Navigation: Functions >

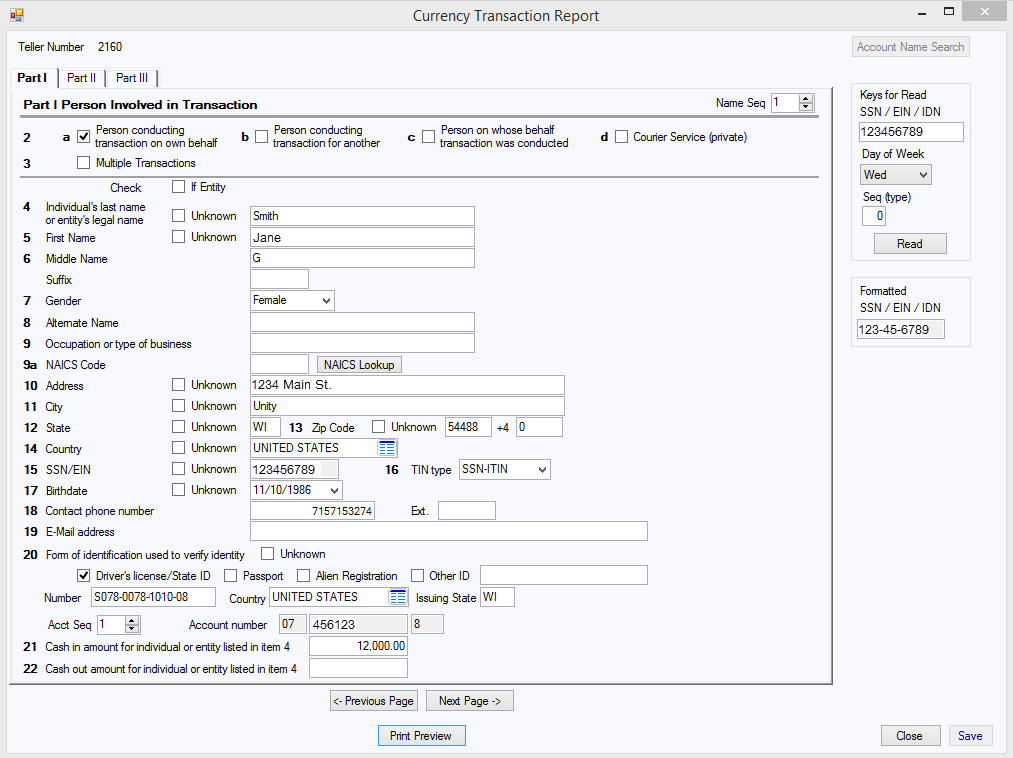

Currency Transaction Report

CIM GOLDTeller Functions menu > Currency Transaction Report

The Currency Transaction Report totals all currency transactions made during the day for each Social Security number. It must be filed by your institution online using the BSA website or through Verafin. All accounts that have the same IRS owner Social Security number will be combined. Once you fill out the information on this screen, you can click <Print Preview> to view the information in its finished form.

This screen will also be enabled automatically if the customer is over limit when transactions are processed.

To open the Currency Transaction Report screen, select "Currency Transaction Report" from the CIM GOLDTeller Functions menu. See the examples below.

Teller System > GOLDTeller > Functions > Currency Transaction Report

The following notes apply to Part 1:

•If no Social Security Number is entered on the transaction, Box 2a will be marked.

•There is no limit to the number of names on this form.

•The system populates Box 18 with the first contact phone number found in this order: home, cell, work.

•The Alien Registration field for Item 20 is the same as the Non-Citizen ID.

•If the state entered in the Issuing State field for Box 20 is in the United States, then the Country field will be populated automatically.

•Account numbers are repeated for both Box 21 and Box 22 when deposits and withdrawals have been processed for the same SSN.

•Up to 30 accounts can be printed on the form.

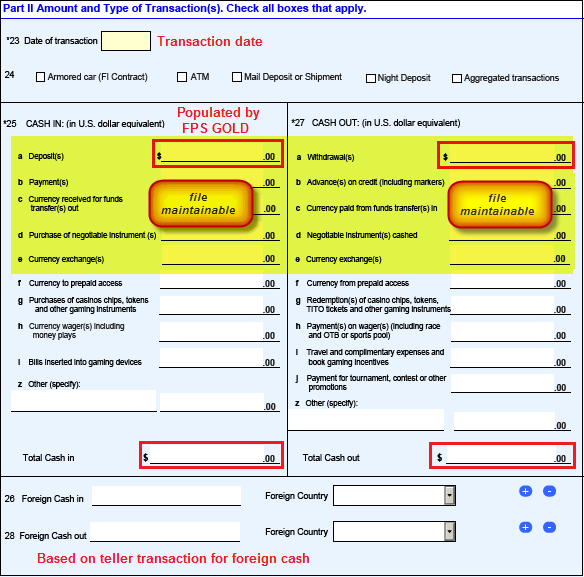

Currency Transaction Report, Part II

The following notes apply to Part II:

•Box 23 is the Transaction Date.

•Box 24 is not populated by FPS GOLD.

•Boxes 25a, 27a, and the Total Cash In and Total Cash Out are populated by FPS GOLD. Boxes 25a–e and 27a–e (highlighted in the example above) are file maintainable. You can move the cash amounts to the appropriate category. FPS GOLD has not programmed for all transaction codes.

•26 and 28 are based on the teller transaction for foreign cash.

•You can add an unlimited number of accounts to other names on the report.

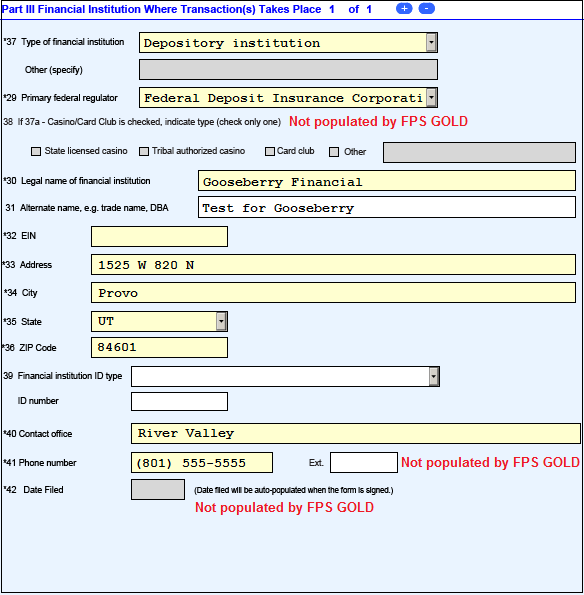

Currency Transaction Report, Part III

The following notes apply to Part III:

•Items 29-37 (out of order on the form) are populated from PC institution settings.

•Items 40 and 41 are populated from branch settings.

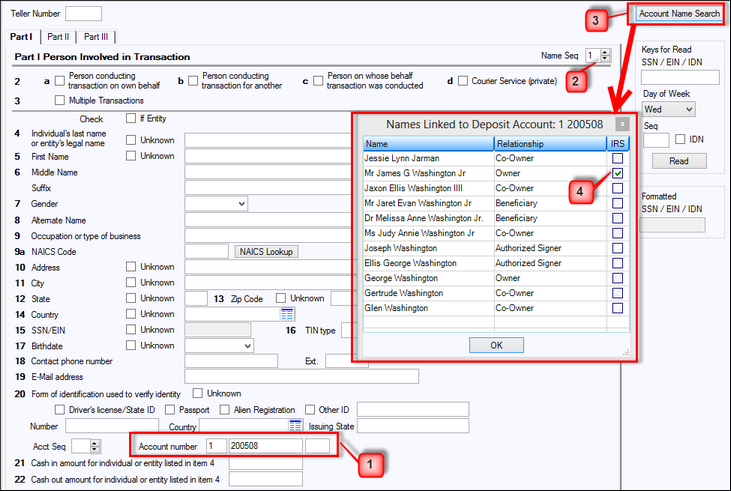

You can add additional names to the form using the account entered on line 20. A button in the top right corner of the screen, <Account Name Search>, will be enabled when an account number is entered on the form. (See the example below.) If you add additional Cash In and Cash Out amounts on lines 21 and 22, you will need to manually add them to Part II of the form. Fields b, c, d, and e are open for file maintenance for lines 25 and 27.

To use this feature, complete the following steps:

1.In line 20, enter the account number to be used.

NOTE

Once an account has been entered, it cannot be changed. If it is left blank and cash in or out is entered, you cannot add an account. |

2.Select the proper name sequence in the Name Seq field at the top right corner of the screen.

3.Click <Account Name Search> to get the list of names linked to the account entered in Step 1.

4.Double-click the appropriate name on the Names Linked to Account dialog box.

All the current CIS information will be automatically populated on the form for the name sequence selected.

Currency Transaction Report Account Name Search

Banks and other financial institutions are required to file a Currency Transaction Report for each transaction involving more than $10,000 in cash. The IRS requires all Currency Transaction Reports to be filed with them within 15 days of receipt. However, some persons and entities are exempt from this rule, such as the following:

▪another bank in the United States;

▪any federal, state or local government (including the District of Columbia, U.S. territories and possessions, and various tribal government authorities);

▪any listed corporation whose stock is traded on the New York Stock Exchange or the American Stock Exchange (Excluding stock listed on the Emerging Company Marketplace of the American Stock Exchange);

▪any listed corporation whose stock is designated as a Nasdaq National Market Security listed on the Nasdaq Stock Market (excluding stock issued under the separate Nasdaq Small-Cap Issue heading); or

▪any consolidated subsidiary of a listed corporation that files combined federal income tax returns.

Please review your institution’s requirements and procedures for creating and sending Currency Transaction Reports to BSA. Currency Transaction Reports are stored on the FPS GOLD system for seven days. You must have your own long-term retention plan for the forms you file with BSA.

NOTE

Foreign cash in and cash out are not captured for this report. |

For more information concerning the Currency Transaction Report, visit the BSA website.

Institution option (NCTR, New CTR Form) must be set to use this form. The cumulative total of cash transactions throughout the day should be logged by the Social Security number of the person conducting the transaction at the teller window. If your tellers do not enter the SSN for the person, the IRS owner on the account will be logged as the one doing business. We suggest you review your policy and procedures to make sure you are in compliance. You may need to add the SSN field to your teller transactions in order to use it. The following 33 transactions currently have this field on them:

•1120, DEP Deposit

•1130, WDR Withdrawal

•1190, CLS Close

•1400, CCN Check Cash No Hold

•1400, CCO Cash Check On-Us

•1400, CCH Cash Check-Hold

•1400, OTC Hold On-Us

•1410, MON Money Order

•1410, AMO Account Money Ordr

•1410, MOF Money Order F/M

•1420, TCK Travelers Check

•1420, ATC Acct Travelers Chk

•1420, TCF Travelers Chk F/M

•1430, ECK Exchange Checks

•1430, AEC Acct Exchange Chks

•1430, ECF Exchange Check F/M

•1430, ECK Exchange Checks/2

•1440, CCK Cashiers Check

•1440, ACC Account Cashrs Chk

•1440, CCF Cashiers Check F/M

•1450, CCP Credit Card Pay

•1450, CPC Credt Crd Pay-Acct

•1460, CCA Credit Card Adv.

•1460, CAC Credt Card Adv-Acct

•1480, BND Bond Cashing

•1480, BND Bond Redemption

•1490, XCT Exchange To U.S.

•1490, XCF Exchange Fm U.S.

•1490, XWD Exchange Withdrawal

•1490, XDP Exchange Deposit

•1490, XFC Xchg Frgn To Frgn

•1800, GLD G/L Debit

•1810, GLC, G/L Credit

NOTE

On transactions 1450 (Card Payment) and 1460 (Card Advance), card numbers are masked in compliance with Payment Card Industry Data Security Standards. For more information, see FPS GOLD PCI Compliance. |

Institution option (CTRA, CTR Amount) was created to allow your institution to set the CTR form limit. Previously, the limit was cash amounts over $10,000.00, but you can now set it at a lower limit if you want to gather customer information for the form before the required $10,000.00 limit. If you want to set these two options for your institution, please submit a work order.

The data fields that are required on the form are populated automatically from the CIS file based on the SSN. If no SSN is entered on an account transaction, the IRS owner information will be used. The physical address tied to the customer will be used; if one is not available, the address information on the form will be left blank. We will add email addresses, phones, and other data to the form when it is available. Some of the fields present on the form are not available on transactions or on our system, so they have been disabled.

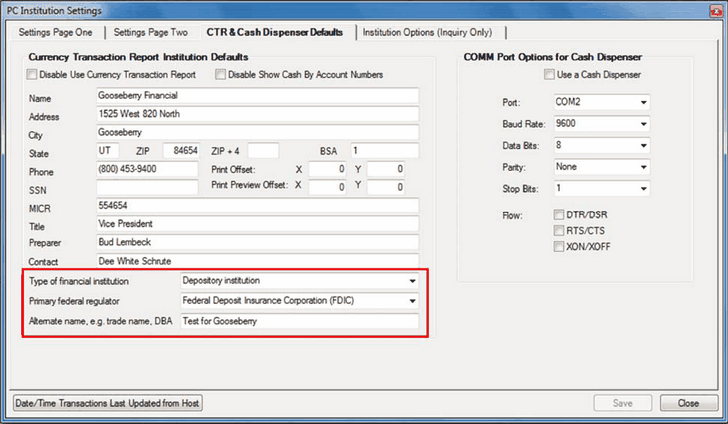

The following example of the PC Institution Settings dialog box, CTR & Cash Dispenser Defaults tab shows the new fields highlighted.

PC Institution Settings Dialog, CTR & Cash Dispenser Defaults Tab (Functions > Administrator Options > PC Institution Settings)

The fields highlighted on the screen above need to be filled out to pre-populate the bank information on page three of the CTR form.

NOTE

Tellers can minimize this screen if they need to access another transaction before finishing the document. |

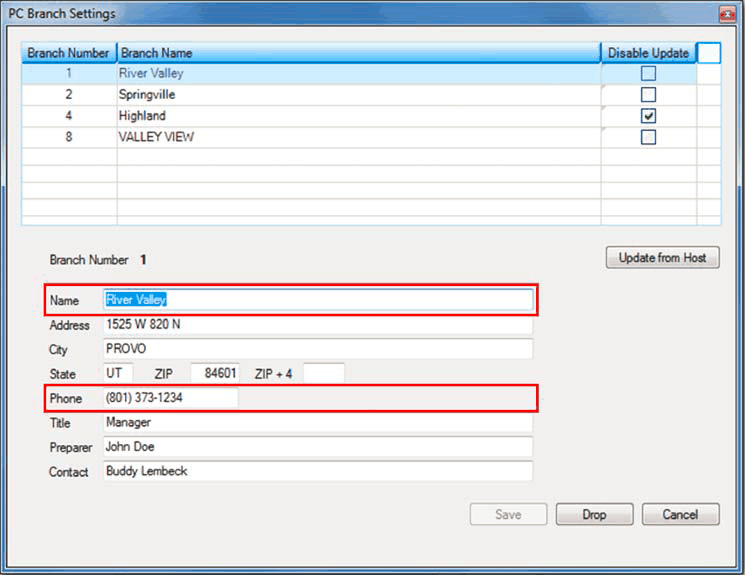

The CTR form enters branch information using the PC Branch Settings dialog box. The name of the office and the phone number are used on the CTR in fields 40 and 41. See the following example.

PC Branch Settings Dialog Box