Navigation: »No topics above this level«

Use the Create Returns screen to set up either an ACH or inclearing check item that needs to be returned and is not listed as an item on the Process Exception Items screen. You cannot create any check or ACH returns after the cutoff times set for your institution in the GEM Cutoff Time for ACH (RTIM) field and the GEM Cutoff Time for Checks (ITIM) field on the Institution Options screen (GOLD Services > Institution Options screen, General tab).

You can also create ACH returns using the <Create Returns> button on the Deposits > Account Information > Incoming ACH tab and from the Restrictions and Warnings > ACH Stop Payment tab. See Creating a Return from the ACH Tabs on Other Screens below.

NOTE

You cannot create returns for IAT transactions from GEM or from the screens under Deposits shown above. IAT information is stored for processing IAT returns on transactions that did not reject for any reason. These items will show in GEM as Host Posted with a Primary Reason of IAT. See the Other Conditions field group section in Selection Setup for more information on how to view these items. |

For example, if you placed a stop payment on a check after the afterhours processed and the check was presented to clear, it will post and the check will not be displayed in GOLD ExceptionManager for the stop payment. Therefore, you would need to create a return item. See the Actions topic in Process Exceptions Items help for information about returning exception items that do appear on the Process Exception Items screen.

This screen was designed to do the following things:

•Allow creation of ACH and inclearing check return items.

•Allow posting a correction transaction to a customer's account for the amount of the returned item and the fee at the same time the item is being created.

•Allow the creation of Dishonored and Contested Dishonored returns.

NOTE

You cannot return items on FPS GOLD or Federal Reserve holidays. |

To create a return item:

1.Access the Create Returns screen under GOLD Services > GOLD ExceptionManager in the left tree view in CIM GOLD.

2.Select the type of return by clicking on the radio button next to either ACH or Check. Fields will be added or removed from the screen depending on which type of return you select. If the return item is a loan, check the Loan checkbox, and verify that either ACH or Check is selected, as applicable.

3.Choose the action you want to take on this return by selecting one of the three action types:

•Return, Reverse Tran, Fee

•Return, Reverse Tran

•Return, No Tran

4.Tab to each field, typing in appropriate and accurate data. (For a list of fields and their definitions, see the field descriptions after these steps.)

5.Once all the data has been entered correctly, click <OK>.

When you click <OK>, the data is sent to the host. A name and address verification box is displayed. If the name and address are correct, click <OK>. According to what you selected in the Type and Action Fields field group, the action will process.

If you selected Return, Reverse Tran, Fee, the transaction will return the item, reverse the transaction, and charge a fee to the account. When you view the Process Exception Items screen, "ORT" will appear in the Source column for this item.

Additionally, a fee may be charged to the account, depending on if your institution charges fees for returns. Fees are set up using the GOLD Services > Institution Options screen, GOLD ExceptionManager tab, Deposits - Descriptors and Fees tab.

Using this screen you can also return Dishonored Returns back to the Receiving Depository Financial Institution (RDFI), or send Contested Dishonored Returns to the Originating Depository Financial Institution (ODFI).

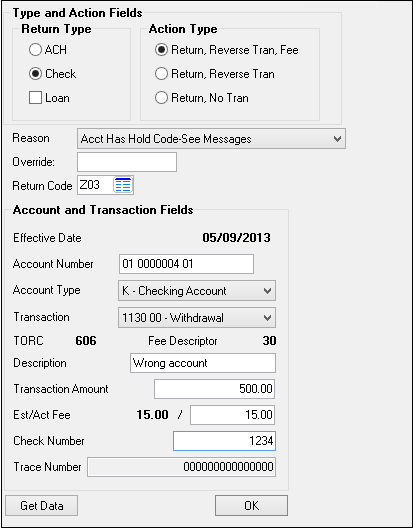

See the following example of the Create Returns screen followed by field descriptions.

GOLD Services > GOLD ExceptionManager > Create Returns Screen

Field |

Description |

|---|---|

Type and Action Fields field group |

The Type and Action Fields field group on the Create Returns screen is used to enter the type of return you are creating and the action on the account you want to process in regards to this return. |

|

Mnemonic: ACH and Check, EIRACH; Loan, EIDBIT |

In the Return Type field group, select the type of return you want to create. If you select ACH, you cannot select Check, and vice versa. The remaining fields on this screen will change according to whether you select ACH or Check. If you select ACH, the ACH Type Fields and ACH Return Only Fields field groups are also displayed on the screen.

Checkmark the Loan box if the return is also a loan.

For checks, you must enter the correct Transaction Amount and a valid Check Number corresponding to that Transaction Amount before clicking <Get Data>.

If multiple checks are found matching that account number and check number, a dialog box is displayed that enables you to select the appropriate check from the list. |

You can select from three possible actions to make on the transaction, as shown below.

These actions are as follows:

Return, Reverse Tran, Fee

Return, Reverse Tran

Return, No Tran |

|

Reason |

Using the drop-down menu, enter the reason for the returned item. One of more than 50 possible reasons can be given. If one of the reasons for the returned item is not listed, you can type your own reason in the Override field. This reason will be printed on the return notices. |

Override

Mnemonic: EIORSN |

If the reason for the returned item is not included in the Reason drop-down list, you can type your own reason in this field. |

Return Code

Mnemonic: EIARET |

Use this field to enter an ACH return code. The ACH return codes provide a reason why the item is being returned. Click the list icon |

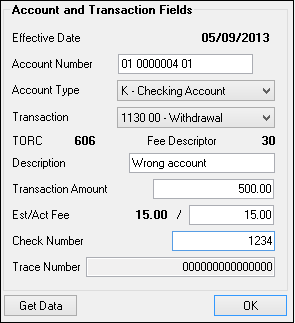

Account and Transaction Fields field group

The Account and Transaction Fields field group on the Create Returns screen is used to enter information concerning the check or ACH item that is being returned.

See the following definitions.

Field |

Description |

|

|---|---|---|

Effective Date

Mnemonic: EIEFDT |

This field displays today's date, which is the date this return is created and processed against the account.

|

|

Account Number

Mnemonic: EIACTO, EIACTA, EICKDG |

Enter the account number where the funds or check payment was deposited into and where the return will be processed against. This is a required field and must contain a valid account number. |

|

Account Type

Mnemonic: EIATYP |

This field indicates the type of account the return is intended for. Valid entries are "S - Savings Account" and "K - Checking Account." This information is used to determine the correct ACH tran code when sending the return. If this field is left blank, it defaults to "K." |

|

Transaction

Mnemonic: EITCOD |

Use this field to select the specific transaction code that needs to be reversed from the account. This should match the original transaction that was made when the check or funds were deposited or withdrawn from the account.

Possible choices are the following:

1120 00 - Deposit 1130 00 - Withdrawal |

|

TORC

Mnemonic: EITORC |

This is a 4-digit field that designates the transaction origination code, or TORC, that was used in processing the original transaction.

|

|

Fee Descriptor

Mnemonic: EIFDSC |

This is the descriptor fee, as set up in the Return Fee Descriptor field on the Deposits - Descriptors and Fees tab of the GOLD Services > Institution Options screen, GOLDException Manager tab. |

|

Description

Mnemonic: EITDSC |

This is an optional field used for the description of the transaction. It will be printed on the customer's statement. For check return types, this field only displays Withdrawal. |

|

|

Mnemonic: EITAMT |

This required field is used to enter the amount of the transaction. |

|

|

Mnemonic: EIEFEE, EIAFEE |

The Est/Fee field is the defaulted amount of the fee that has been set up by your institution for returned items on the GOLD Services > Institution Options screen, GOLD ExceptionManager tab,Deposits - Descriptors and Fees tab. This field is not file maintainable, but you can change the actual fee charged on each exception item manually in the field next to this one (Act Fee field).

The data in the Act Fee field is entered by the system when an item is returned with a fee. Though this field is pre-filled by the system, you can change it. |

|

|

Mnemonic: EICKNB |

This field requires the check number, if any, of the check item being returned. If more than one check number exists for this account after you click <OK> or <Get Data>, a dialog box will display with a list of those check numbers. You can select the correct check number from this list.

See also: |

|

Trace Number

Mnemonic: EIACH7 or EIACH8 |

This field is required for all returns. It should contain the 15-digit trace number of the original ACH or inclearing item that is being returned. |

|

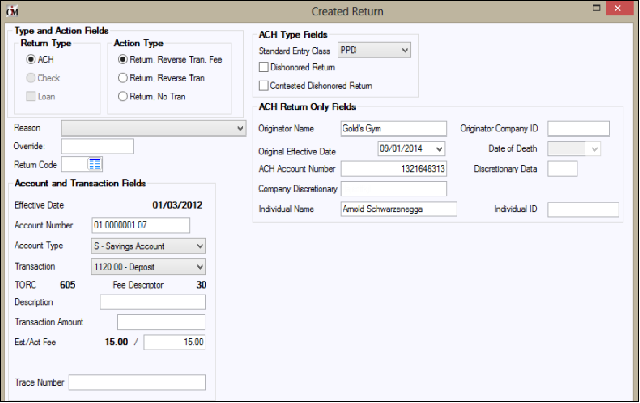

The ACH Type Fields field group on the Create Returns screen is only displayed after you select the ACH Return Type. The ACH Return Only Fields field group is also displayed, as shown below:

|

||

Standard Entry Class |

This field is for the standard entry class of the original ACH return you are creating. This field is required. Use the drop-down menu to enter a Standard Entry Class code. The Standard Entry Class (SEC) Codes are used to communicate exactly how the customer gave you authorization to debit/credit their bank account.

See the Standard Entry Class section for detailed information for each of the Standard Entry Class codes. |

|

Check this box if this is a dishonored return. If this field is checked, the Dishonored Return Item Information field group is displayed on the screen. The fields in this field group must also be filled in. |

||

Check this box if you are creating a contested dishonored return for returns that have been denied by the originator of the transaction. The default is a blank box (no), but check this box if the item being created is a contested dishonored return ACH item. If this field is checked, the Contested Dishonored Return Item Information field group is displayed on the screen. The fields in this field group must also be filled in. |

||

The ACH Return Only Fields field group on the Create Returns screen is only displayed after you select the ACH Return Type. The ACH Type Fields field group is also displayed (as shown above). |

||

Originator Name

Mnemonic: EIORNM |

This field is for use with ACH items when an item is returned. This field should be filled in with the name of the originator of the original ACH item for which the return is being created. |

|

Originator Company ID

Mnemonic: EIOBID |

This required field is used for either the customer identification number or the company identification number, depending on whether this account is for an individual or a company. The ID number is required under NACHA rules to ensure there is clear identification of the source of an ACH transaction. Specifically, the rules require the originator to populate this field with the company EIN. This company identification appears on the account holder’s statement and is used to identify the originator should the company name be incorrect or missing. |

|

Original Effective Date

Mnemonic: EIOEDT |

This field is for the original effective date for the ACH return. |

|

Date of Death

Mnemonic: EIACH7 |

This field is only used if the account owner is deceased. Enter the date of death of the account owner, if applicable. |

|

ACH Account Number

Mnemonic: EIACH6 |

This field is for the account number. This is a required field. |

|

Discretionary Data

Mnemonic: EIACH6 |

This field enables entry of descriptive data to be sent in the item to the Federal Reserve in the batch header record. This field must be used if the item is being returned. This is for your company's internal use. |

|

Company Discretionary

Mnemonic: EICDSC |

This is the company discretionary data that is sometimes sent in the header of an ACH item. You could enter the description of the transaction in this field. This may be printed on the receivers’ bank statement by the receiving financial institution (e.g., payroll). |

|

The Dishonored Return Item Information field group on the Create Returns screen is only displayed after you select the ACH Return Type, and then select Dishonored Return or Contested Dishonored Return.

ACH return items will be dishonored by the Government Disbursing Office if discrepancies exist between the data on the return item and the data on the original payment. If your institution receives a dishonored return, the information in the return should be corrected and a new return should be originated in accordance with NACHA Operating Rules. Dishonored returns are sent from the ODFI (Originating Depository Financial Institution) to the RDFI (Receiving Depository Financial Institution).

See the following example of this field group:

|

||

Return Item Trace Number

Mnemonic: EIACH6 or EIACH7 |

This field is used to enter the trace number from the return item. |

|

Return Item Reason Code |

Click the list icon |

|

Return Item Settlement Date

Mnemonic: EIACH7 |

This field is used to enter the date on which this return was settled with the Federal Reserve. |

|

The Contested Dishonored Return Item Information field group on the Create Returns screen is only displayed after you select the ACH Return Type, and then select Contested Dishonored Return. A contested dishonored return is when a dishonored return is received by your institution, but you are contesting it and sending it back to the Originating Depository Financial Institution (ODFI). You can only use one of six reasons for the contested dishonored return.

See the following example of this field group:

|

||

Dishonored Return Item Trace #

Mnemonic: EIACH6 and EIACH7 |

Use this field to enter the trace number from the dishonored return item. |

|

Dishonored Return Item Settlement Date

Mnemonic: EIACH7 |

This field is used to enter the date on which this dishonored return was settled with the Federal Reserve. |

|

Dishonored Item Reason Code

Mnemonic: EIACH7 |

Click the list icon |

|

Original Item Settlement Date

Mnemonic: EIACH7 |

This field displays the original item settlement date on which the return item was settled with the Federal Reserve. |

|

Date Original Entry Returned

Mnemonic: EIACH7 |

This field displays the date the original return item was returned. |

If you have a teller number and file maintenance security to the Deposits > Account Information > Incoming ACH tab and the Restrictions and Warnings > ACH Stop Payment tab, you can process returns using the <Create Returns> button.

These created return items are shown on the Process Exception Items screen in GEM just like the ones created from GEM, and they will be forwarded in the same way to the FRB. You can use GEM reports to balance to your ACH returns each day.

NOTE

From these two tabs, you can only process ACH returns, not checks or loans. |

To create a return on the Incoming ACH or ACH Stop Payment screens:

1.Select an item in the list view.

2.Click <Create Return> to open the Created Return screen. Several of the required fields will already have the information filled in from the selected ACH record. See the example below.

3.Enter any other necessary information, such as the action type, return reason, return code, and transaction description.

4.To ensure that you are returning the correct transaction, enter details such as the trace number and amounts.

Recurring transactions update the record with the last data received. If you are returning a prior transaction, make the appropriate adjustments.