Navigation: Foreclosure & Repossession & Judgment Screen >

The Lienholders tab on the Foreclosure & Repossession & Judgment screen contains fields used to enter and view information about lienholders on the property. This tab is also found on the Loans > Account Information > Collateral screen.

For loans with more than one property, the lienholder fields are attached to the loan record, not the location (property) entity. If there is more than one property linked to the loan, you many want to indicate in the Miscellaneous field which property the lien is on.

There can only be five liens per loan regardless of how many properties might be linked to the loan. If your institution has additional loans on the same property and there are additional liens (either internal or eternal), you need to set up the lien information on each loan.

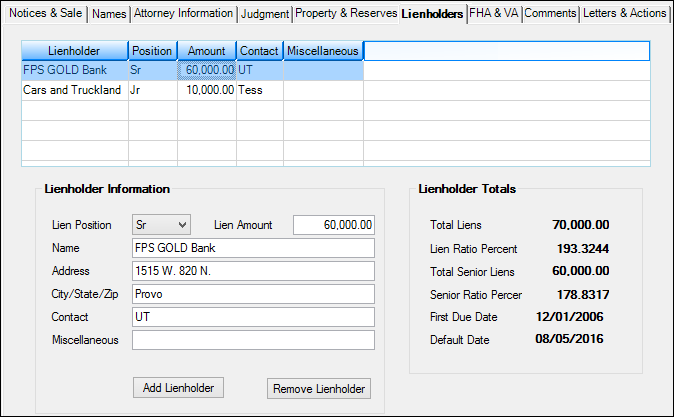

The following is an example of this tab, followed by field descriptions.

Loans > Collections > Foreclosure & Repossession & Judgment Screen > Lienholders Tab

Field |

Description |

|---|---|

Lienholders list view |

This list view displays information about lienholders on the property. It includes the name of the lienholder, the lien position, amount, contact information and miscellaneous information.

You can add a lienholder to the list view by filling out the fields below and clicking

To delete an item from the list view, highlight the item and click |

Lienholder Information field group |

These field are used to enter information about lienholders on the property. The names and lien amount information can be included in reports generated through GOLDWriter. |

Lien Position

Mnemonic: F1CSTA |

This field is used to select the senior (Sr) or junior (Jr) position of the lien and the current dollar amount of a lien. You can enter lien information and positions in any order, e.g., junior items can be entered before senior liens. |

Lien Amount

Mnemonic: FC1AMT |

This field is used to enter the lien amount. |

Name

Mnemonic: FC1NAM |

Enter the name of the lienholder in this field. |

Address

Mnemonic: FC1AD1 |

Enter the street address of the lienholder in this field. |

City/State/Zip

Mnemonic: FC1AD2 |

Enter the city/state/ZIP information for the lienholder in this field. |

Contact

Mnemonic: FC1CON |

Enter the name of the contact at the lienholder's institution in this field. |

Miscellaneous

Mnemonic: FC1MIC |

This is used to enter any miscellaneous lienholder information you want to store on the screen. For loans with more than one property, the lienholder fields are attached to the loan record, not the location (property) entity. If there is more than one property linked to the loan, you many want to indicate in the Miscellaneous field which property the lien is on.

There can only be five liens per loan regardless of how many properties might be linked to the loan. If your institution has additional loans on the same property and there are additional liens (either internal or eternal), you need to set up the lien information on each loan. |

Lienholder Totals field group |

These fields display information about lienholder totals for the loan. See the following definitions. |

Total Liens |

This is the total of all lien amounts. It is calculated by adding the amount of all senior and junior liens. |

Lien Ratio Percent |

This is the Total Liens field divided by the appraised amounts. |

Total Senior Liens |

This is the total amount of all liens with an Senior indicator. |

Senior Ratio Percent |

This is the total of all senior amounts divided by the appraised amount. |

First Due Date

Mnemonic: LN1DUE |

This is the loan first due date pulled from the First Due Date field on the Loans > Account Information > Account Detail screen > Payment Detail tab. |

Default Due Date

Mnemonic: FCCDFD |

This is the date the default notice was sent and is pulled from the Default Notice field. It is set up on the Notices & Sale tab on the Foreclosure & Repossession & Judgment screen. |