Navigation: How to... > Run a Transaction >

Mass Loan Payments (600/50/0)

Use the Mass Loan Payments screen to quickly process many transactions for many different accounts. This function is especially useful if your institution has one employee or a small number of employees responsible for entering loan payments on accounts. For example, if you receive many loan payment checks each day in the mail, an employee can use this screen to enter that information for each account.

The Mass Loan Payments function allows you to perform loan payment transactions 600 (and 2600) and 690 and payments with principal decreases. With Mass Loan Payments, you can perform multiple loan payment transactions of the following types:

•Regular Payment

•Bulk Activity Payment

•Regular Payment with Additional Principal

•Spread Payment

•Spread Payment with Reserve

•Mail-in Payment

•Walk-in Payment

You can add payments for multiple accounts at one time. However, you can only process one type of payment at a time. Once you select one of seven Payment Transaction types listed above, you must send all of the transactions of that type before you can select another type.

To perform mass loan payment transactions:

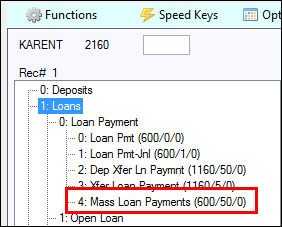

1.Select "Mass Loan Payments (600/50/0)" from the Loans menu in CIM GOLDTeller:

NOTE

If Mass Loan Payments does not appear in your transaction list, someone with security access will need to add it. See Setup > Administrator Options > Menu Design for information on how to set up your transaction list. |

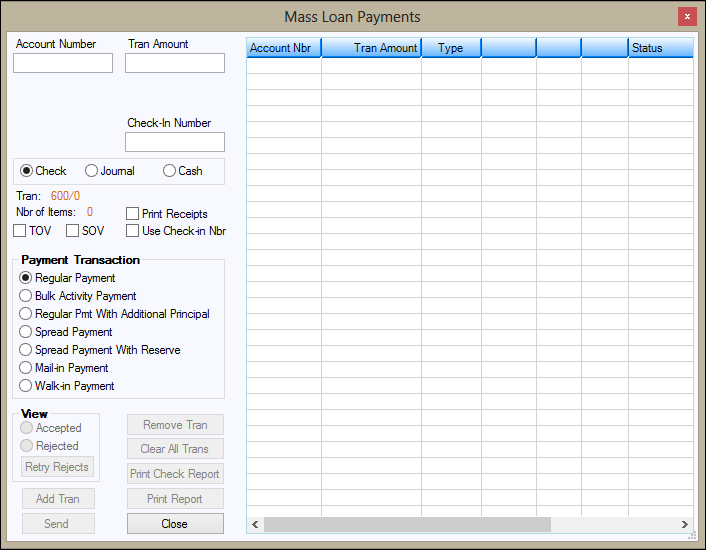

| The Mass Loan Payments screen opens: |

2.In the Payment Transaction field group, select the type of transaction you want to run.

| If you are entering many transactions, group the transactions by type. For example, if you have a pile of loan payments that are from walk-in payments, mail-in payments, and regular payments, you would group the mail-in payments together and process those; then group the walk-in payments and process those; and then group the regular payments and process those. |

Hint: Select the transaction type first. If you enter account information first, and then change the transaction type, the system will ask you if you want to clear all transactions. You will either have to process the transactions with the transaction type that was already selected, or you will lose all the information you entered and be forced to enter it again using the transaction type you need.

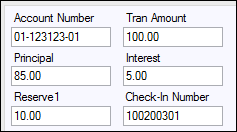

3. Enter an account number in the Account Number field.

4.Enter the payment amount in the Tran Amount field.

5.Click on Check, Journal, or Cash to specify the method of payment.

6. If the payment is being made by check, enter the check number in the Check-In Number field.

7.Enter information specific to the transaction type you selected in Step 2:

•If this is a spread payment (tran code 690), enter the principal amount in the Principal field and the interest amount in the Interest field.

•If this is a spread payment (tran code 690) and you need an extra field to enter another amount, such as escrow, click the Spread Payment With Reserve radio button. The Reserve1 field will appear below the Principal field.

•Enter the extra amount in Reserve1, if necessary.

•If this is a Regular Payment with Additional Principal Field transaction, enter the amount of the additional principal in the Additional Principal field. This field does not

•appear on the screen until you select the Regular Payment with Additional Principal Field radio button.

•Similarly, if you are running a Spread Payment or Spread Payment with Reserve Field transaction, enter the appropriate payment information in the Principal, Interest, and Reserve 1 fields.

8.Click <Add Tran>. Hint: If using the number keypad to quickly enter account information, press the <+> key.

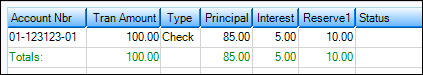

The information, including a running total in green, will be displayed on the right-hand side of the screen.

The columns in the list view change according to the type of transaction.

NOTE

If this is a spread payment (tran code 690) and the amounts do not add up when you click the <Add Tran> button, a message will display stating that the amounts do not add up. You must fix the amounts before you continue. |

The system will do a pre-test of a regular payment with additional principal before processing the transaction to be sure that both the payments and the principal decrease will work. If an override is needed, both the payment (tran code 600) and the principal decrease (tran code 510 field credit) will be rejected.

9.Enter any other payments of the same type that you need to enter.

NOTE

After you click <Add Tran>, you cannot change the Payment Transaction type until you click <Send>. |

10.Click <Send>. All the loan payments that can be processed without an override will be sent to the host and processed.

When the transaction is finished, the screen will display accepted and rejected loan payments.

![]()

| You can pPrint a report of the transactions by clicking either <Print Bank Report> or <Print Tran Report>. |

11.When you have completed processing a group of accounts and want to begin processing another group, click <Clear All Trans>. A warning dialog box box opens. If you click <Yes>, the screen will become blank and return to default settings.

Loan payments that require a teller or supervisor override will reject.

You can either click <Remove Tran> to delete a rejected payment or process an override.

WARNING

Checking one of the override checkboxes will post all pending transactions in the list view with the override; you can't select one at a time and send them individually. |

To process an override:

1.Click the TOV checkbox for teller override or SOV checkbox for supervisor override.

2.Click <Retry Rejects> and then <Send>. The Override Required dialog box box opens.

3.Enter the necessary information.

NOTE

If you know beforehand that certain items will require an override, it would be faster to process those items together in a separate batch (for instance, payments that have been sent from the collection department). |

You can print a report of all rejected items by clicking <Print Report>.

•When posting a payment on a loan that is two or more payments past due for this tran code, the system requires a teller override (TOV).

•For contract collections, late charges included in the regular payment are shown in the seller history as a separate item. If a correction transaction is processed on the same day and for the same amount as the 600 transaction regular payment, both transactions are cancelled. Otherwise, the correction will show on the Afterhours Processing Exceptions Listing (FPSRP013).

•When posting a payment on a payment method 5 loan that is higher or lower than the actual amount, the system will require a TOV and display one of the following messages: "TOV AMT TOO LOW -- PMT IS $XXX.XX" or "TOV AMT TOO HIGH -- PMT IS $XXX.XX."

•For payment methods 0, 1, 2, and 7, when posting a payment on a loan that has received a partial payment, the system requires a teller override (TOV).

•When making a reversal of a payment tran (600), if one or more 500s and/or 510s were posted after the payment was posted, all the 500s and 510s must be reversed prior to the reversal tran (608). If one or more 500s and/or 510s were posted and you only want to reverse one particular transaction (and not the payment), you don't have to reverse all of the transactions posted after that transaction,just that transaction itself.

Options: The following institution options are available when posting loan transactions:

•OPT 8 BSOV: Allows you to bypass the supervisor override when posting payments for payment method 6 where the borrower pays more than the scheduled amount (if the loan has not been sold to an investor).

•OPT Y CFEE: Requires a TOV when posting a payment if miscellaneous fees are due on the loan. (This option is available for all payment methods.)

•OPT Y BTOV: Stops the requirement for a TOV when posting a loan payment for an amount greater than the payment amount. This was created for processing mass payments; however, it also works with regular loan payments. (This option is only available with payment method 5 loans.)

•OP01 BKPM: Bankruptcy (Hold Code 4 and 5):

oAllows a principal decrease (tran code 510/518)

oAllows a principal increase (tran code 500/508)

oAllows a pay-off (tran code 580)

oAllows a loan payment (incl. auto payments) (tran code 600/608)

oAllows a "teller spread" payment (tran code 690/698)

oAllows payment of late charges (tran code 550/558)

oAllows waiving of late charges (tran code 570/578)

oAllows VSI Add (tran code 870/878)

oAllows VSI Cancel (tran code 890/898)

oAllows assessing of misc. fees (tran code 660/668)

oAllows a payment of misc. fees (tran code 850/858)

oAllows waiving of miscellaneous fees (tran code 670/678)

oAllows a partial payment (tran code 510/508 to field 33)

oAllows an automatic payment

•OP01 PIWD: Allows interest to be paid only in full-day increments for payment method 6 loans. If this option is set, when a payment is posted (600 transaction code only), interest will only be paid in full-day increments. For example, if the per diem is $5.50, only multiples of $5.50 would be paid to interest ($5.50, $11.00, $16.50, etc.), up to the full amount of interest owed. Any remaining amount will be applied to principal. If the amount paid is less than the per diem, no interest will be paid. The result of this option will be a more accurate Date Last Paid To.

Example:

Given:

Principal balance: $3,816.10

Loan rate: 30.0000%

Interest base: 365

Per diem: $3.14

Interest for 30 days: $97.34

P/I constant: $264.00

A payment of $100.00 divided by the per diem of $3.14 will be 31. The per diem multiplied by 31 is $97.34.

The remainder of the payment ($2.66) will be applied to the principal.

•OP02 APCO: Charge-Offs (Hold Code 2):

oAllows a loan payment (including auto payments) (tran code 600/608)

oAllows a "teller spread" payment (tran code 690/698)

oAllows payment of late charges (tran code 550/558)

oAllows waiving of late charges (tran code 570/578)

oAllows VSI Add (tran code 870/878)

oAllows VSI Cancel (tran code 890/898)

oAllows assessing of misc. fees (tran code 660/668)

oAllows a payment of miscellaneous fees (tran code 850/858)

oAllows waiving of miscellaneous fees (tran code 670/678)

oAllows an automatic payment

•OP03 ACCO Charge-Offs: (Hold Code 2):

oAllows a principal decrease (tran code 510/518)

oAllows a principal increase (tran code 500/508)

oAllows a pay-off (tran code 580)

•OP03 PM07: Allows you to bypass the supervisor override when posting payments for payment methods 0 and 7 where the borrower pays more than the scheduled amount (if the loan has not been sold to an investor).