||||||||||||||||||||||||||||||||||||||||

Last Payment Date

(BUDTLP) |

This is the date the last payment was made (LNDTLP) as of monthend.

This field is informational as of monthend and not reported directly at this time. |

||||||||||||||||||||||||||||||||||||||||||||

Last Transaction Date

(BUTRAN) |

This field contains the date of the last transaction on this account. The system supplies this date through the teller transactions. This is pulled from the loan field LNTRAN at monthend.

This field is informational as of monthend and not reported directly at this time. |

||||||||||||||||||||||||||||||||||||||||||||

Maturity Date

(BUMATD) |

This is the maturity date (LNMATD) as of monthend. The system will pull the date associated with action code 1 (Balloon Payment Due) or 18 (Final Payment Due), if different from the maturity date.

This field is used for reporting the CDIA Balloon Payment Due Date and is not reported directly at this time. |

||||||||||||||||||||||||||||||||||||||||||||

Opened Date

(BUOPND) |

This is the date this loan was opened (LNOPND). This date indicates to the credit repository that this is a new loan; therefore, once the loan has been opened, it should not be changed. See New Loans for more information.

If an information provider is visible with the message “May Cause Duplicate Tradeline,” this field's value has changed since the loan was last reported and you will need to research the loan to determine why the field has changed. If you choose to report the change, you may need to contact the credit repositories to be sure it will not create duplicate tradelines.

This field is used for reporting the CDIA Date Opened and is not reported directly at this time. |

||||||||||||||||||||||||||||||||||||||||||||

Purchased Date

(BUPUDT) |

This field is used in conjunction with reporting the CDIA Consumer Account Number. We look at the Newly Converted indicator (LNNCLN = Yes) and the Conversion Date (LNCVDT NE 0) to ultimately determine what CDIA Consumer Account Number should be reported. It will either be the default account number (18 blanks plus 10-digit account (BU4NBR) plus 2-digit check digit (LNCKDG)), or if purchased or converted, the Account Number from Prior Service Bureau (BUCMSC) or Old Account Number (BUOACC). |

||||||||||||||||||||||||||||||||||||||||||||

2 Year Payment History field group

(LPPAT1) (BUPMPF) |

This field is used in reporting the CDIA Payment History Profile. This will be the 24-month history prior to FPSBUUPD running (it will be the 24-month history prior to the CDIA Date of Account Information field 24). This field will freeze on closed and released loans.

The 2 Year Late Pattern & History is comprised of two lines of information.

The top line displays the late charge assessment for the last 24 months. (This is for your information only and is not reported.)

The file maintainable bottom line of the 2 Year Late Pattern & History is an alphanumeric field and is reported. It is only updated each monthend during the screen updating process. As updating occurs, only the information for the month just ending is updated. All other months remain the same, except the information for prior months shifts to the left. 2 Year Late Pattern & History codes 0-6 show the number of days delinquent in 30-day increments. If the codes in this field are 0-6, they should be the same as the Payment Rating field on this screen.

To assist you with making corrections for the past 24 months, data reported for a prior month can be file maintained and will be submitted on the current transmission.

File maintenance to this field writes to loan history.

Valid codes for the 2 Year Late Pattern & History and Payment Rating fields are as follows:

If any of the below-mentioned hold codes is present on an account at the end of the month, the 2-Year Late Pattern & History for that month is updated as follows:

Note: For line-of-credit loans (payment method 5, 9, or 10), if the loan is set up to use service fee code 6 (charge a flat fee on anniversary if zero principal balance since last anniversary date), then the month the fee is charged, the principal balance will be reported as zero if there are no additional principal advances between the charging of the fee and the end of the month. If there are additional advances after the fee is charged, the principal balance reported will be the principal balance minus the amount of the fee. No adjustments are made after the month the fee is charged. |

||||||||||||||||||||||||||||||||||||||||||||

Times Late field group

(BU12M) (BU24M) |

This field group indicates how many payments were 30-plus days late in the last year and how many were 60-plus days late in the last two years. It is calculated each monthend using the 2-year credit profile. Each time a one or greater is encountered for the past 12 months, the counter increases by one. This field is informational as of monthend and not reported directly at this time.

30+ Days Late Last 12 Months: This identifies how many times in the last 12 months the loan was 30-plus days late. It is calculated each monthend using the 2-year credit profile. Each time a one or greater is encountered for the past 12 months, the counter increases by one.

60+ Days Late Last 24 Months: This identifies how many times in the last 24 months the loan was 60-plus days late. It is calculated each monthend using the 2-year credit profile. Each time a two or greater is encountered for the past 24 months, the counter increases by one.

These fields are not reported to the credit repositories; they are informational only. These fields are displayed on the Loans > Account Information > Reserves > PMI screen and can be used in GOLDWriter and also GOLD EventLetters.

Note: Non-numeric values in the 2-Year Late Pattern & History field (see description below) are not included in the calculation. |

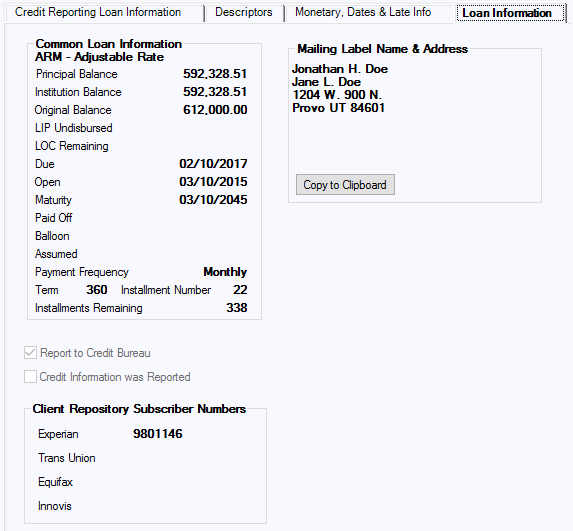

The Loan Information tab on the Credit Reporting screen gives you at-a-glance information of this loan. See the following example of this tab, followed by descriptions of the fields on this tab.

Loans > Account Information > Credit Reporting Screen, Loan Information Tab

Field |

Description |

||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Common Loan Information field group |

These fields are informational. |

||||||||||||||||||||||

Payment Method

(LNPMTH) |

This field displays the method used to calculate interest and what rules to follow in processing the loan payments and accruing interest. The following payment methods are available:

|

||||||||||||||||||||||

Principal Balance

(LNPBAL) |

This is the unpaid principal balance of the loan. It can only be entered or changed by teller transactions. Depending on the kind of loan, a transaction may either reduce or increase this balance.

Line-of-credit loans (payment method 5 for consumer loans, and 9 or 10 for commercial loans) can be opened with a zero principal balance. |

||||||||||||||||||||||

Institution Balance

(WKIBAL) |

This field displays the institution's portion of the principal balance. It is calculated as follows:

Principal Balance x Portion Sold = Investor's Portion Principal Balance - Investor's Portion = Institution's Portion |

||||||||||||||||||||||

Original Balance

(LNOBAL) |

This field displays the original amount of the loan. On precomputed loans (payment method 3), this amount will include the loan principal plus the add-on amounts. This field is originally entered through a teller transaction; however, you can file maintain this field on the Account Detail screen, Origination tab.

WARNING: This field feeds to the New Loan Report for TFR reporting. |

||||||||||||||||||||||

LIP Undisbursed

(LNLBAL) |

This field displays the undisbursed LIP balance. |

||||||||||||||||||||||

LOC Remaining

(LNWRLAV) |

This field displays the remaining line-of-credit. It is calculated differently depending on whether it is a revolving or non-revolving line-of-credit:

Revolving: Line-of-Credit Limit - Principal Balance = Remaining Line

Non-revolving: Line-of-Credit Limit - Line-of-Credit Used = Remaining Line |

||||||||||||||||||||||

Due

(LNDUDT)

|

This is the date in MM/DD/YYYY format that the next regular payment is due. It is determined by the system from the payment frequency code. This field can be used in conjunction with the Due Date Day field on the Account Detail screen, Payment Detail tab. The system requires a due date to be on the loan before the loan can be opened.

Note: If the due date is in the past and the account is open, the date will appear in red.

File maintaining the Due Date field will change the Due Date Day field to match the day portion of the due date.

For an LIP loan, this is the date to which the payments have been received. If interest is charged against the LIP, the due date and the LIP Next Bill or Charge Date should always agree. If the LIP interest is billed, the LIP Next Bill or Charge Date will roll when the interest is billed and the due date will roll when the payment is collected.

For line-of-credit loans (payment method 5, 9, or 10) with a zero balance, a balance increase transaction will update the loan due date by adding the number of days before the finance charge date to the current run date.

An online error message will appear when file maintenance occurs on this field. If the interest calculation code is 1, 2, or 3, the system will not allow the due date to be anything except one payment frequency ahead of the date last accrued. For LIP loans with an interest calculation code of 1, 2, or 3 and an LIP method code of 2 or 102, the error message will also appear. The error message will be "NO F/M - DATE LAST ACCRUED NOT 1 FREQ BEHIND DUE DATE."

If institution option OP08 DD27 is set, the due date day will not be allowed to be greater than 27. |

||||||||||||||||||||||

Open

(LNOPND) |

This field displays the date the loan was opened or funded. The system automatically supplies this information when a new loan transaction (tran code 680) is performed. For precomputed loans (payment method 3), this field is one of the keys for calculating rebates. Although the system enters the data for this field, it is file maintainable on the Account Detail screen, Origination tab. |

||||||||||||||||||||||

Maturity

(LNMATD) |

This field contains the date for when the last payment is due and when the loan should be paid off. All loans must have a maturity date, except payment methods 5, 8, 9, or 10, or the payment cannot be posted.

An option (CLZB) is available that will automatically close zero-balance line-of-credit loans. At the time the loan is closed, the payoff date is also updated. The Close transaction is a file maintenance tran code 22 to field 999. At the same time, the system will update the payoff date. The loan will automatically close on the night of the maturity date. If the maturity date is on a weekend or holiday, the loan will close on the night of the first business day following the maturity date.

Note: If the maturity date is in the past and the account is open, the date will appear in red.

Monetary balances that must be zero are principal balance, reserve balance, partial payments, miscellaneous funds, late charges, loan fees, accrued interest, accrued interest on reserves, and accrued interest on negative reserves. In addition, the loan cannot have an LIP method code greater than zero.