Navigation: Institution Options Screen > GOLD ExceptionManager Tab > Deposits Tab >

Negative Options field group

The following fields are found in the Negative Options field group on the Deposits tab of the GOLD ExceptionManager tab (Institution Options screen).

•Negative Charge Applies to ATM Only

•Post Service Charge if Negative

•Warning in GEM for Negative Account

•Negative Charge Limit Per Day

•Minimum Transaction Amount for Negative Fee

•De-Minimis Amount for Negative Fee

FPS GOLD Programming for Regulation E

To further help your institution comply with the FDIC Best Practices suggestions for Regulation E, we have created other CIM GOLD fields, reports, and options. The paragraphs below explain the features that are available. These options are only used on personal accounts.

1.The Excessive Negative Balance Fee Report (FPSDR229) shows accounts that have more than six fees charged in the last 12 months. This report should be set up to process at monthend. Non-personal accounts will not be included on the report. This report can be used to contact customers and notify them of their excessive fees.

| An alert option, “Negative Balance Fee Service Message,” is available to be used on the report for accounts that have more than six fees charged in the last 12 months. The alert will be sent to the IRS owner’s e-mail address and must be set up in your Internet options before you can use it. Alerts will be sent only to your Web customers. The wording for these alerts is customized by your institution. Send in a separate work order with the alert message for Message #105. |

2.The Minimum Transaction Amount for Negative Fee option (FMIN) is used to set a transaction limit based on the transaction amount before charging a fee. This will work in the afterhours (using the options NGCH/NGFE) or through the ATMs (using options NSFF/NGFE). Any transaction equal to or less than the amount of the limit will post without a fee. This option only applies to personal accounts.

3.Contact Queues (Queues > Contact Queues > Contact Queues screen) can be used to alert you to the accounts that have processed their seventh fee in the last 12 months. The fields on the Contact Queues screen must be used in your GOLDWriter for the logic to create the Contact Queue list.

4.A deposit statement message number (999903) can be printed on your customers’ statements when they have more than six overdraft fees in the past 12 months. The message number is a system-defined number, and in order to use it, you must create the new message with your customized message text. If you want to use this feature, set up the required message for your bank on the CIM GOLD > Deposits > Definitions > Advertising Messages screen. Your new message will print before the current advertising message you may be using on your statements. Both messages will print if the account is over the limit of fees, based on the current option for your advertising message. Each account on a combined statement over the six fees will get a separate message on each account section of the statement.

5.A checkbox and date field labeled Opt-Out for Overdraft/Non-ATM are available on the Deposit Activity tab of the Deposit Activity screen for Non-Regulation E transactions, such as ACH and inclearing checks transactions. These fields are used in conjunction with the ATM/debit card Opt-Out field (Opt-Out for Overdraft/Negative ATM/POS) so the customer can opt in to ATM/debit transactions and opt out for all other transactions. If the account is set to opt out and these types of transactions need to use the negative limit to be paid, they will be rejected and sent to GOLD ExceptionManager (GEM) as NSF with a note in the Comment field of "Opt-Out" indicating that the customer has opted out.

NOTE

NSF withdrawal transactions at the teller window are not included in this process. The teller needs to have a conversation about it with the customer and post the fee manually when necessary. |

6.The De-Minimis Amount for Negative Fee option (DMIN) is available to be used for the de-minimis overdraft amount based on account balance. This option will be used on ATM/debit, checks, and ACH transactions.

| Example: An ATM transaction for $5.00 is presented to your bank for a customer that has a $4.50 balance with 50 cents available in their negative limit. If the institution option was set to $.75, the transaction will post to the customer’s account without the overdraft charge. A transaction for $5.26 or more will be accepted, based on the negative limit; and if funds are available, the fee and transaction will be processed because it is 1 cent over $.75. Subsequent transactions will use the same calculation by using the de-minimis amount for the difference in the balance and the negative amount used for each transaction. This only applies to personal accounts. |

7.The Negative Charge Limit Per Day option (NGLP) can be used to set a limit on fees based on ACH, ATM, debit card, GEM, and check transactions processed using the negative limit.

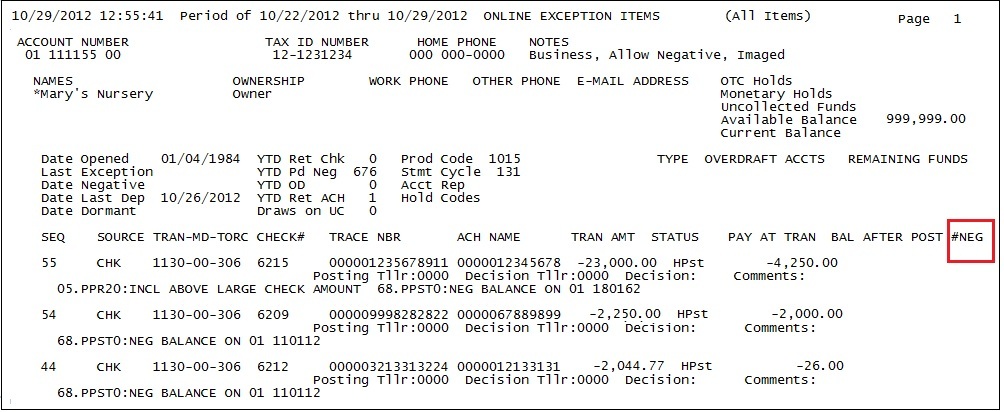

8.The GEM Processing screen and online report can show the number of fees for the day. If you use the Negative Charge Limit Per Day option described above, you can add the number of negative fees processed for the day to the GEM Processing screen. This field indicates how many fees have been charged today on the account. If it is over your institution’s daily limit, the processor should not add any additional fees for paying NSF transactions. To add the field (# Neg Fees) to the Processing screen, each processor will have to make changes to their User Preferences. The field (#Neg) will be printed on the online report in the far-right column (as shown below).