Navigation: »No topics above this level«

Overview of the Bankruptcy System

The Bankruptcy system is comprised of two screens:

1.Bankruptcy Information screen

2.Bankruptcy Transaction screen

The Bankruptcy Transaction screen is used to process bankruptcy-related transactions. It is used to establish the bankruptcy, automatically populating key fields on the Bankruptcy Information screen, while linking associated borrower(s), account(s), and phone restrictions as specified in the bankruptcy documents.

Use the Bankruptcy Transaction screen to set up bankruptcy information. The Bankruptcy Information screen is used to set up bankruptcy information for the borrower who actually filed the bankruptcy transaction. It can then automatically set up the bankruptcy information on all loans and phone restrictions that borrower is connected to.

If multiple individuals are involved in the same bankruptcy filing, you can quickly select the names using the Lookup Name feature on the Bankruptcy Transaction screen. For example, if a husband and wife filed bankruptcy, you could look up the information for the husband and select his applicable accounts, then look up the wife. If she has additional accounts that the husband does not have and those accounts are involved in the bankruptcy, they too can be linked.

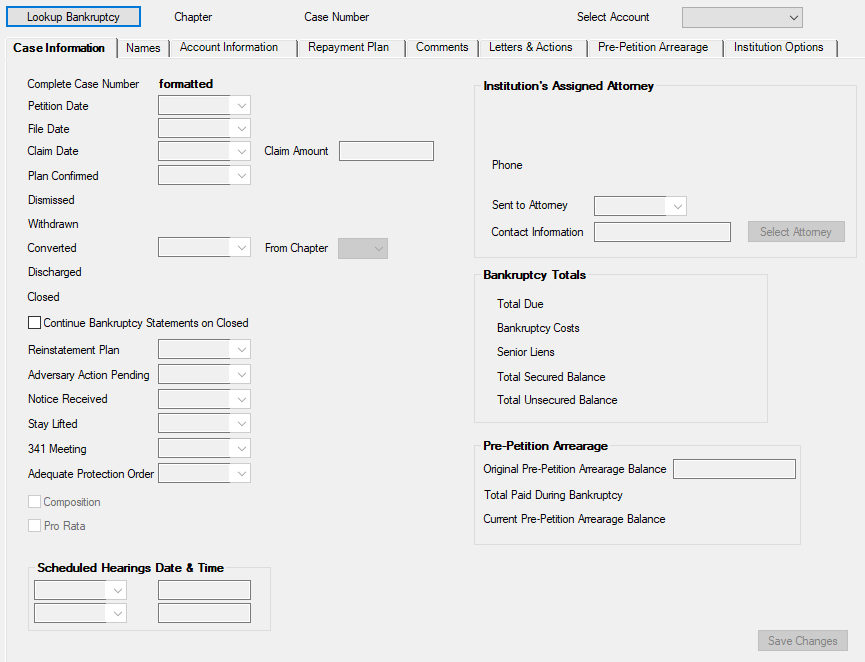

Once the bankruptcy is established, tracking will be done using the Bankruptcy Information screen, which is a bankruptcy-level screen comprised of seven tabs: Case Information, Names, Account Information, Repayment Plan, Comments, Letters & Actions, and Institution Options.

The Customer Search screen in CIS can be used to locate an existing bankruptcy. This can be done by selecting ![]() in the search drop-down list. Then enter all or a portion of the case number. The list view will display the matching data and can then be selected, taking you to the Bankruptcy Information screen.

in the search drop-down list. Then enter all or a portion of the case number. The list view will display the matching data and can then be selected, taking you to the Bankruptcy Information screen.

An afterhours report (FPSRP208) shows all accounts that have a bankruptcy status (hold code 4 (Chapter 7, 11, 12) or 5 (Chapter 13)).

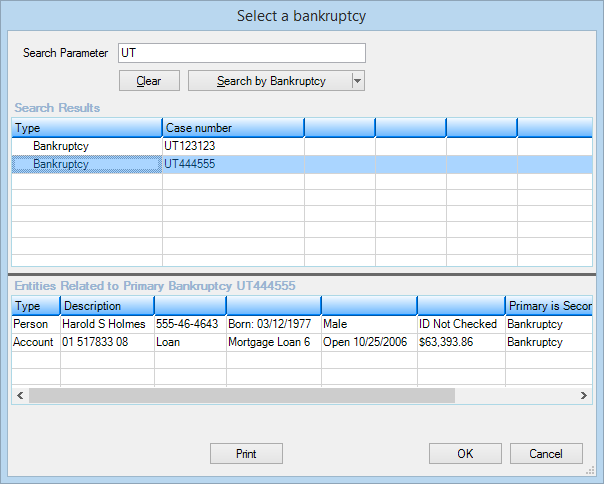

If you did not access the Bankruptcy Information screen by first looking up the bankruptcy using the Customer Search screen, you can lookup the bankruptcy by clicking ![]() at the top of the screen. The following dialog box is displayed:

at the top of the screen. The following dialog box is displayed:

Search by the case number which bankruptcy you are looking for. The system allows partial entries, such as "UT" would search for all case numbers starting with "UT," as shown in the example above. Remember: Accounts must first be processed using the Bankruptcy Transaction screen before you can look for them here.

Double-click the bankruptcy you want in the Search Results list view, and this dialog box will close and the Bankruptcy Information screen will display information for the selected bankruptcy.

Once a bankruptcy is selected, associated account information can be viewed by clicking on the desired account in the Select Account drop-down list. The Chapter and Case fields next to the ![]() button will display the bankruptcy chapter and case number of the selected bankruptcy.

button will display the bankruptcy chapter and case number of the selected bankruptcy.

See the following example of this screen, followed by descriptions of each tab.

Loans > Collections > Bankruptcy Information Screen

•The Case Information tab stores basic bankruptcy information. From this tab you can quickly update information as the bankruptcy progresses.

•The Names tab displays all names linked to the bankruptcy. It shows the names, ownership, ECOA codes, CIID codes (credit reporting consumer identification information codes), phone numbers, email addresses, secured balance, unsecured balance, previous chapter, previous file date, debtor's attorney, and bankruptcy trustee.

•The Account Information tab displays all of the loan account-level information for the selected account.

•The Repayment Plan tab stores repayment plan details and tracks paid and unpaid repayment plan payments. Payments posted using the BAP transaction will automatically update fields on the repayment plan.

•The Comments tab accesses the Collection system, where you can store collection comments. Note: Collection comments are not the same as Notepad comments.

•The Letters & Actions tab displays hold codes, action codes, and event letter information.

•The Institution Options tab displays options that affect the way bankruptcy transactions will process.

Information entered on the Bankruptcy Information screen can be used in GOLDWriter to create special bankruptcy tracking reports.

Note: Some fields on this screen are file maintained automatically when bankruptcy transactions are processed (see the Bankruptcy Transaction screen for more information).