Navigation: Bankruptcy Information Screen >

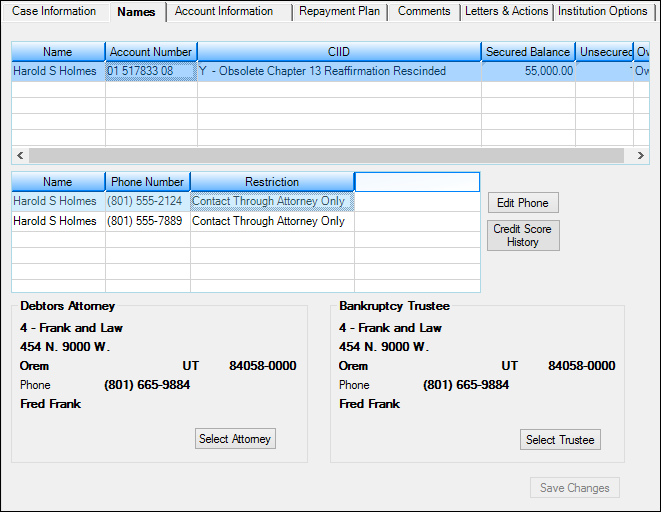

The Names tab on the Bankruptcy Information screen shows names connected to the bankruptcy, as well as any attorneys and trustees involved with this bankruptcy. See the following example of this tab:

Loans > Collections > Bankruptcy Information Screen > Names Tab

The top Names list view displays all borrower names, phone numbers, accounts, secured balances, unsecured balances, percent paid unsecured creditor, ownership, ECOA (Equal Credit Opportunity Act) and CIID information (credit reporting Customer Information Indicator) for all borrowers in the bankruptcy. File maintenance to the ECOA and CIID information can be done directly on the Names list view, as well as to the secured and unsecured fields. You can also view the credit score history of a borrower in this list view.

Telephone restrictions (No Phone Calls) can be added as well using the Phones list view.

Use the consumer information indicator (CIID) to adjust the bankruptcy status for individual borrowers as the bankruptcy progresses. Example: You have a loan that has a husband and wife and the wife’s parents, and all are co-borrowers. The husband and wife file bankruptcy, but the parents don’t. You would need to set up the CIID information for only the husband and wife. As the bankruptcy progresses, you will need to update the CIID information for both the husband and the wife.

To update this field:

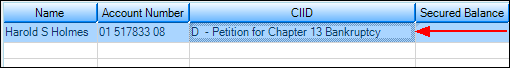

1.Click the CIID column in the list view. You will notice the CIID column changes from this:

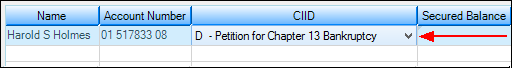

to this:

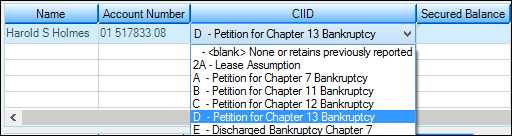

2.From the CIID drop-down, select the new code to apply to this account, as shown below:

3.Click ![]()

The credit reporting CIID codes include the following:

| Code | Description |

| <blank> None or retains previously reported |

| A | Petition for Chapter 7 Bankruptcy |

| B | Petition for Chapter 11 Bankruptcy |

| C | Petition for Chapter 12 Bankruptcy |

| D | Petition for Chapter 13 Bankruptcy |

| E | Discharged Bankruptcy Chapter 7 |

| F | Discharged Bankruptcy Chapter 11 |

| G | Discharged Bankruptcy Chapter 12 |

| H | Discharged/Completed through Bankruptcy Chapter 13 |

| I | Chapter 7 Bankruptcy Dismissed |

| IA | Personal Receivership |

| J | Chapter 11 Bankruptcy Dismissed |

| K | Chapter 12 Bankruptcy Dismissed |

| L | Chapter 13 Bankruptcy Dismissed |

| M | Chapter 7 Bankruptcy Withdrawn |

| N | Chapter 11 Bankruptcy Withdrawn |

| O | Chapter 12 Bankruptcy Withdrawn |

| P | Chapter 13 Bankruptcy Withdrawn |

| Q | Removes Previously Reported Bankruptcy Indicator |

| R | Reaffirmation of Debt |

| S | Removes Reaffirmation of Debt/Debt Rescinded Indicators |

| T | Credit Grantor Cannot Locate Consumer |

| U | Consumer Now Located |

| V | Chapter 7 Reaffirmation of Debt Rescinded |

| W | Obsolete Chapter 11 Reaffirmation of Debt Rescinded |

| X | Obsolete Chapter 12 Reaffirmation of Debt Rescinded |

| Y | Obsolete Chapter 13 Reaffirmation of Debt Rescinded |

| Z | Undesignated Chapter |

| 2A | Lease Assumption |

Any changes made to these fields will be reported to your institution's credit repositories during monthend credit reporting. For more information about credit reporting, see the Credit Reporting manual.