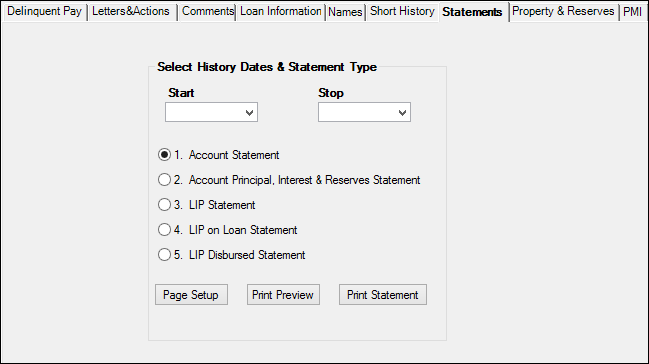

The Statements tab on the Loans > Collections > Account Delinquency screen is used to generate and print a variety of online statements with loan history information. Use the fields in the Select History Dates and Statement Type field group to set date parameters and select the type of statement you want.

The ![]() button allows you to choose the page format you want for your statement. The

button allows you to choose the page format you want for your statement. The ![]() button allows you to view the items before printing them. When you would like to print the statement press the

button allows you to view the items before printing them. When you would like to print the statement press the ![]() button.

button.

FPS GOLD stores life-of-loan history; however, your institution can request a history drop that deletes all history items on all your loans for previous years. If your institution converted to the FPS GOLD system or purchased loans from another institution, history from the prior system will not be included.

See the following example of this tab, followed by descriptions for each of the fields:

Loans > Collections > Account Delinquency Screen > Statements Tab

Field |

Description |

|---|---|

Start and Stop Date |

Use these fields to select the first and last date for which you want to see history information in your statement. Enter the date using MMDDYYYY format, or use the drop-down calendar to select the date.

•If the Start field is left blank, history will start with the first transaction processed for this account. •If the Stop field is left blank, history will stop with the last transaction processed for this account. |

Account Statement |

Select this radio button to print a standard account statement. |

Account Principal, Interest & Reserves Statement |

Select this radio button if you want the statement to use a more simplified format showing principal, interest, and reserves (generally on a single line).

In this format, when a late charge is paid, it appears in the principal column because a separate column is not available for late charges. All miscellaneous items that are not principal, interest, or reserve will appear in the principal column on the simplified statement format. |

LIP Statement |

If this radio button is selected, only the LIP transactions will be printed in LIP statement format. If the transaction entered was transaction code 431, the payee name will print below the disbursement code description.

This statement shows a running undisbursed LIP balance. |

LIP on Loan Statement |

Select this radio button if you want LIP information printed on the statement. This statement would be similar to the standard statement with LIP information included. |

Start and Stop Transactions |

The Start Transaction and Stop Transaction fields allow you to select history records based on the transaction code used.

Entering just a Start Transaction or Stop Transaction parameter will bring up only the histories associated with that transaction code.

By entering both the Start Transaction and Stop Transaction parameters, the system will search for a range of transaction codes that begin and end with the Start Transaction and Stop Transaction parameters.

If both fields are blank, all transactions will be displayed.

Note: The file maintenance tran codes are 022 and 023. If you want to view history without seeing file maintenance, enter 024 in the Start Transaction field and 999 in the Stop Transaction field.

Once all the appropriate search parameter fields are filled in, click <Display History> to view the results in the list view below. |

LIP Disbursed Statement |

Select this radio button if you want an LIP statement that displays a running LIP disbursed balance.

The LIP Disbursed statement is similar to the LIP statement except the LIP Disbursed statement displays a running disbursed/accrual balance, whereas the LIP Statement shows a running undisbursed balance.

In addition, the number of days between monetary and/or rate change activity is displayed.

Also displayed are debits and credits to the loan principal balance or the customer balance. Those items only appear in the Debit/Credit columns without a running balance. This was done so the Disbursed Balance column only displays the LIP Disbursed Balance and is easy to understand. (See the Interest Accrual section below.)

If the transaction entered was transaction code 431, the payee name will print below the disbursement code description.

Additional information displayed at the bottom of the statement are original balance, due date, interest basis code, LIP method, loan type, accrued interest, principal balance, LIP balance, LIP YTD interest, and total YTD interest. This statement eliminates the need for you to manually calculate the disbursed balance and the number of days between monetary transactions or rate changes.

As disbursements are made, interest is accrued on the LIP disbursed balance (principal balance minus the LIP undisbursed balance). Credits or debits to the loan principal balance affect the calculation of the LIP disbursed balance. The disbursed balance shown on the statement is always the amount that interest is accrued on.

Example: Principal balance is $120,000 and the undisbursed balance is $30,000, then interest is being accrued on $90,000 ($120,000 - $30,000 = $90,000).

If a principal decrease of $20,000 is posted, then the principal balance becomes $100,000 and the disbursed balance becomes $70,000. (Principal balance of $100,000 minus the undisbursed balance of $30,000 equals disbursed balance of $70,000.) |