Navigation: Account Delinquency screen >

The Short History tab on the Loans > Collections > Account Delinquency screen contains fields used to enter parameters and execute a short history search. It displays only certain monetary transactions.

This provides you with a quick way to view loan payments, reserve disbursements, debits and credits to the principal balance, finance charges (for line-of-credit loans), the assessment and/or payment of fees and late charges.

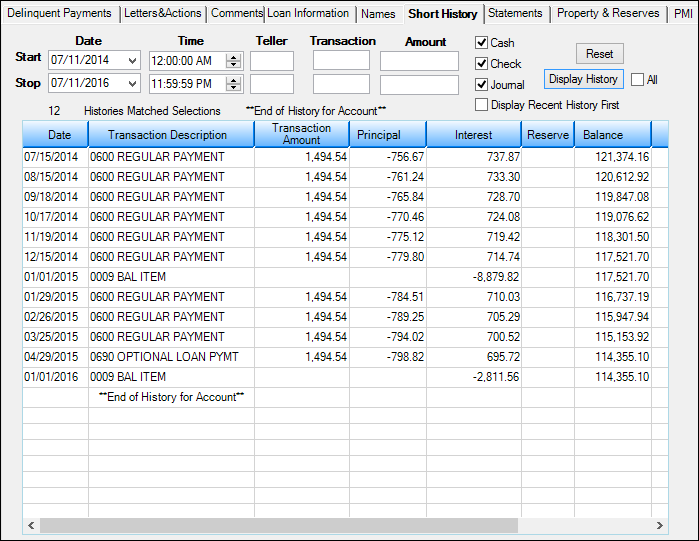

See the following example of this tab, followed by descriptions for each of the fields:

Loans > Collections > Account Delinquency Screen > Short History Tab

Field |

Description |

|---|---|

Name |

The Start Date and Stop Date fields at the top of the Short History tab allow you to enter the dates you want displayed.

1.If just the Start Date field is entered, the display will show history from that date to today. If just the Stop Date field is entered, history will show from the beginning when the account was first opened to the date you entered in the Stop Date field.

2.If both fields are left blank, all history items on file for the account will be displayed.

3.If you enter information in both the Start Date and Stop Date fields, history entered on and between those two dates will be shown. Enter the date using MMDDYYYY format, or use the drop-down calendar to select the date.

If the date on a transaction in the list view is blue, it means the transaction has an As of Date. |

Start and Stop Time |

The Start Time and Stop Time fields at the top of the screen allow you to enter the time history items were entered on the system and for which you want displayed.

1.If just the Start Time field is entered, the history display will show information beginning with that time.

2.If just the Stop Time field is entered, history will be displayed from the beginning when the account was first opened to the time entered in the Stop Time field.

3.If both fields are left blank, all history items on file for the account will be displayed.

4.If information is entered in both the Start Time and Stop Time fields, history entered on and between those two times will be shown.

Once all the appropriate search parameter fields are filled in, click <Display History> to view the results in the list box below. |

Start and Stop Teller |

The Start Teller and Stop Teller fields allow you to use the teller or employee identification number in history selection.

Entering just a Start Teller or Stop Teller parameter will bring up only the histories associated with that teller or employee number.

By entering both the Start and Stop Teller parameters, the system will search for a range of teller or employee numbers that begin and end with the Start Teller and Stop Teller parameters. If both fields are blank, all transactions will be displayed.

Note: The FPS GOLD afterhours teller number is 8910, 8920, and 9910. |

Start and Stop Transactions |

The Start Transaction and Stop Transaction fields allow you to select history records based on the transaction code used.

Entering just a Start Transaction or Stop Transaction parameter will bring up only the histories associated with that transaction code.

By entering both the Start Transaction and Stop Transaction parameters, the system will search for a range of transaction codes that begin and end with the Start Transaction and Stop Transaction parameters.

If both fields are blank, all transactions will be displayed.

Note: The file maintenance tran codes are 022 and 023. If you want to view history without seeing file maintenance, enter 024 in the Start Transaction field and 999 in the Stop Transaction field.

Once all the appropriate search parameter fields are filled in, click <Display History> to view the results in the list view below. |

Start and Stop Amount |

The Start Amount and Stop Amount fields allow you to select the transaction amount to use in history selections. A Start Amount parameter entered alone will bring up only the histories associated with that amount.

Entering just the Stop Amount parameter will bring up history numerically starting with $.01 and ending with the amount you enter in the Stop Amount field.

By entering both the Start and Stop Amount parameters, the system will search for a range of amounts that begin and end with the Start Amount and Stop Amount parameters.

If both fields are blank, all amounts will be displayed.

Once all the appropriate search parameter fields are filled in, click <Display History> to view the results in the list box below. |

Cash |

Select this box if you want history information to be displayed for cash transaction types. |

Check |

Select this box if you want history information to be displayed for check transaction types. |

Journal |

Select this box if you want history information to be displayed for journal transaction types. |

Display Recent History First |

This field indicates what institution option OP09 DRHF is set to. This institution option controls which way loan history is displayed when accessing accounts.

•If the option is set, then history will display beginning with the most recent item. •If the option is not set, history will display beginning with the oldest items.

You can check or uncheck this field to reverse the order of the history for that account while you are on this tab; however, when you leave the Short History tab, the institution option becomes effective again. |

Short History list view |

This list view contains several columns, including Date, Transaction Description, Transaction Amount, Principal, Interest, Reserve, Balance, Due Date, Late Charge, and Fee. You can use the horizontal scroll bar to see all the columns. Column headings can also be dragged and dropped to change the column order.

Note: If the date on a transaction in the list view is blue, it means the transaction has an As of Date. The time on the transaction listed is the actual time for the transaction, not the As of Date entered at the time the transaction is processed.

The Transaction Description column contains the transaction code and a brief description of the transaction this history item represents. Some examples are:

0680 OPEN NEW LOAN 0600 REGULAR PAYMENT 0140 ESCROW REFUND 0160 RESERVE REFUND 0440 RESERVE DISBURSEMENT 0640 RESERVE DISBURSEMENT 0560 ASSESS LATE CHARGE 0550 LATE CHARGES PAID 0570 WAIVE LATE CHARGE 0420 AMORT DEFRD COST 0410 MISC G/L DEBIT 0500 DEBIT FIELD 0510 CREDIT FIELD 0580 LOAN PAYOFF 0610 POST ESCROW INTEREST |