Navigation: How to... > Run a Transaction >

Retirement Distribution (1230)

When you process a Retirement Distribution (transaction code 1230), the withholding amount displays on the GOLDTeller screen so you can use it to balance the transaction.

Example: A customer wants to withdraw $1000.00 from their retirement account.

To process this transaction:

1.Enter the Transaction Amount on the transaction, then click <Calculate Withholding>.

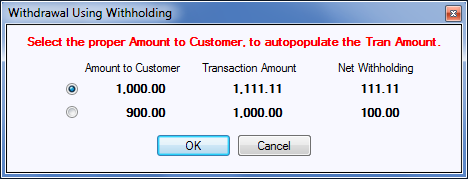

The following dialog box box is shown after the withholding is calculated using the settings on the account.

2.Ask how much the customer wants. In this example, there are two options:

•the withholding can be computed on the $1000.00 withdrawal amount, to give the customer $1000.00;

•the customer can receive the net of the withholding, which is $900.00.

As you can see, the withholding amount is different based on the Amount to Customer.

3.Select the appropriate amount in the dialog box box.

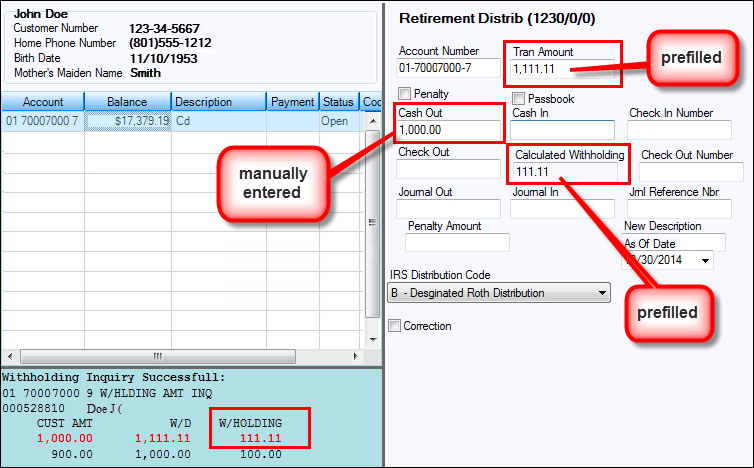

The Tran Amount field and the new field Calculated Withholding are prefilled.

4.Tellers should enter the amount to the customer from the dialog box box above in the Cash, Check, or Journal Out fields to make the transaction balance. See the following example.

NOTE

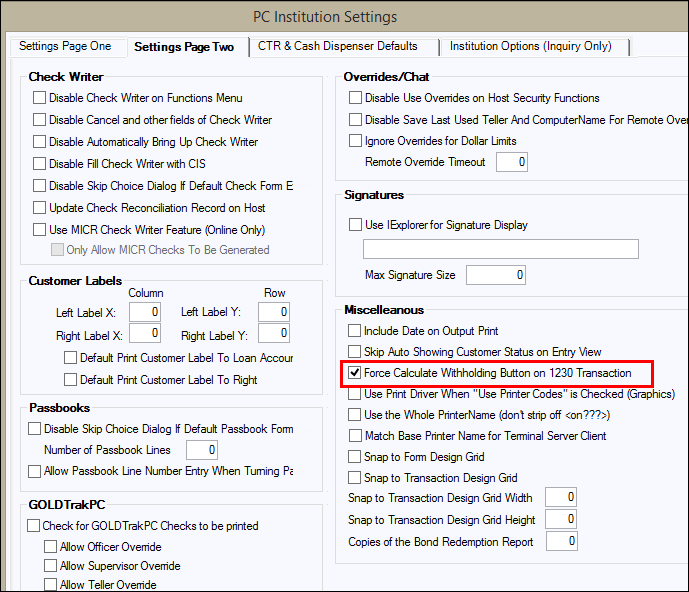

We recommend that tellers click the <Calculate Withholding> button on the transaction for every distribution. You can require tellers to click it before they can proceed with the transaction. To do this, check the Force Calculate Withholding Button on 1230 Transaction field (GOLDTeller Functions menu > Administrative Options > PC Institution Settings > Settings Page Two, Miscellaneous field group). See the following example. |