Navigation: Print Notices >

Before you can send immediate email alerts (or other types of alerts) to customers notifying them of returned check or ACH items, you must first set up your customer with an an email address. Email addresses are set up on the CIS > Entity Maintenance Person, Trust, or Organization screen. This alert can also be sent as a text, Facebook message, or whatever the customer specifies using the Email Address field on the Entity Maintenance screen. You must also get the text message for alert #149 set up on your website.(Note: Other types of alert messages require that institution option P0E0 be set up for your institution.) The Primary E-mail address for the IRS owner of the account will be used if the Send Alert? checkbox is also checked.

Once an email address has been established for the Person, Trust, or Organization, returns can be sent to that email address by completing the following steps:

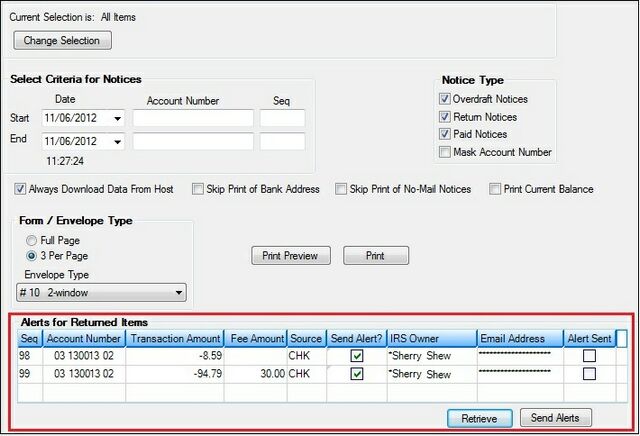

| 1. | On the GOLD Services > GOLD ExceptionManager > Print Notices screen, enter information in the Select Criteria for Notices field group according to what dates and account numbers you want to retrieve return data. |

| 2. | Make sure the Return Notices checkbox is selected in the Notice Type field group. |

| 3. | To ensure you are getting the most up-to-date information (such as any updated email addresses, etc.), make sure the Always Download Data From Host field is checked and do not send any alerts until all your items have been handled and balanced. |

| 4. | Under the Alerts for Returned Items list view, click <Retrieve>. All matching returned items will be displayed in the list view, as shown below: |

GOLD Services > Gold Exception Manager > Print Notices Screen

| Notice that the Send Alert? column displays checkmarks. |

| 5. | Click <Send Alerts>. The email alert will be sent immediately to all accounts with a checkmark in the Send Alert? column. The system generally sends only one email to the IRS owner of all accounts in the list. However, depending on how many accounts this person or organization has, they may receive more than one email alert. The system only sends one email for every five accounts. For example, if there are 10 accounts tied to one IRS owner, the IRS owner will receive two emails. If there are 11 accounts, the IRS owner would receive three emails, and so forth. |

| After the alerts are sent, a checkmark will be displayed in the Alert Sent column. You cannot send another alert once the first alert has been sent for that IRS owner. |

| The following is an example of an email alert that is sent to your customers for returned exception items. |

From: "FPS GOLD Bank" <email@fpsgoldbank.net> IRS Owner: CINDY TELLER

Returned Item Alert

Account Number Tran Amt Fee Source XX XXXX10 07 13.64 25.00 ACH

FPS GOLD Bank

|