Navigation: Variable Queue Setup Screen > Queue Selection Criteria field group >

Field Name

Entry: User, alphanumeric

F/M: Yes

Mnemonic:

Screen: Loans > Collections > Queues > Variable Queue Setup

Field Group: Queue Selection Criteria

This field is used to select criteria for the queue. Enter the desired mnemonic and its associated range. The mnemonics and ranges entered will control which accounts will be included in the queue. For a list of all possible mnemonics used by the Collections sytem, click ![]() . (See also Special Fields below.)

. (See also Special Fields below.)

There is no priority in the selection. All conditions need to be met by a loan for it to be included in the queue for processing. Up to 24 mnemonics can be used as selection criteria. Each mnemonic can only be used once per queue in the selection section. Note: The servicing officer (MLLSOR) and the relationship manager (LWOFCR) can also be used.

An error provider ![]() will indicate if an invalid mnemonic is entered.

will indicate if an invalid mnemonic is entered.

Only CIS and Loan record mnemonics that are no longer than six characters in length can be used to select criteria. Indicator mnemonics (yes/no fields) can also be used by entering a "Y" in the Low Value field and leaving the High Value field blank or leaving both fields blank to indicate "no" (unchecked box).

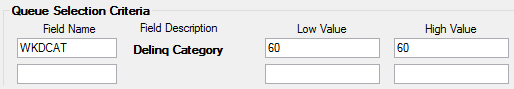

Example 1:

You want to set up a queue that pulls accounts that have a delinquent category of 60. You would set up the selection criteria like this:

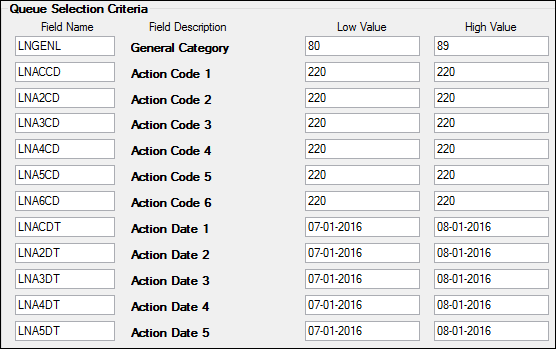

Example 2:

You want to set up a queue that pulls all accounts that filed for bankruptcy last month. First, you would need to set up an Action Code for your institution for Bankruptcy (see the Action Code field on the Letters & Actions tab for more information). Then for each bankruptcy, make sure that Action Code is selected, as well as the Action Date. For our example, we set Action Code 220 to be "Bankruptcy."

Then you would set up the selection criteria like this:

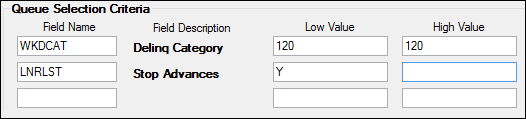

Example 3:

You want to set up a queue that pulls all accounts that have a delinquent category of 120 and have stopped all advances. You would set up the selection criteria like this:

Setting up the fields to your exact specifications may take some time. Your FPS GOLD customer support can help you with setting these up.

Additionally, the following is a list of the special Collection system afterhours mnemonics (fields) and their descriptions that can be used. These mnemonics were created specifically for the Collection system and are not available in GOLDWriter. As a result, they will not appear in your GOLDWriter dictionary.

Afterhours Mnemonic |

Description |

|---|---|

LNHLDS |

Variable queue setup mnemonic (LNHLDS) reads data stored in hold code 1 (LNHLD1) and hold code 2 (LNHLD2). You could use this, for example, to set up a collection queue for all loans in bankruptcy (hold codes 4 and 5). Enter the mnemonic “LNHLDS” in the Field Name field, “4” in the Low Value field, and “5” in the High Value field. When the queue is processed during the afterhours, the program will pull all loans that have 4 or 5 in hold codes 1 or 2. |

LNFCLS |

This field is used for loans in foreclosure. This mnemonic reads data stored in hold code 1 and hold code 2 that have a hold code equal to 7 or 9 (foreclosures). To create a collection queue for loans in foreclosure, enter “LNFCLS” in the Field Name field and nothing in the Low Value or High Value fields. When the queue is created during the afterhours, the program will pull all loans that have a 7 or 9 in hold codes 1 or 2. |

WK1DUE |

This field is used to identify delinquent loans that are delinquent for their First Due Date. The system compares the First Due Date (LN1DUE) to the Due Date on the loan and if they are equal, the loan will appear in the queue. |

WKDYLT |

Calculates the number of days an account is past the due date. It takes the due date on the loan and compares it to the processing date plus one working day. On the selection screen, you can put a negative number to pull current accounts before the due date. These must be set up in queues 9900 - 9996. |

WKLTVC |

Calculates the current LTV on the loan so that the current LTV can be used as selection and sorting criteria. This takes the lower of the selling price or the appraisal relative to the current loan balance. |

WKDCAT |

Uses delinquency category (LNDCAT) definition but on a daily basis.

When the afterhours update function Update Delinquent Category (82) runs, the delinquent category is set.

The update function classifies loans by counting the number of installments necessary to bring the loan current. If, for example, you have a loan due in November and the update function runs each monthend, on November’s monthend the loan would owe one installment. Owing one installment is considered less than 30 days delinquent. Owing two installments is considered 30 days delinquent. If no payments are received before December’s monthend, the delinquent category is set to 30. On January’s monthend, it is set to 60, and so on. Valid categories are 0, 30, 60, 90, and 120 and over.

If option OP04 UDQG, Use Delinquency Grading, is set and the late charges plus the “applied to” is greater than or equal to the payment amount, the due date will be artificially advanced as many payments as possible before the Delinquency Category field is calculated. |

WKLTVO |

Calculates the original LTV on the loan so that the original LTV can be used as selection and sorting criteria. This takes the lower of the selling price and the appraisal relative to the original loan balance. |

WKPMON |

Pulls only loans into the queue that have a due date in the month prior to the queue run date. Example: If the queue is created the night of 2/5, loans with a due date in the month of January will be pulled into the queue.

If option OP04 UDQG, Use Delinquency Grading, is set and the late charges plus the “applied to” is greater than or equal to the payment amount, the due date will be artificially advanced as many payments as possible before the Delinquency Category field is calculated. |

QAFDTE |

This field is the collection comment follow-up date. It is the date being displayed in the Follow-up Date field on the Loans > Collections > Account Delinquency screen, Comments tab. |

QADRCD |

This is the FNMA-defined Reason Code, which is stored on the Account Delinquency screen, Comments tab. |

QADSCD |

This is the FNMA-defined Status Code, which is stored in the Account Delinquency screen, Comments tab. |

QAHLD1-QAHLD2 |

These are the two Special Information fields located on the Comments tab of the Account Delinquency screen. These are two-digit user-defined fields that can be used as selection criteria for variable queues, or for whatever purpose your institution wants. An example of what a field might be used for would be to create queues specifically for Spanish-speaking customers. You could assign a “1” to mean “Spanish speaking,” and by requiring 1’s to be placed in the first field (QAHLD1), you could then create a queue using that field as a selection criteria. |