The information on the PMI tab of the Account Delinquency screen is for use with delinquent accounts that have Private Mortgage Insurance attached to the loan. These fields are used specifically for the PMI/MILAR report (FPSRP100).

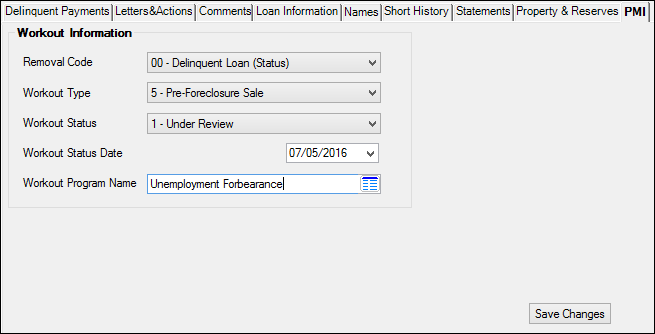

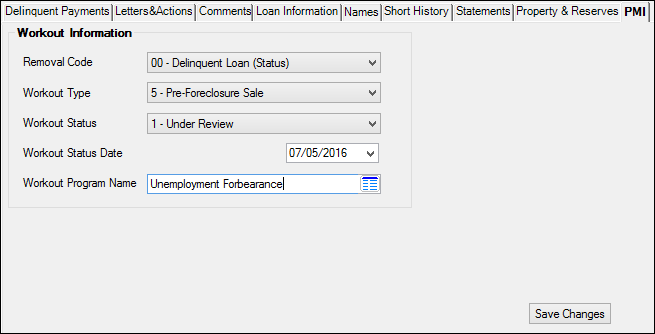

See the following example of this field, followed by field descriptions:

Loans > Collections > Account Delinquency Screen > PMI Tab

Field

|

Description

|

Removal Code

Mnemonic: PIWIRC

|

These codes indicate the loan status, loan status change or reason for removal from the report. The codes are as follows:

Code

|

Description

|

No code (space)

|

Performing Loan (Status) = less than 44 Days overdue

|

00

|

Delinquent Loan (Status) = more than 45 Days overdue (2 payments/billings overdue)

|

01

|

Reinstated - Loan brought current (Status change from Delinquent) = less than 44 Days overdue

|

Codes 02 through 99 should only be used when a loan is being removed from the MI Portfolio

Code

|

Description

|

02

|

Assumed - Date and Code when the loan was assumed.

|

03

|

Sold (or Servicing Transfer)

|

04

|

Paid in Full – NOT REO

|

05

|

Claim Paid, Date and Amount Received – This coincides with the 05 Claim Paid field on the Foreclosure & Repossession & Judgment Screen, which must also be marked with the date the claim was paid.

|

06

|

Charge off/Loan Uncollectable

|

99

|

MI Coverage Terminated

|

|

Workout Type

Mnemonic: PIWIWT

|

Select from one of the following values:

Type

|

Description

|

1

|

Standard Forbearance (Traditional or Standard Forbearance, including unemployment forbearance programs).

|

2

|

Trial Modification Forbearance (Trial Period Forbearance for HAMP or other Modification with a trial period).

|

3

|

Payment Plan

|

4

|

Loan Modification (Post Trial Period)

|

5

|

Pre-Foreclosure Sale

|

6

|

Deed-in-Lieu

|

7

|

Promise to Pay (Optional)

|

|

Workout Status

Mnemonic: PIWIWS

|

Select from one of the following values.

Status

|

Description

|

1

|

Under Review (The servicer has received a request for a workout and is evaluating the request.)

|

2

|

Approved (The servicer has approved a request for a workout; the workout has not yet been executed.

|

3

|

Closed (All documents have been signed, executed and/or recorded, and all requirements have been fulfilled.)

|

4

|

Denied (The servicer has denied a request for a workout.)

|

5

|

Failed (The borrower has failed to comply with the terms of a previously closed retention workout.)

|

6

|

Cancelled (The servicer and/or borrower have cancelled the request for a workout.)

|

|

Workout Status Date

Mnemonic: PIWISD

|

This is the date of most recent change in Workout Status. It may not be a future date

|

Workout Program Name

Mnemonic: PIWIPN

|

These numeric program codes apply to all servicers. For custom program codes, please contact the applicable mortgage insurance company.

Note: The program names listed in this drop-list are set up for you by FPS GOLD in the IMAC tables. If a workout name is not listed in this drop-list table, contact you FPS GOLD client service representative for any additions you want added.

|