Navigation: How to Grade Customers >

CIS provides your institution the capability to grade your customer file, as well as evaluate the profitability of individual customers to your institution. The following documentation will help you understand grading and the evaluation process. It will also help you set up the parameters for this feature to work according to your expectations.

For more detailed information about customer grading, see the Customer Grading section below. For more detailed information about customer evaluation (profitability), see the Customer Evaluation section below.

Note: This screen uses the following features in CIS:

•Bank Parameter Setup

•Customer Grading Schedule

•Customer Index Bubble

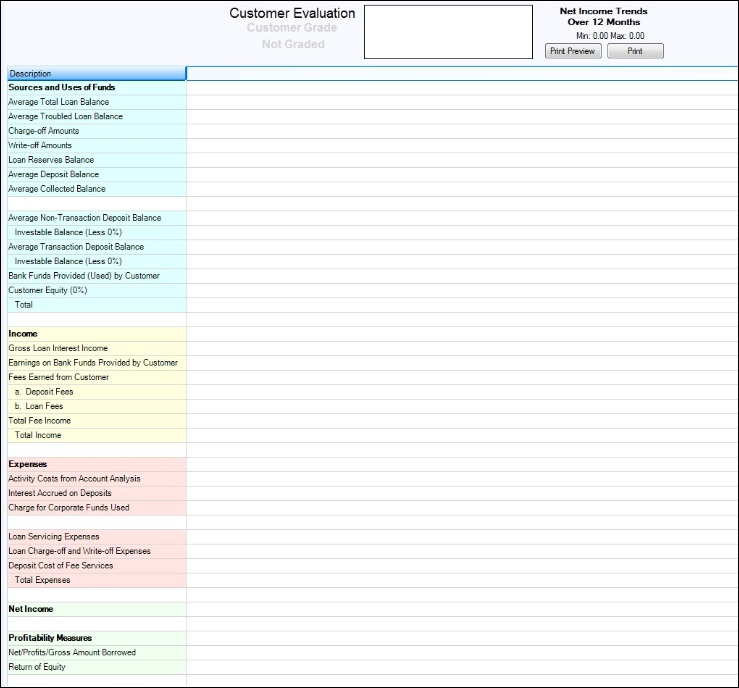

The Customer Evaluation screen reflects the profitability of a customer to your institution. The screen is designed to give a fairly detailed customer performance view for the past 12 months. It contains the following sections (see the example below):

In the upper left-hand corner, the customer’s name, customer ID, and percentile are listed. The percentile is the level this customer has in value in relation to all other customers in the banks portfolio. For example, if a customer is in the top 14 percent of all customers, then 13 percent of all customers are more valuable to the bank than this customer, while 86 percent of customers are less valuable.

In the center top of the screen beneath the title, the customer’s grade is displayed in color. The Customer Information bubble (opened by clicking on the ![]() icon in the upper, right-hand corner of the screen) displays the grade with a colored background and lists the grade by letter. Note: Marking the Automatically Show Customer Information Pop-up checkbox on the User Preferences dialog (Options menu > User Preferences) will automatically show the Customer Information bubble.

icon in the upper, right-hand corner of the screen) displays the grade with a colored background and lists the grade by letter. Note: Marking the Automatically Show Customer Information Pop-up checkbox on the User Preferences dialog (Options menu > User Preferences) will automatically show the Customer Information bubble.

Letter grades and corresponding colors are as follows:

•Platinum: The best of the bank customers

•Gold: Very good customers

•Silver: Better than average customers

•Green: Average customers and customers who have not yet been graded (usually new customers)

•White: Bank employees

•Red: Non-performing customers

This shows relative performance of the customer’s profitability to the institution over the past 12 months. It is intended to show trends and is not graphed relative to zero. The minimum value and the maximum value in the graph are listed in the upper right-hand corner.

The <Print Preview> and <Print> buttons create a paper statement that shows the figures on this screen for the last month, 3-month averages, and 12-month averages. The fields on the statement correspond to those on the screen. WARNING: This document is intended for use by your institution only and should not be given to customers.

The evaluation grid takes up the remainder of the screen. Because rows and columns in this grid have specific purposes, you cannot re-sort the grid as you normally can in grids on other screens. Instead of sorting, click on a column header for any of the individual months and a dialog appears showing the detail of the summarized data fields in that column.

Columns in the grid are as follows:

•Description. This describes the purpose of the data.

•12-Month Average. This provides the average for each row over the last 12 months.

•3-Month Average. This provides the average for the three most recent months for each row.

•Month columns. This lists the last 12 months (if available) in reverse order. The system only carries this information on a client for 12 months. For example, June 2013 totals replace June 2012 totals. Clicking on a month column header brings up a detail grid that shows from where the numbers in the column were derived. Each account amount used for the data is shown along with a summary line that displays the number used in the rows for this column.

The grid contains several sections, some of which are color-coded. They are Sources and Uses of Funds; Income; Expenses; Net Income; and Profitability Measures. They are described below.

The top section of the grid gives summary information about the money that the customer has deposited with the bank (deposit accounts), the money the customer has borrowed from the bank (loans), and losses the bank has sustained, or may sustain, from loans (troubled loans, charge offs, and write-offs). Transactions and amounts from closed loans are included on this screen and statement if the Paid Off Date (LNCLDT) falls in the reporting period(s) applicable for the screen/statement.

•Average Total Loan Balance. This is the average balance of all open loans the customer has with the bank.

•Average Troubled Loan Balance. This is the average amount of all open loans the customer has with the bank. Loans with any of the following conditions are considered troubled loans:

Bankruptcy |

Hold code 4 (chapter 7, 11 or 12) Hold code 5 (chapter 13) |

In Foreclosure |

Hold code 7 (legal hold foreclosure FHLMC) Hold code 9 (legal hold foreclosure) |

Repossession |

Hold code 93 (repossession by grantor) General category 81 (repossessed non real estate property), or 85 (repossessed assets) |

Non-performing or non-accrual |

Non-performing status is check marked (LNNONP) Non-accrual status is check marked (LNACST) |

Charge Off |

Hold code 2 (charge off) General category: 82 (charge-off non real estate) 83 (charge-off credit cards/related plans) 84 (charge-off commercial & other loans) 86 (charge-off loan to farmers) |

•Charge-off Amounts. This is the amount in the Charge Off field (LNCOBL) for all open or closed loans this customer has with the bank. This amount will always be displayed; it is not just for the 12-month period. Note: The amount charged off does not change the loan principal balance. The field is located on Loans > Account Information > Account Detail screen, Valuation & Credit Risk tab.

•Write-off Amounts. This is the amount in the Partial Write Off field (LNPWOA) for all open or closed loans this customer has or had with the bank. This amount will always be displayed; it is not just for the 12-month period. Note: The amount of the write off reduces the loan principal balance. The field is located on Loans > Account Information > Account Detail screen, Valuation & Credit Risk tab.

•Loan Reserves Balance. The balance on hand in loan reserves (for taxes and insurance) at the end of the month for loans on which this customer is a borrower.

•Average Deposit Balance. The monthly average balance of all deposit accounts for which this customer has direct monetary control.

•Average Collected Balance. The monthly average collected balance of all deposit accounts for which this customer has direct monetary control.

•Average Non-Transaction Deposit Balance. The monthly average balance of all non-transaction deposit accounts (such as certificates of deposit, savings, and so on) for which this customer has direct monetary control.

•Investable Balance (Less X%). Federal laws require banks to keep a percentage of deposited funds on hand. They are not allowed to re-invest that amount. The X% is the most recent percentage required. It is only guaranteed to be accurate for last month. However, since it has not changed for quite some time, it is most likely to be accurate for all. This balance is the amount of the average non-transaction deposit balance that the bank had available for investing during the month.

•Average Transaction Deposit Balance. The monthly average balance of all transaction deposit accounts (such as checking accounts) for which this customer has direct monetary control.

•Investable Balance (Less X%). Federal laws require banks to keep a percentage of deposited funds on hand. They are not allowed to re-invest that amount. The X% is the most recent percentage required. It is only guaranteed to be accurate for last month. However, since it has not changed for quite some time, it is most likely to be accurate for all. This balance is the amount of the average transaction deposit balance that the bank had available for investing during the month.

•Bank Funds Provided (Used) by Customer. When a customer has more funds deposited than he owes in principal on loans, the customer is providing funds to the bank for investing. When the loan principal is higher, the customer is using bank funds. This field is calculated by subtracting the sum of the asset fields from the sum of the liability fields. The asset and liability fields are as follows:

Asset |

Institution Portion of the Average Loan Balance |

Liability |

Investable Non-transaction Deposit Balance Investable Transaction Deposit Balance Loan Customer Equity Reserve Balance |

•Customer Equity. In some profitability models, it is suggested that you should give the customer a percentage of credit for loans that he has with the bank since the bank is making money through the money lent to the customer. By having a loan with the bank, the customer is providing income and should not be charged the full charge for using bank funds. The CIS Designer > Bank Parameter Setup screen provides a customer equity rate that banks may use to provide this credit to the customer. Customer equity is calculated as the customer equity percentage rate times the institution portion of the average loan balance divided by 12 (Equity% * LoanAvgBal / 12).

•Total. Provides the total net balance of all bank funds provided and or used by the customer for the month.

This section itemizes the sources of income to the bank from the customer. It includes the following items:

•Gross Loan Interest Income. The sum of investor service fees, institution interest, and LIP interest received from the customer during the last month.

•Earnings on Bank Funds Provided by Customer. When the liability balance (see Bank Funds Provided (Used) by Customer above) is higher than the asset balance, the customer provides funds for the bank to reinvest. This field is the estimated amount that the bank was able to earn on those reinvested funds. This is calculated by multiplying the Internal Rate of Return entered on the Bank Parameter screen by the Bank Funds Provided by Customer and dividing the product by twelve (IRR * FundsProvided / 12).

•Fees Earned from Customer. This lists the fee income received during the month. This includes the following:

Deposit Fees: Fees charged and collected on deposit accounts

Loan Fees: Includes the following:

oMiscellaneous Loan Fees Paid (Tran Codes 850 and 858) using Miscellaneous Fees Codes that are income fees (not receivable fees)

oAmortization of Deferred Fees (Tran Codes 450 and 458) and Deferred Discounts/Gains (Tran Codes 70 and 78)

oLoan-related G/L Credit transactions (Tran Codes 310 and 318) from the loan history that match the exact descriptions entered on the CIS > CIS Designer > GL Income Transactions Setup screen.

This section itemizes the expenditures required to support accounts owned by the customer. It includes the following items:

•Activity Costs from Account Analysis. For customers that use account analysis, this figure is brought over from the account analysis system. Please refer to account analysis documentation for more information on this cost.

•Interest Accrued on Time Deposits. The calculation program calculates the interest accrued on all deposit accounts from the first of the month to the end of the month and accumulates it into this field.

•Charge for Corporate Funds Used. When the asset balance (see Bank Funds Provided (Used) by Customer above) is higher than the liability balance, the customer uses bank funds that are lent to him. This field is the estimated charge that the bank incurred by not having those funds available to reinvest. This is calculated by multiplying the Cost of Funds rate entered on the Bank Parameter screen by the Bank Funds Used by Customer and dividing the product by 12 (COF * Funds Used / 12).

•Loan Servicing Expenses. This is the cost the bank incurs to service the loans of this customer for the month. This is calculated by multiplying the number of loans the customer has by a service cost per loan. The cost is entered by the bank on the Bank Parameters screen. The bank has the capability of specifying a generic cost that is used for all loans. An override table is also provided by general category that allows banks to specify specific charges for specific types of accounts. Types that are not specified are charged the general cost. Also includes the Amortization of Deferred Costs (Tran Codes 420 and 428) and Deferred Premiums/Losses (Tran Codes 80 and 88).

•Loan Charge-off and Write-off Expenses. This is the amount that has been charged-off or written-off during the month the transaction occurred. During the grading and evaluation process (at month end) the program reads loan history for loans for the following transactions.

| 2022-01 | Charge Off |

| 2022-02 | Reverse Charge Off |

| 860 | Partial Charge Off |

| 868 | Reverse Partial Charge Off |

| 2510-00 | Partial Write Off (and correction) |

| 2510-05 | Full Write Off (and correction) |

•Deposit Cost of Fee Services. This is the cost the bank incurs to service the deposit accounts of this customer for the month. This is calculated by multiplying the number of accounts the customer has by a service cost per account. The cost is entered by the bank on the Bank Parameters screen. The bank has the capability of specifying a generic cost that is used for all deposit accounts. An override table is also provided by general category that allows banks to specify specific charges for specific types of accounts. Types that are not specified are charged the general cost.

This single line item shows the estimated profit or loss the bank made on servicing this customer for the month.

This section provides metric numbers that may be used in analyzing customer profitability. It includes the following items:

•Net/Profits/Gross Amount Borrowed. This is a ratio of profits to outstanding loan balances. It is a rate calculated by Net Income / Average Loan Balance.

•Return of Equity. This is a ratio of profits to Bank Funds Provided or Used. The rate is calculated by Net Income / Bank Funds Provided (Used) by Customer.

Your entire customer file is graded according to the parameters set up on the Customer Grading Schedule screen (CIS > CIS Designer > Customer Grading Schedule). Your file is automatically graded once a month at month end. You can also manually request to have your file re-graded directly on the Customer Grading Schedule screen. This can be done once in a given day at no charge, but additional requests to have your file re-graded may incur a charge.

FPS GOLD has formulated default parameters for this screen to provide institutions with a starting point for grading customers. Although the default parameters can grade your customer base in a meaningful way, you may want to determine your own parameters based on your institution-specific goals and desires.

Your customer file is graded on a points-based system. The following criteria can be used in grading:

•Average Weighted Deposit Rate

•Average Weighted Loan Rate

•Business Deposit Balance by Product

•Business Loan Balance by Type

•Customer Profitability

•Deposit Balance Influenced

•Has a Credit Card

•Has an ATM Debit Card

•Has an LOC/Overdraft Loan

•Has Sweep Accounts

•Is a Web User

•Is a GOLDPhone User

•Loan Balance Influenced

•Personal Deposit Balance by Product

•Personal Loan Balance by Type

•Time With Bank in Months

•Uses Account Analysis

Your institution determines how many points are required to be a Platinum (A), Gold (B), Silver (C), Green (D/No data to grade), or Red (F/Non-performing) customer. This grading is reflected in the Customer Index bubble and icon and on various screens throughout CIS and CIM GOLD. Based on the criteria used from the choices listed above and the weight given to each item, the grading can be tailored and customized according to your institution’s preferences.

When initially determining how to set up the Customer Grading screen, we recommend you do the following:

| 1. | Determine the criteria important to your bank from the list above. |

| 2. | Weight each item according to priority and importance. |

| 3. | Ascertain the appropriate parameters for each item and determine if different categories exist (e.g., Time With the Bank: 0-6 months; 6 -36 months; 36-60 months; 60+ months). |

| 4. | Assign points to each item according to the way you have weighted them. |

| 5. | Determine the points required for each grade (Platinum, Silver, etc.). |

With the ability to re-grade your file up to once per day, finding the ideal grading parameters for your institution can be a process of trial and error and can be adjusted as time goes along to reach the optimum desired outcome.

Given the tremendous customizing capabilities of the Customer Grading screen, institutions can set up grading to be profitability-based, product-based, loyalty-based, etc. It can also be used as a marketing or analyzing tool for your institution. The possibilities for ways this grading can be used are endless.

The profitability of an individual customer is determined based on criteria entered on the Bank Parameter Setup screen (CIS > CIS Designer > Bank Parameter Setup). Customer evaluation is completely separate from customer grading (although grading can be profitability-based) and is intended to help you determine an individual customer’s value to the bank.

FPS GOLD does not provide defaults for this screen because these factors vary from institution to institution. If certain factors are known to be changing in the future, this screen can be set up with future parameters that will take effect on a future date.

Each customer’s evaluation is calculated on customers at monthend when the file is graded. Evaluation can be re-calculated if parameters are changed mid-month and you chose to re-grade the file on the Customer Grading Schedule screen.

It is important to enter certain criteria on this screen for customer evaluation to function properly, such as cost of funds, internal rate of returns, and costs of servicing deposit and loan accounts.