Navigation: Functions >

The names on this log are used to screen non-customer transactions against your institution's FinCEN 314a file. This log is a way for you to keep track of transactions performed for individuals that do not include an account and get them screened as required. An example of this kind of transaction is cashing a check for a non-bank customer without using an account number. Other examples include money order purchases, cashier's checks, and so forth.

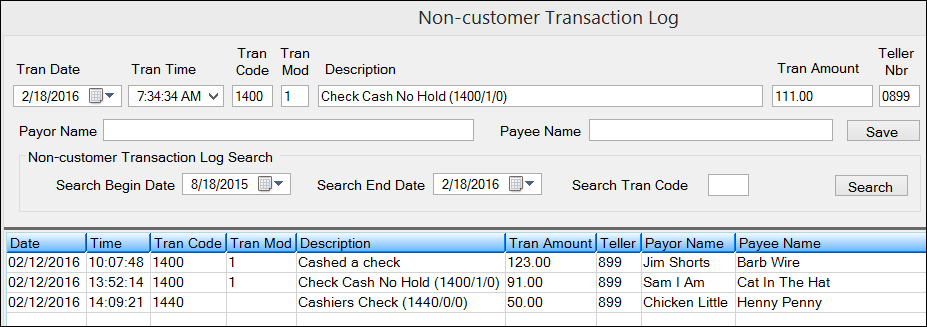

The screen pre-fills some of the information from the last transaction the teller ran. The columns on the screen are as follows:

•Date: This is the date of the transaction to add to the log.

•Time: This is the time of the transaction to add to the log.

•Tran Code: This is the transaction code.

•Tran Mod: This is the transaction modifier.

•Description: This is the description of the transaction.

•Tran Amount: This is the total amount of the transaction.

•Teller: This is the number of the teller who performed the transaction.

•Payor Name: This is the name of the person from whom you received checks or cash for the transaction.

•Payee Name: This is the name of the person to whom checks or cash was paid by the transaction.

If you do not access this screen after the transaction, you can manually enter all the data for the transaction.

The PC Institution Setting Disable Repeat F12 Transaction Key must be unmarked for the Non-Customer Transaction Log function to work because the log gathers some information from the last transaction run. The PC Institution settings are located in GOLDTeller under the Functions menu > Administrator Options.

The FinCEN list follows slightly different rules. This list is only made available to banks. The bank receives a 314a request, usually every two weeks, but possibly more or less than that. They have 14 days to report the results of the search. The search should only occur once for a specific FinCEN list. The search must include a search of accounts on file for up to 12 months, and of transactions that are not linked to an account for the last 6 months.

The FinCEN list is not guaranteed to be nationwide and may be regional. Therefore, banks may not all receive the same list. Accordingly, we will have each bank upload its own FinCEN list, and we will process it when we receive it. Each bank will search its own list. FPS GOLD has no access to the lists. They are stored on your bank's database.

A screen is available in CIM GOLD to enable you to upload your bank's FinCEN 314a list. It is found under Miscellaneous/FinCEN 314a. Once you download the file, you can process a screening against your non-customer list and CIS. These files will be screened each time they are loaded.

There is a GOLDTeller function available to facilitate the entries of 314a transactions for non-customer transactions.

Institutions may use the FinCEN list to assess risk before opening accounts, but are not required to do so. For our purposes, new account OFAC searches will not search the FinCEN list.

Banks must keep the following information about each FinCEN list to verify that they are in compliance with FinCEN reporting:

•date of the request;

•tracking numbers within the request;

•date the request was searched.

If positive matches, also keep the following information:

•the date matches were reported;

•the accounts and transactions that were identified in the match process.

This information must be kept for five years.