Navigation: »No topics above this level«

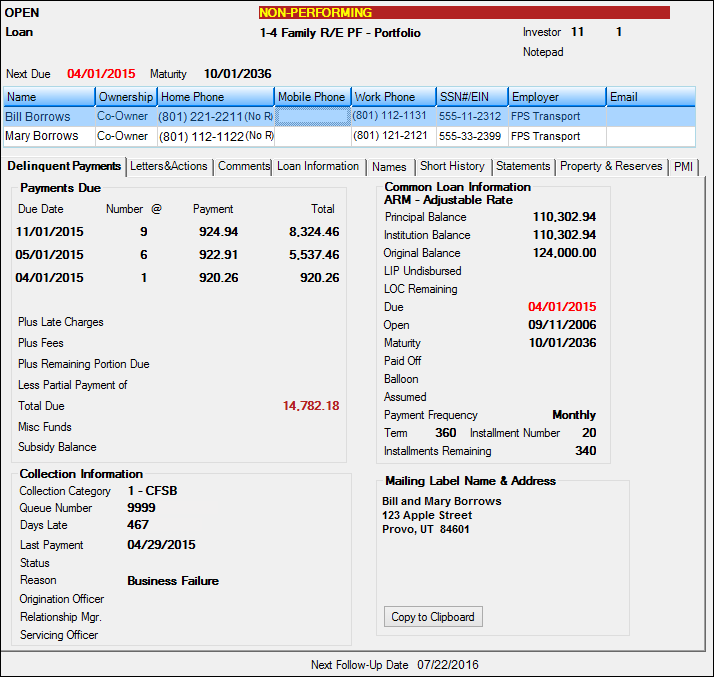

The Account Delinquency screen allows a collector to view borrower information such as borrowers' names, telephone numbers, due date, total due, and other general loan information. A collector can also send an email from this screen. (See the Comments tab.)

The following tabs are located on the Account Delinquency screen:

•PMI

See the following example of the Account Delinquency screen:

Loans > Collections > Account Delinquency Screen

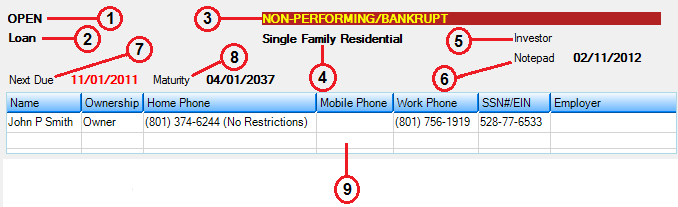

At the top of the Account Delinquency screen is the account status information, alert status (if any), loan type description, next due date, maturity date, and a list view displaying all the names attached to this account. The following is an example of this section of the screen, followed by descriptions for each field.

Field |

Description |

|||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

1 |

Account Status |

The account status displays whether the loan is opened, matured, closed, or released. |

||||||||||||||||||||||||

2 |

CIS Account Description |

This is the product description, loan pattern description, or the customized description set up for this account. Examples include "Loan," "Savings," or "Certificate." It is pulled from the Account Description field on the Entity Maintenance Account screen in CIS. If that field is blank, this field will display data from the Account Type field on that screen. |

||||||||||||||||||||||||

3 |

Alert Status |

This indicates that an alert exists for this loan. Alerts include non-accrual, charged-off, repossessed, bankruptcy, written off, deferred principal, or in foreclosure.

Alerts will be displayed under the following conditions:

For a non-performing and/or non-accrual loan, if either of those fields is checked, that field will appear in the alert status area. If an account has one of the above-mentioned general categories and is a non-performing and/or non-accrual loan, both descriptions will appear with slashes (“/”) before and after. |

||||||||||||||||||||||||

4 |

Loan Type Description |

This field displays the loan type description defined by your institution. It is pulled from the Loan Type field on the Classification tab of the Account Detail screen. The codes and descriptions are set up in System Setup on the Loan Type & Class Descriptions screen.

The Loan system uses loan type descriptions to group loans together. These descriptions can be placed on reports for loan servicing convenience and sorting purposes. Also, General Ledger accounts can be tied to loan types using the Loans > System Setup > Autopost > G/L Account Identifiers By Loan Type screen. |

||||||||||||||||||||||||

5 |

Investor |

This field enables you to determine if the loan is sold and to whom. If the loan is sold, this field will show the investor master and group number assigned to the loan. The information is pulled from the Investor system. |

||||||||||||||||||||||||

6 |

Notepad |

This is the last date an employee entered a comment on the Notepad screen for this account. |

||||||||||||||||||||||||

7 |

Next Due (LNDUDT) |

This is the date the next payment is due. This is the same date as the date displayed in the Due Date field in the Payments Due field group on the Delinquent Payments tab. |

||||||||||||||||||||||||

8 |

Maturity (LNMATD) |

This is the maturity date of the loan, when the term of the loan ends and the loan should be paid off. |

||||||||||||||||||||||||

9 |

Names list view |

This table lists all the names associated with this account. It displays the first and last name, the relationship this person has to the account (Ownership column), the home, mobile, and work phone numbers, the Social Security number or EIN, the name of the employer, and the person's email address. This information is set up when the loan is originally opened and also through the CIS system. |